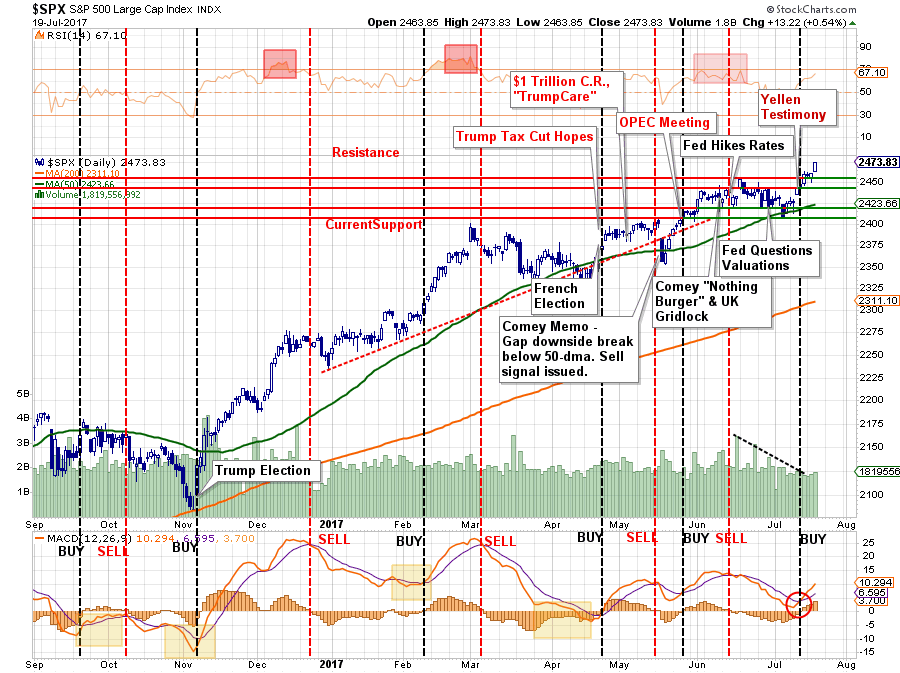

As you I discussed last week, we added risk exposure to portfolios with the breakout to new highs that came in conjunction with a short-term “buy signal” as shown below.

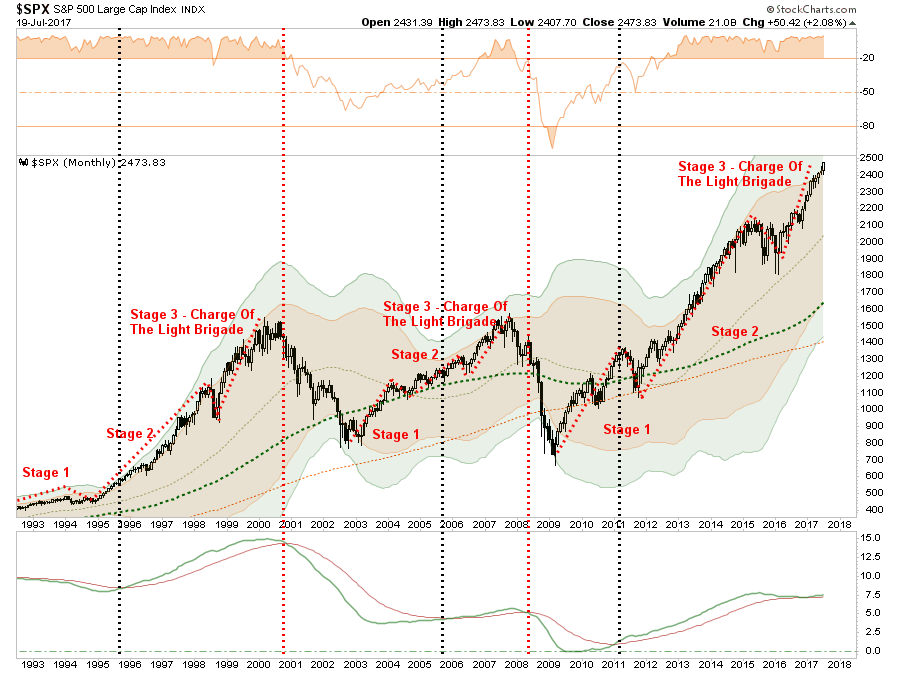

However, when we zoom out a bit, a different picture emerges. Note that in all 3-cases, there was a “Stage-1 Advance”followed by a correction which led to a “Stage-2 Advance.” The correction that followed then provided for the final bullish advance which I call the “Charge Of The Light Brigade.”

The “Charge of the Light Brigade” was a charge of British light cavalry led by Lord Cardigan against Russian forces during the Battle of Balaclava in 1854, during the Crimean War. Lord Raglan, the overall commander of the British forces, had intended to send the Light Brigade to prevent the Russians removing captured guns from overrun Turkish positions, a task well-suited to light cavalry. However, due to miscommunication in the chain of command, the Light Brigade was instead sent on a frontal assault against a different artillery battery, one well-prepared with excellent fields of defensive fire.

Although the Light Brigade reached the battery under withering direct fire and scattered some of the gunners, the badly mauled brigade was forced to retreat immediately. Thus, the assault ended with very high British casualties and no decisive gains. War correspondent William Russell, who witnessed the battle, declared:

“Our Light Brigade was annihilated by their own rashness, and by the brutality of a ferocious enemy.”

This current set up is very much like what faced the British Calvary. A market is that overly bullish, overly complacent and overly valued has already had horrible outcomes for those that charged headlong into it.

Leave A Comment