I have a simple question…

If the rally in the market that began following the election was pricing in the expectations for tax reforms, repatriation, building the wall, and infrastructure spending, then what did the rally on Wednesday following Trump’s speech to Congress price in?

With the markets now pushing both a 3-standard deviation extension above the 50-dma AND an almost 9% deviation above the 200-dma, there is little argument of the overbought condition that currently exists.

But such rational logic seems to no longer apply.

At least for now.

There is just one thing to remember. The markets price in future expectations for the impact of expected events. So, a tax cut here, an infrastructure plan there, all suggests a positive impact to the bottom line of corporate earnings and a valid reason for pushing asset prices higher.

No argument here. I am currently well positioned in portfolios on the long side of the market for now.

The question that must be answered is just how much of the benefit from these fiscal proposals have already been priced in perfection? What happens if tax reform is less than anticipated? Or infrastructure spending is cut from $1 Trillion to $500 billion? Or repatriation only brings back a fraction of the dollars anticipated?

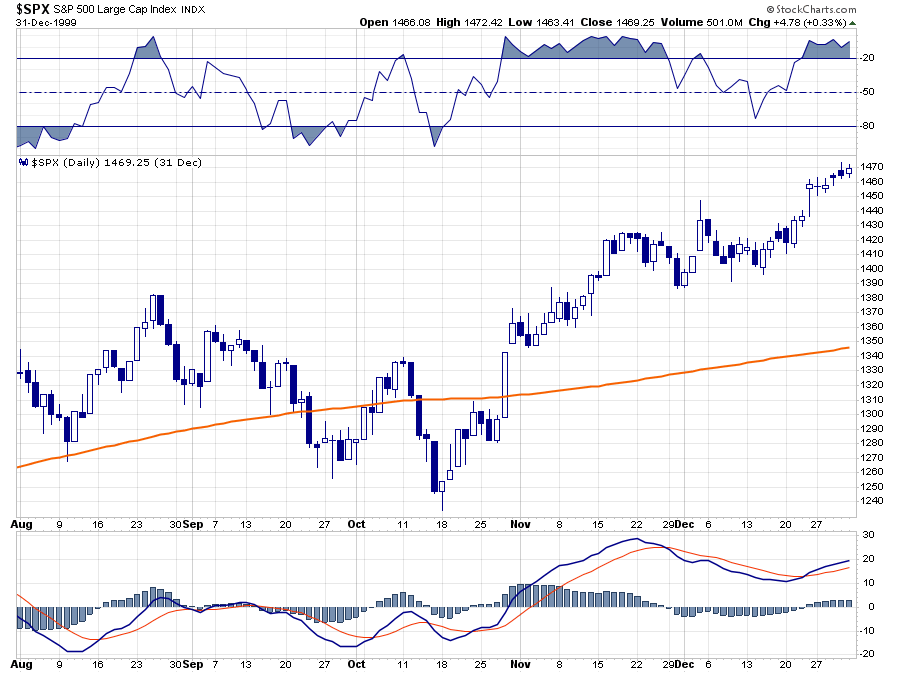

Let’s zoom out for a second and look at the pre- and post-election through the end of last year for clarity.

Oh, shoot!… Sorry, that was 1999. Here is last year.

Just some things I am thinking about this weekend as I catch up on my reading.

Trump/Fed/Economy

Leave A Comment