EUR/USD

The EUR/USD pair initially rose during the course of the week, but struggled at the 1.15 handle. It’s not a huge surprise, it is at the top of the ascending triangle that we have been dealing with lately. However, we did end up forming a hammer on Friday, so I believe that the Euro will continue to gain this week, but whether or not we can break above 1.15 is of course completely different question. With that being the case, a break above the 1.15 level would be extraordinarily bullish.

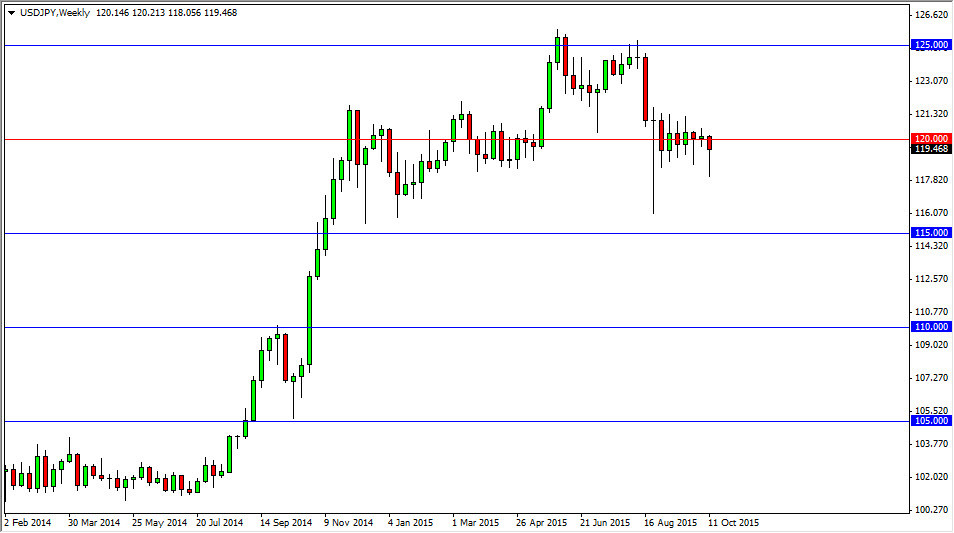

USD/JPY

The USD/JPY pair initially fell during the course of the week, but turned back around to form a massive hammer. That hammer of course suggests that the market is going to continue to go higher given enough time, but in the meantime I expect a lot of volatility. Nonetheless, Friday formed a slightly positive candle that broke above the top of the hammer from Thursday. Because of this, I am a buyer of this pair.

GBP/AUD

The GBP/AUD pair broke higher during the course of the week, bouncing off of the support region near the 2.09 handle. Because of this, I feel it’s only a matter time before this market goes higher, but pullbacks might be needed in order to find support. Ultimately, this is a pair that is most certainly in an uptrend, and although the Australian dollar is doing better as of late, it still won’t do as well as the British pound.

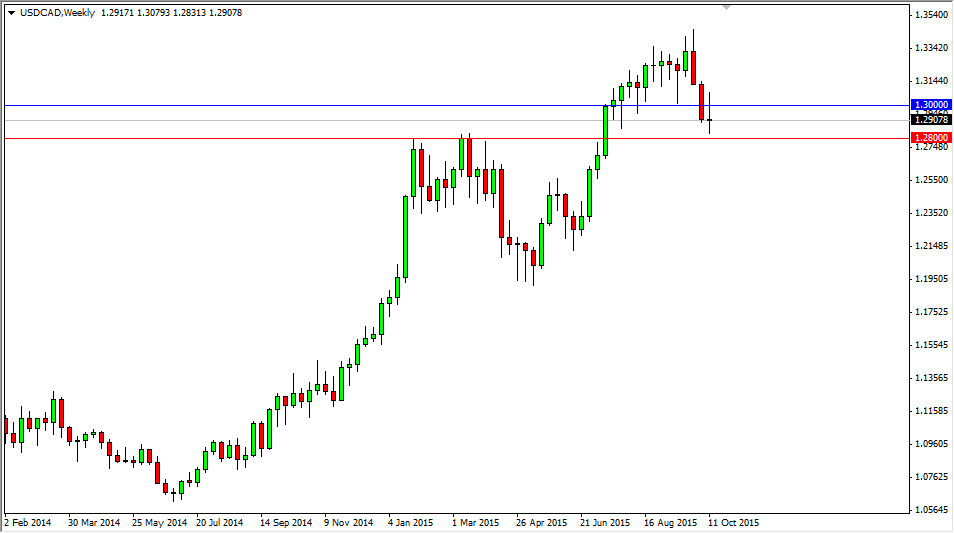

USD/CAD

This is a pair that can be very interesting to watch this week. Quite frankly, I recognize the support between the 1.28 level on the bottom and the 1.30 level at the top of that zone. That is an area that should attract a lot of attention, but if we can break above it again, that would be very bullish. On the other hand, a move below the 1.28 level would be very negative. I do not know whether or not I will trade this pair this week, but quite frankly these 2 levels could kick off the next major move in this market.

Leave A Comment