EUR/JPY

The EUR/JPY pair fell during the course of the week, testing the 125 handle. We close towards the bottom of the candle stick, so I feel that it’s only a matter of time before we break down below the 125 handle. During the week, we may get a bit of a bounce, but I will be looking at shorter-term charts for signs of exhaustion that I can start shorting again.

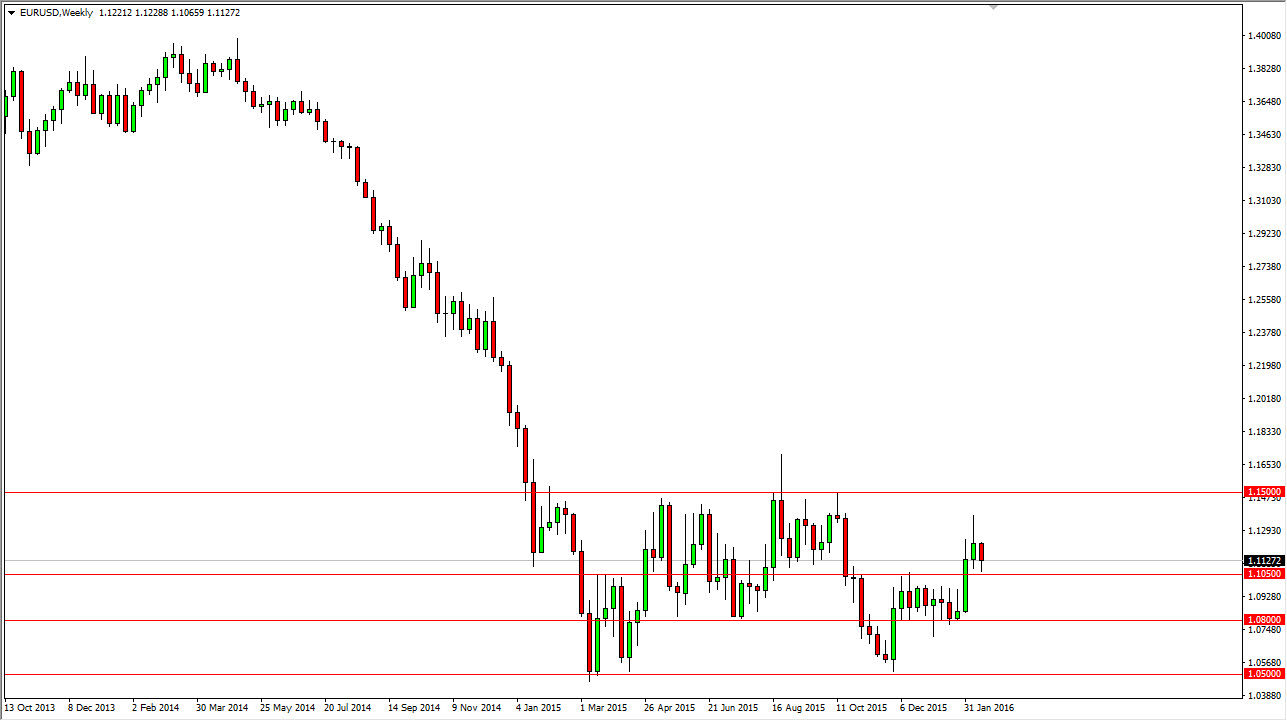

EUR/USD

The EUR/USD pair fell as well, testing the 1.1050 support level. We did bounce significantly, but the previous weekly candle is a shooting star. With that in mind, I believe that this market will be very choppy and tight this week. Quite frankly, I’m not completely against the idea of walking away from this pair for the time being.

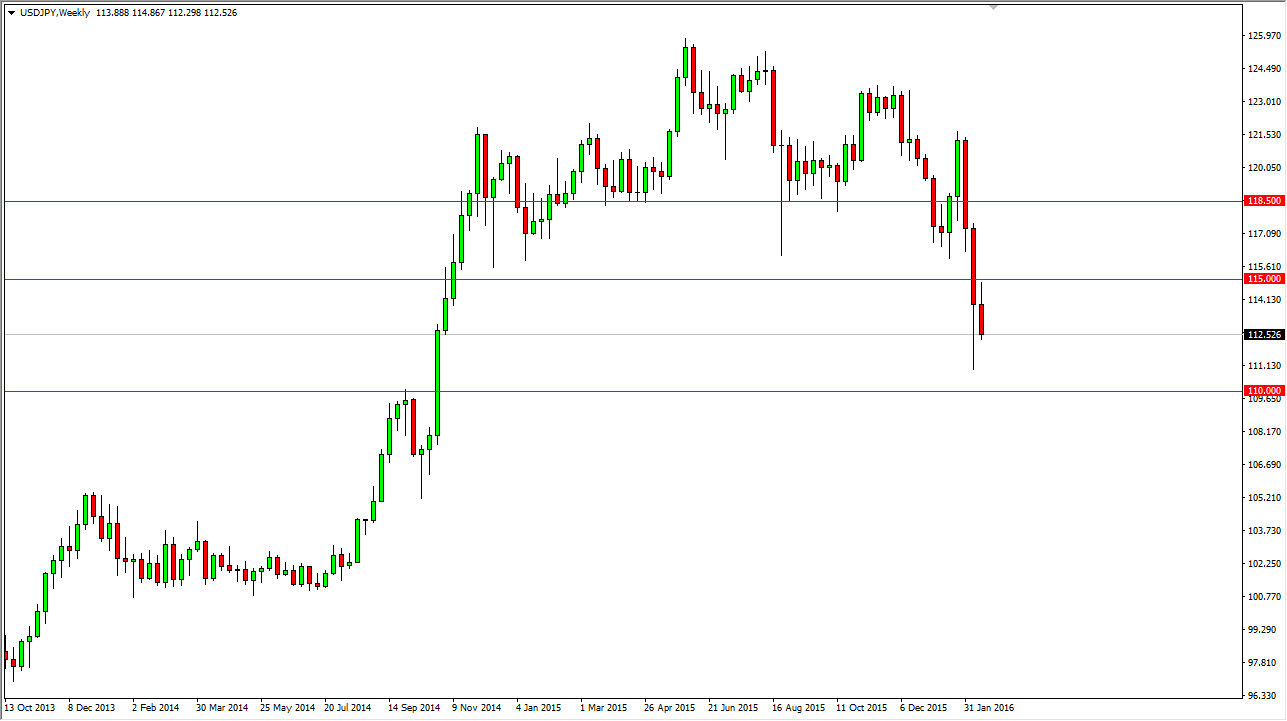

USD/JPY

The USD/JPY pair initially rallied during the course of the week, testing the 115 level. By doing so, it had found resistance at what had been support. With that, we ended up turning back around and falling all the way down to the 112.50 range. I think that the markets probably going to make a serious attempt to the 110 handle, but expect a lot of choppiness. I prefer to look for shorting opportunities based off of short-term exhaustion.

GBP/USD

The GBP/USD pair fell initially during the course of the week, but found enough support at the 1.42 level to turn things around and form a fairly significant looking hammer. This is a pair that may actually go against the grain and try to rally for most of the week, but I think eventually the sellers returned. With that I’m looking for exhaustion above in order to start selling again.

Leave A Comment