EUR/USD

The EUR/USD pair broke out above the resistance at the 1.1050 level, suggesting that we are going to go higher. I believe that short-term pullbacks will continue to be the way to go long of the Euro at this point in time. I expect a positive week. At this point in time, I believe that the 1.15 level will be challenged, but it may not be right away.

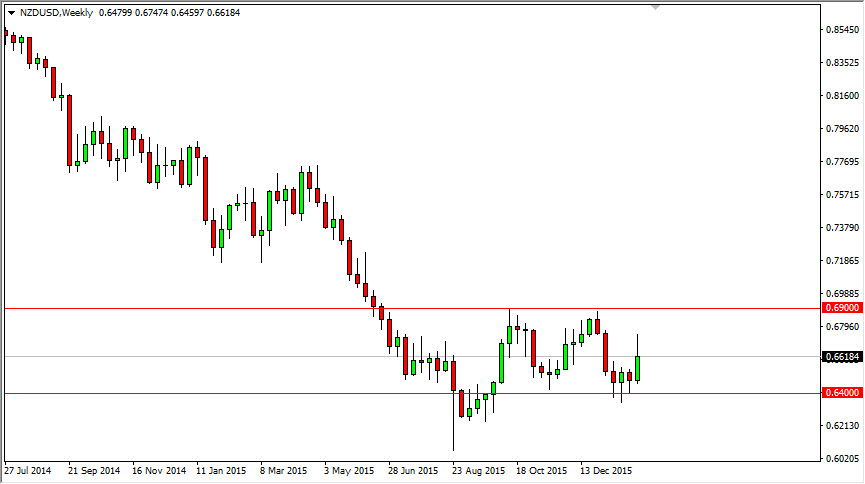

NZD/USD

The NZD/USD pair initially tried to rally during the course of the week, but gave back about half of the gains. I still believe that we are going to be a bit more positive though, so short-term pullbacks should offer buying opportunities as we try to reach back to the 0.69 handle. A break down below the 0.64 level would be somewhat catastrophic.

EUR/JPY

The EUR/JPY pair fell during the course of the week, testing the 130 level. Because of that it appears that the market will more than likely make a decision as to which direction to go based upon the 130 handle. If we are below it, I think we drop. If we are above it, all you can do is buy at that point in time.

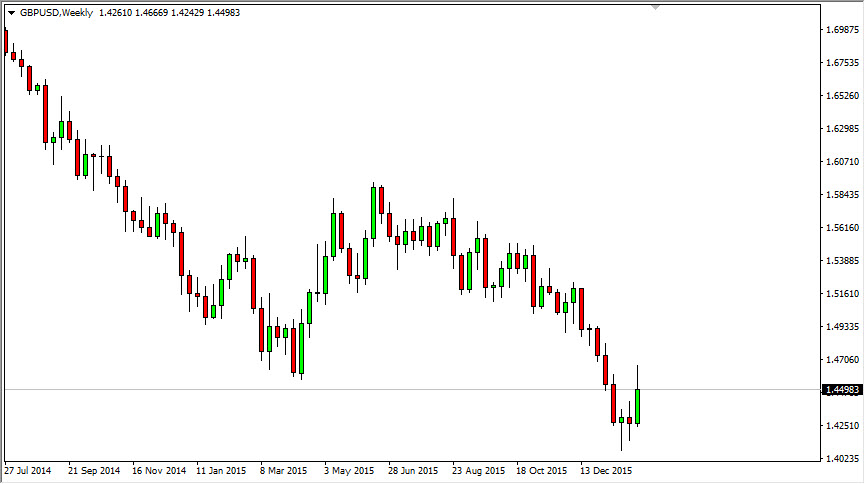

GBP/USD

The GBP/USD pair broke higher during the course of the week, testing the 1.47 level. Ultimately, this market did get back a little bit, so I think that it’s very likely this market will probably try to go higher but it will struggle. I think ultimately the sellers will get back into the market, but at this point in time I think we need to get a little bit of a bounce based upon the fact that we have sold off so hard recently.

Leave A Comment