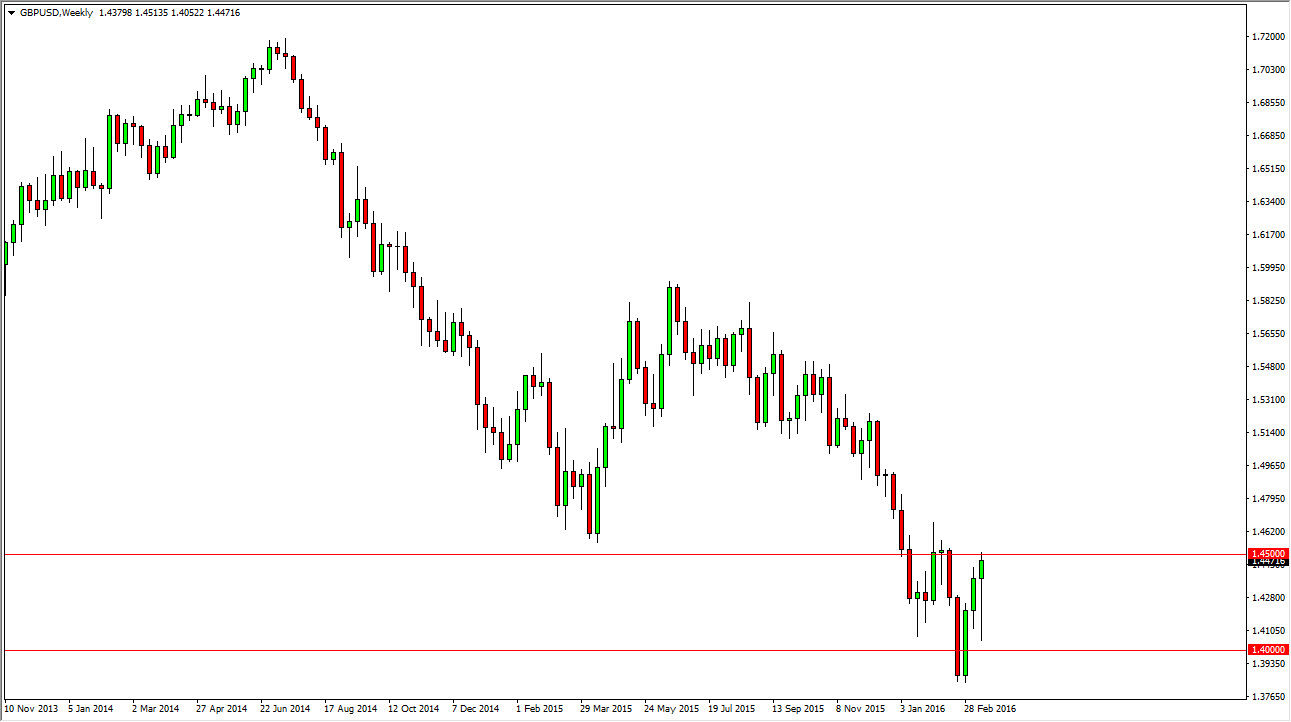

GBP/USD

The British pound initially fell during the course of the week, but found enough support just above the 1.40 level to turn things around and form a bit of a hammer. The hammer of course is a bullish sign and therefore I feel that if we can break above the 1.45 level, this market is ready to go much higher, probably aiming for the 1.50 level.

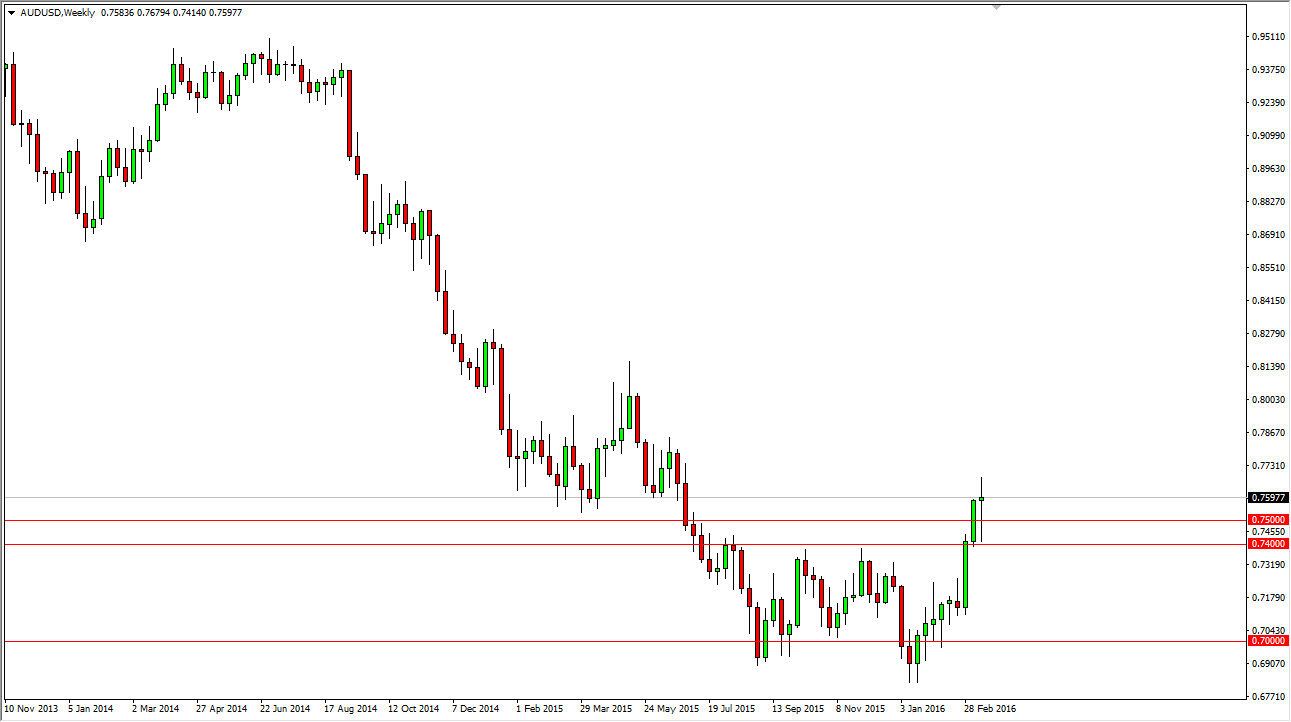

AUD/USD

The USD/USD pair initially fell during the course of the week, but found enough support at the 0.74 level to turn around and form a hammer. Keep in mind the gold markets have been rallying lately as well, so it looks as if we are going to continue to go higher. With the Federal Reserve stepping away from some of the interest-rate hikes this year, it makes sense that the US dollar will continue to lose value. A break of the top of the range for the week, I’m a buyer.

EUR/USD

The Euro fell significantly during the course of the week initially, testing the 1.1050 level. This is an area that had to hold, and quite frankly it did. Because of this, I feel that we are going to reach towards the 1.15 level given enough time, and then perhaps even break out above there.

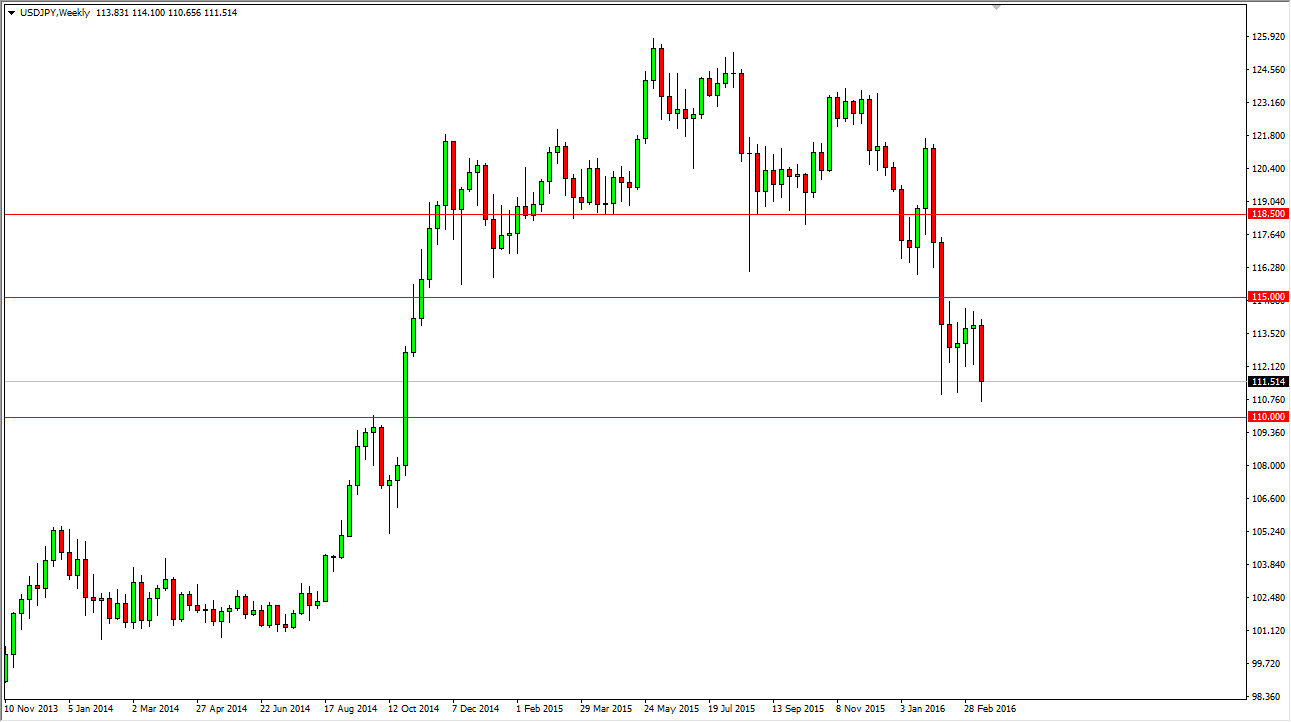

USD/JPY

The USD/JPY pair got pummeled during the course of the week, mainly because of the Federal Reserve stepping away from a couple of its expected interest-rate hikes. However, there’s quite a bit of support all the way down to the 110 level, so I am not interested in shorting this market. Sooner or later, there should be support below, and I will be a buyer then but right now is not the time. Keep in mind that this pair tends to be highly sensitive to risk appetite, so pay attention to stock markets for directionality.

Leave A Comment