EUR/USD

The Euro collapsed on Friday, as fears of contagion coming out of Turkey have taken a hold of the markets. The pair breaking below 1.15 is a significant turn of events, and I think it could send this market much lower, perhaps down to the 1.13 level in the short-term. I think that selling the rallies will be the way forward as long as we are below 1.15 in this pair.

GBP/USD

The British pound continues to struggle and breaking down to the 1.2750 level is just the latest sign of trouble. The pair will continue to struggle over all, and I think until we get some kind of resolution in the Brexit, its unlikely to pick up. I remain bearish below the 1.30 level but recognize that we may be looking for a short-term bounce. Sell it.

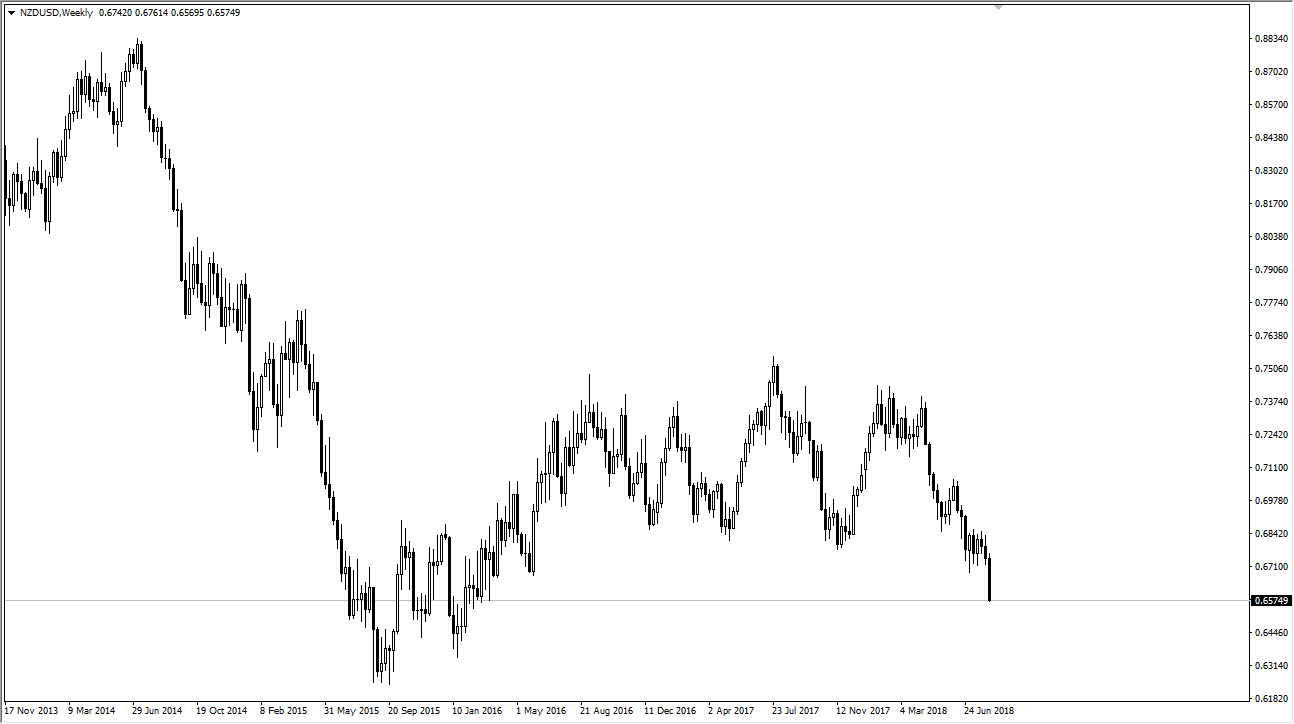

NZD/USD

The New Zealand dollar has broken down significantly, and it looks as if it is ready to continue lower. At this point, there is a lot of noise underneath current levels, so look to sell short-term rallies that fail. I would guess at this point we are heading towards the 0.65 level, but may need to pick up a few sellers before them. A break above the 0.6850 level would change everything. I don’t think it happens in the short-term. I think that this pair is also going to suffer at the hands of the trade war as well.

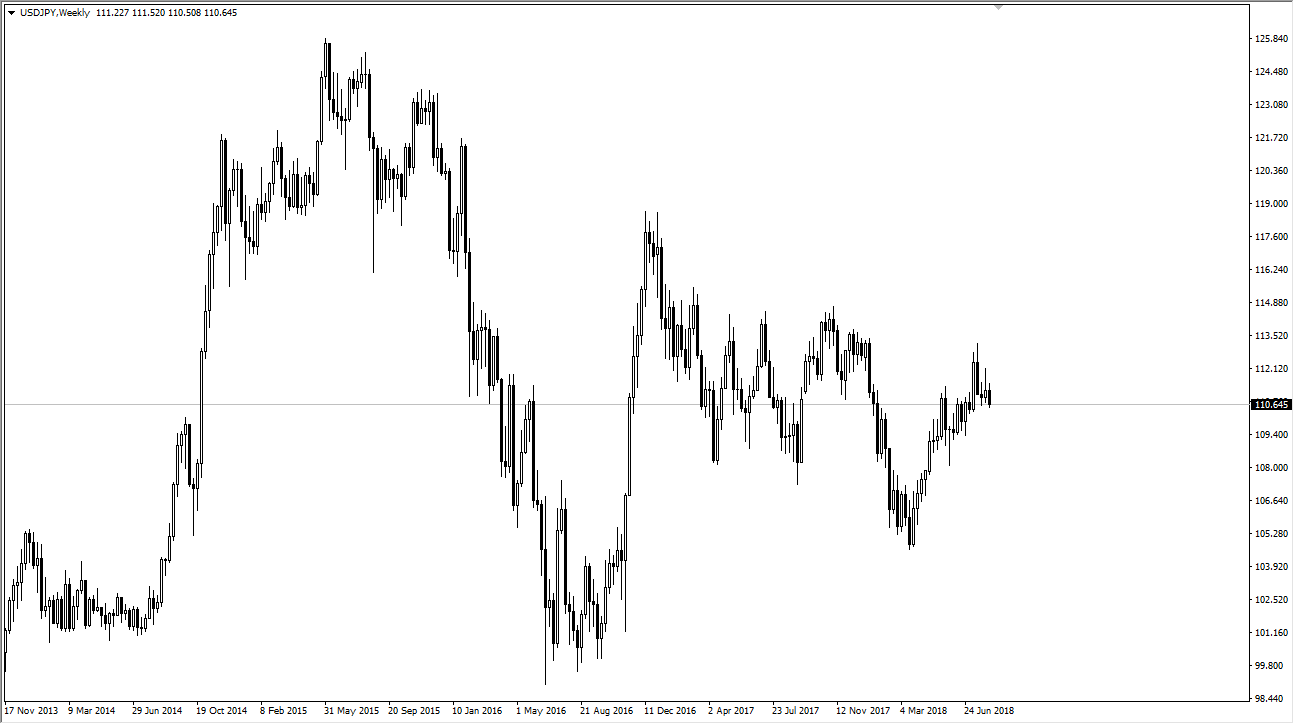

USD/JPY

The Dollar fell for the week, testing the 110.50 level. This are is significant, and sets up a very sideways market in the short-term. However, there are a lot of concerns around the world with global issues, and financial issues, so this could drop on some errant headline. Overall, I would leave it alone.

Leave A Comment