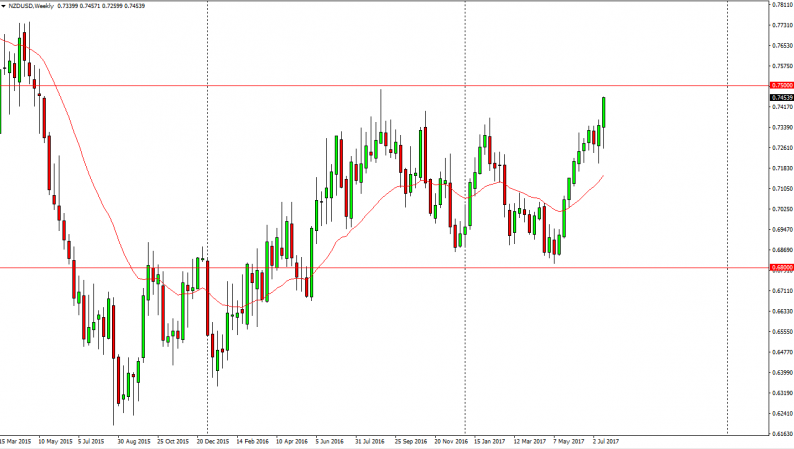

NZD/USD

The New Zealand dollar initially fell during the week but bounced enough to reach towards the 0.75 level above. That’s an area that should cause a significant amount of resistance, so I think that if we stay below there, the market is prone to pullbacks. This pullback should intervene buying opportunities though, because I believe eventually we break above that level, and continue to go much higher.

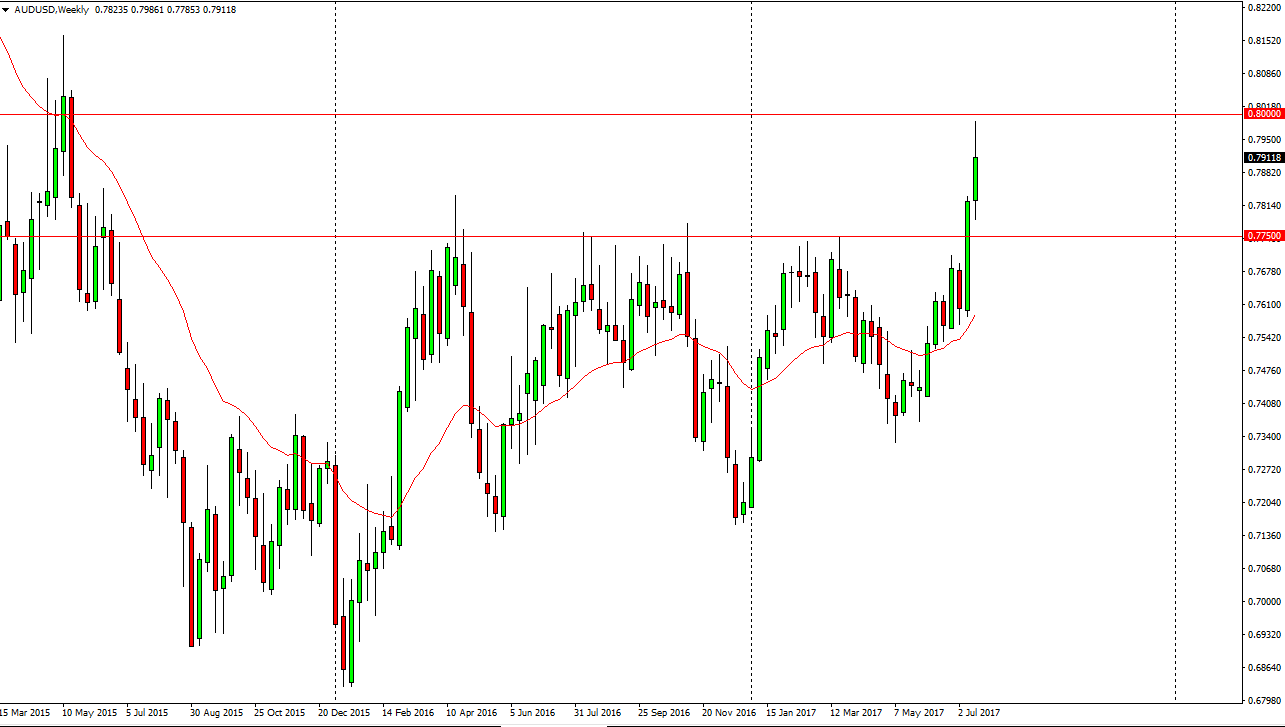

AUD/USD

The Australian dollar rallied during the week, reaching towards the 0.80 level above. That’s an area that has been important going back decades, so it’s not surprising at all that we saw the market push back. I think if we can break above there, becomes a “buy-and-hold” market, but in the meantime, I expect that the Australian dollar will pull back from time to time, offering value as we try to build up enough momentum to finally break out.

EUR/USD

The EUR/USD pair broke out above the 1.15 level during the week, which is an area that began significant resistance. The resistance has been in a fact for almost 3 years, so this breakout is very significant. I believe the pullbacks will continue to offer buying opportunities as the euro should go looking for the 1.18 level.

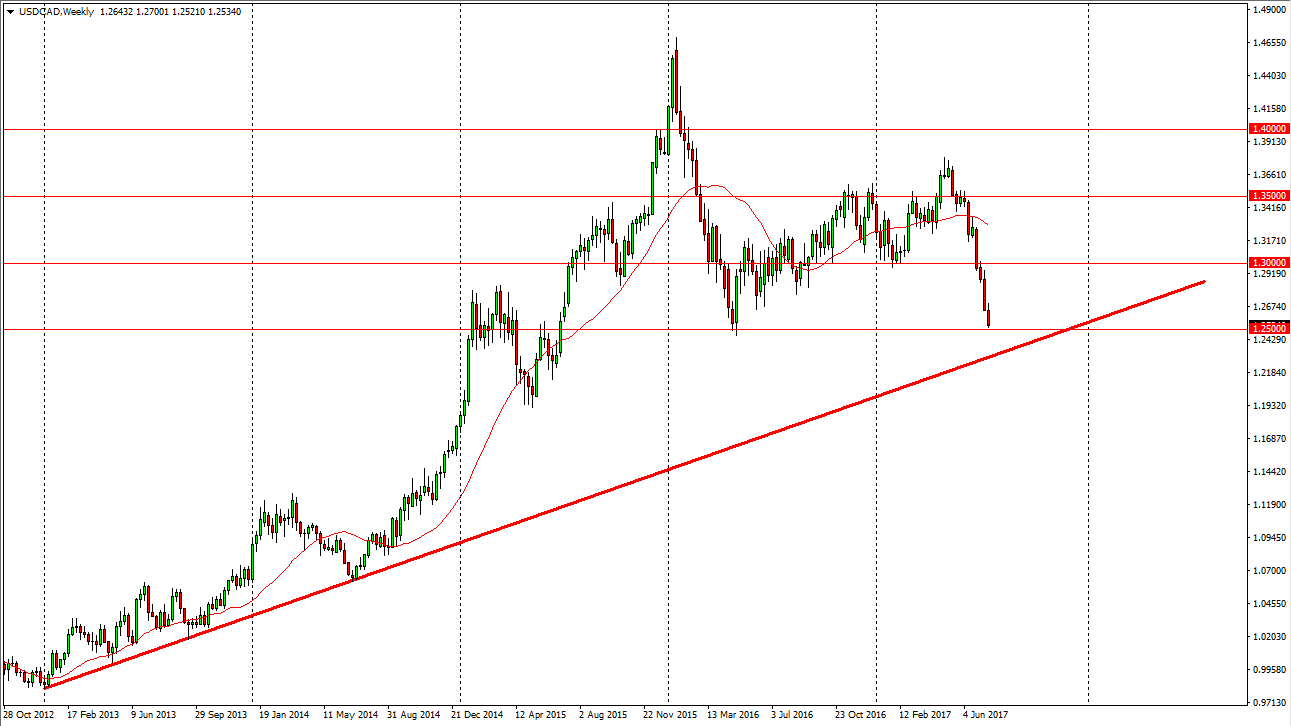

USD/CAD

The US dollar fell against the Canadian dollar again this week, reaching down to the 1.25 handle. However, we are starting to get oversold so expect that we will see some type of bounce. Rallies of this point in time should be selling opportunities though, as there is a much more significant uptrend line below that the market will probably try to target.

Leave A Comment