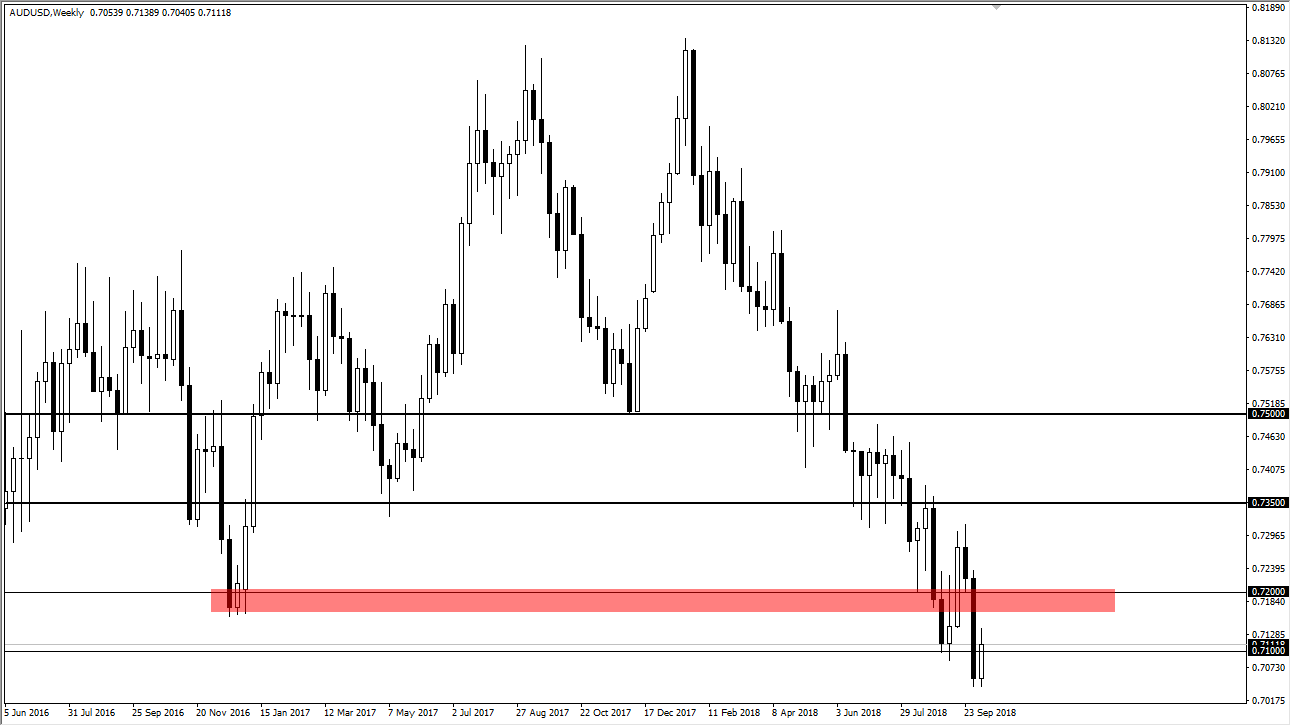

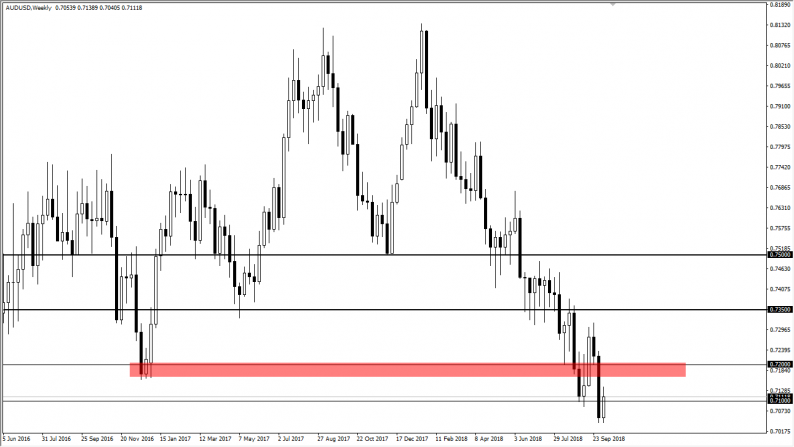

The Australian dollar rallied during most of the week, and even managed to close above the 0.71 handle. At this point, that was a bit of a victory but I also recognize that there is a lot of negativity above, especially near the 0.72 handle. I’m looking for some type of exhaustive candle on a shorter time frame to start selling. I recognize that we could go a little bit higher here, but we are most certainly in a downtrend and the 0.72 level above was significant support previously. I’m looking to sell as soon as I get an opportunity. However, we may have to wait for that opportunity.

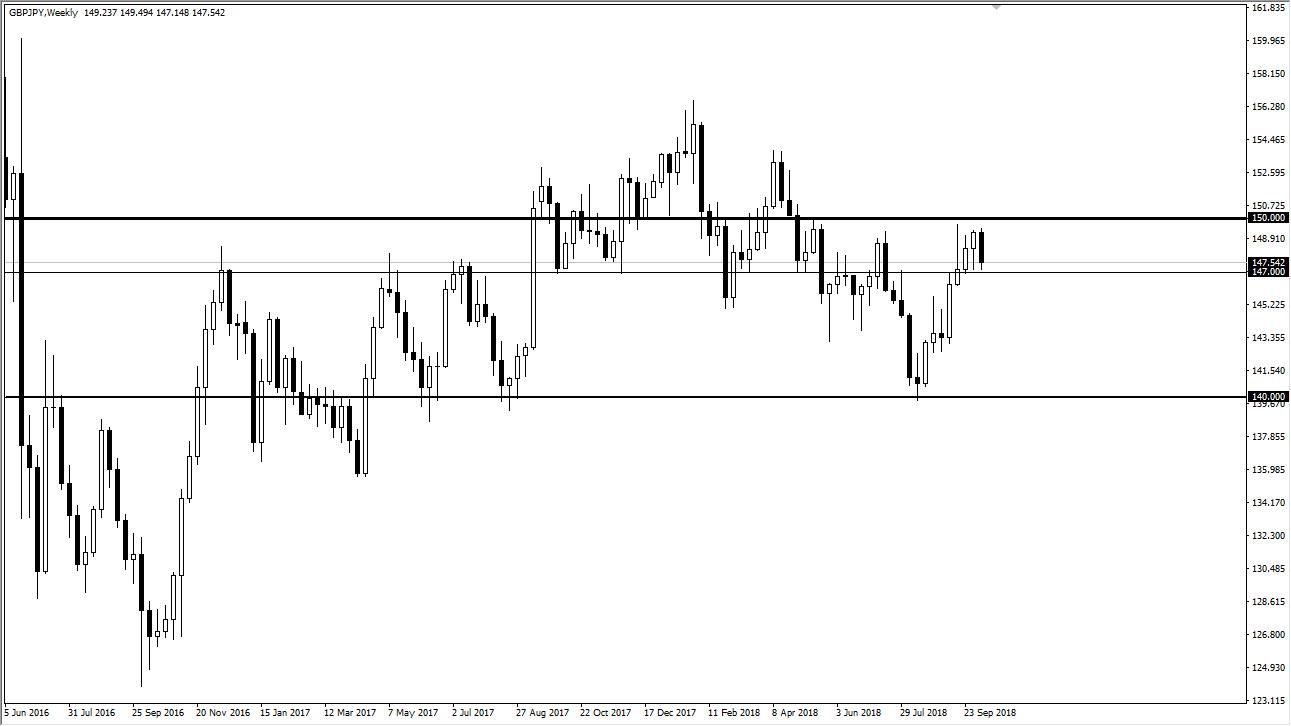

GBP/JPY

The British pound fell rather hard against the Japanese yen during the week, slamming into the ¥147 area. If we can break down below that level, then we could trigger larger selling orders down to the ¥145 level, perhaps even down to the ¥140 level after that. There is a shooting star that has not been broken to the downside from three weeks ago, nor has it been broken above. Since then, we have gone back and forth. I think longer-term traders are waiting to see if we can get out of this little 300 pips range.

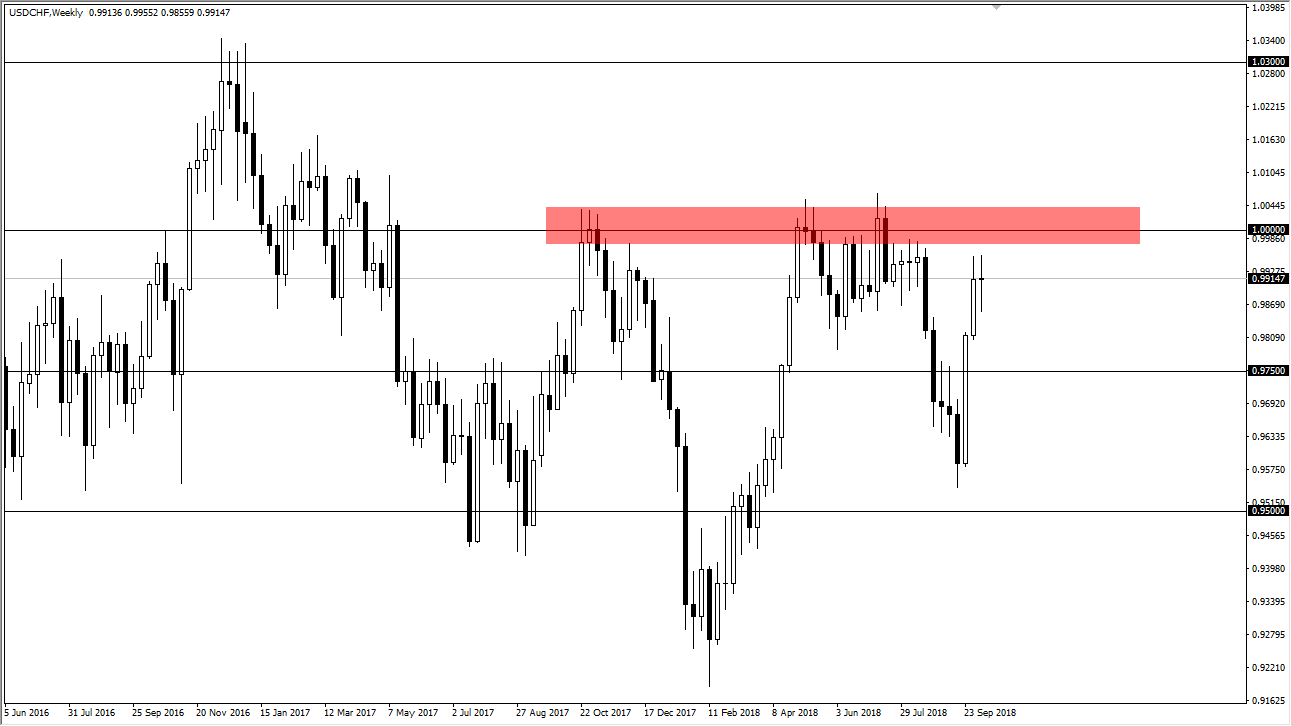

USD/CHF

The US dollar went back and forth against the Swiss franc during the week, finishing basically unchanged. We previously had a couple of very bullish candles, so the fact that we ran out of momentum tells me that we will probably struggle to go higher. Above is the parity level, and I think that the sellers are about to enter this marketplace. If we do pull back from here, I would anticipate a move down to the 0.98 level underneath.

USD/JPY

The US dollar broke below the shooting star from the previous week, slicing down to the ¥112 level. If we break down below the ¥112 level, the market probably drops to the ¥111 level next, but the easy money to the downside has already been made. That of course could be different if the stock markets break down rather significantly as we have in the past couple of sessions. Otherwise, we could get a bit of a short-term bounce.

Leave A Comment