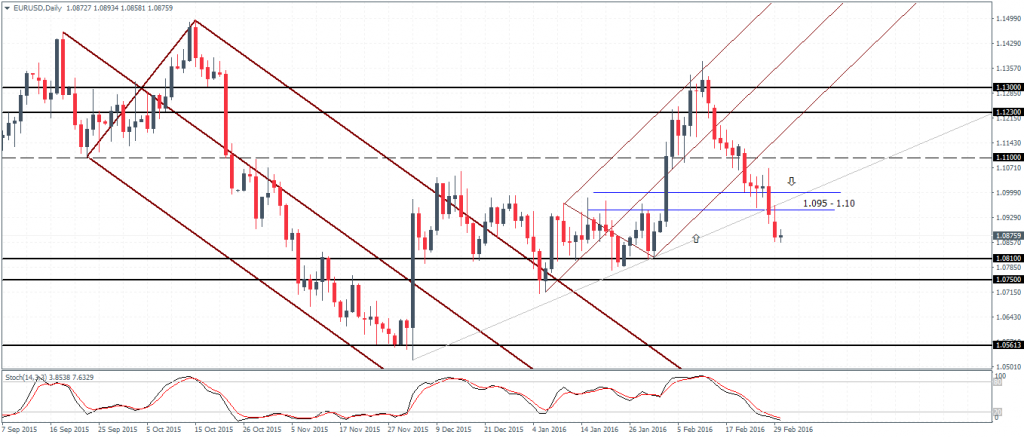

EUR/USD (1.086): The single currency has posted a steady decline over the past few days breaking below the 1.11 support. Further declines could see the Euro fall to 1.081 – 1.075 level, where the next support is established. Below 1.075, EUR/USD could be looking to test the previous lows established near 1.056 region. However, in the near term, following the break of the trend line, EUR/USD could look for a bounce back to retest the broken trend line near 1.095 – 1.10 handle. Establishing resistance on the pullback could pave the way for further downside, to as low as 1.056 levels. The Stochastics on the daily chart is strongly in the oversold level, highlighting the risk of a short-term bounce in prices.

EUR/USD Nearing support at 1.081 – 1.075

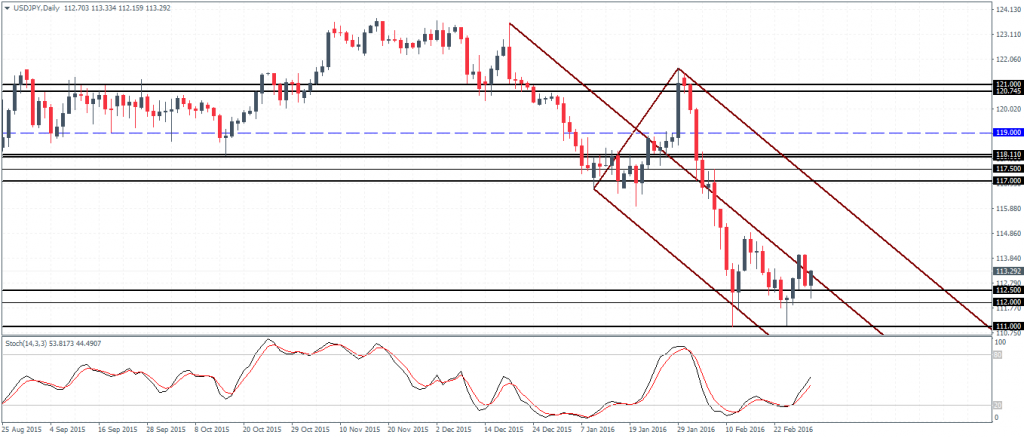

USD/JPY (113.2): USD/JPY remains consolidated above the 112.5 – 112 support with two tests below this level to 111.5 – 111.0 being strongly rejected. An eventual move to 117.0 remains in place but we expect to see a short-term dip to see prices close near the 111.5 – 111.0 support. In the near term, the downside risks for USD/JPY looks to be easing, but the overall bias remains to the downside, with a rally to 117 indicating a pullback to the longer term downtrend. The Stochastics oscillator is has printed a higher low on the lower low in prices, indicating bullish divergence and validating the anticipated move to 117.0.

USD/JPY looks to aim for 117 resistance

Leave A Comment