This is the first of what we hope will be a series of articles designed not only to highlight potential trade set-ups for you to watch out for, but also to enhance your learning with some real-time market analysis.

This week we’ll begin with our monthly and weekly forecasts of the currency pairs worth watching. The first part of our forecast is based upon our research of the past 11 years of Forex prices, which show that the following methodologies have all produced profitable results:

Trading the two currencies that are trending the most strongly over the past 3 months.

Assuming that trends are usually ready to reverse after 12 months.

Trading against very strong counter-trend movements by currency pairs made during the previous week.

Buying currencies with high interest rates and selling currencies with low interest rates.

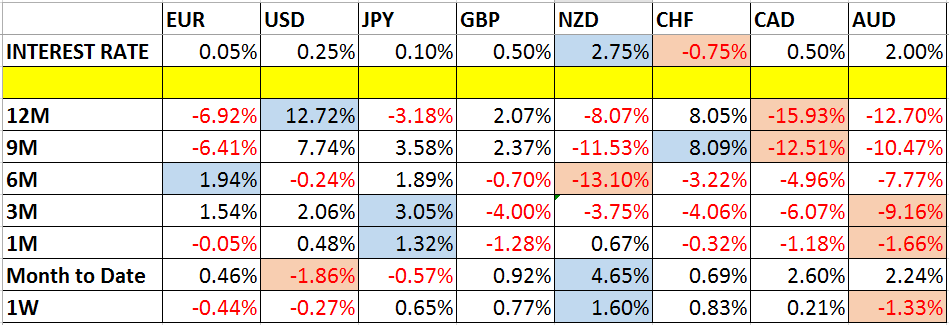

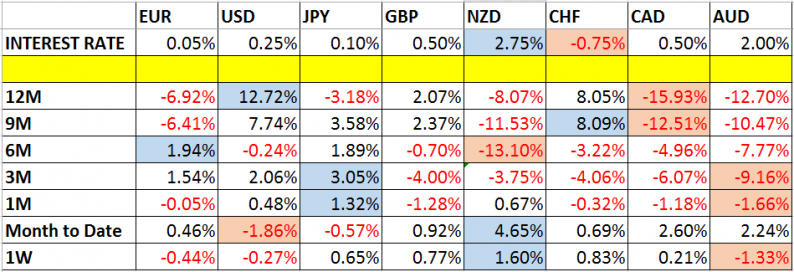

Let’s take a look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast October 2015

This month we forecast that the most probable movement is short AUD/JPY. The performance so far has not been great and is shown below:

Currency Pair

Forecast Direction

Interest Rate Differential

Performance to Date

AUD/JPY

Short ?

-1.90% (0.10% – 2.00%)

-3.15%

Weekly Forecast 18th October 2015

This week, we make no forecast, as there are no strong counter-trend movements.

Last week saw continuing great strength in the NZD, and also strength in the CHF, GBP and JPY. The weakest currency over the week was the AUD.

Volatility was lower than the previous week. Only 25% of the major and minor currency pairs changed in value by more than 1%. Volatility is likely to be higher this this week as there are central bank events scheduled for the EUR, CAD and the AUD.

Leave A Comment