Gold prices ended Friday’s session up $20.43 an ounce, marking their first weekly rise in seven weeks, as the dollar drifted down against most major currencies following comments from Federal Reserve Chairman Jerome Powell and weaker-than-expected reading on durable-goods orders. U.S. and Chinese officials concluded two days of talks on Thursday without any progress. At the Kansas City Fed’s annual symposium, several policy makers said the economy’s solid performance justifies further gradual interest-rate increases.

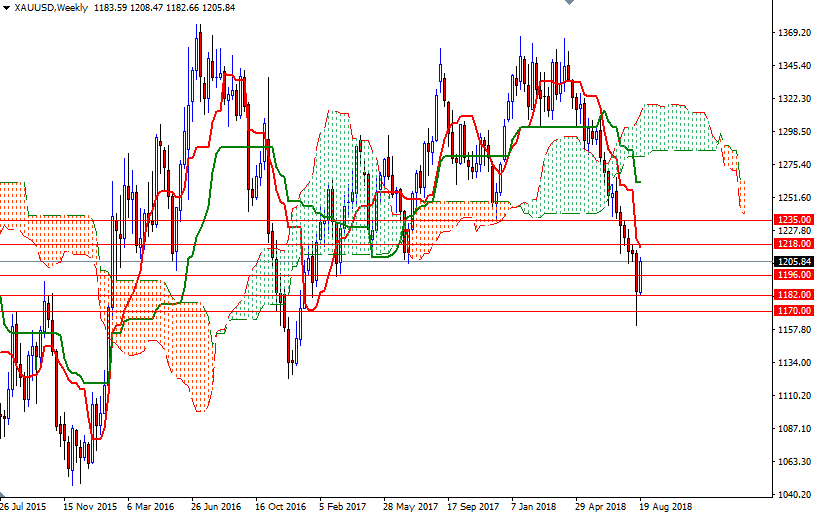

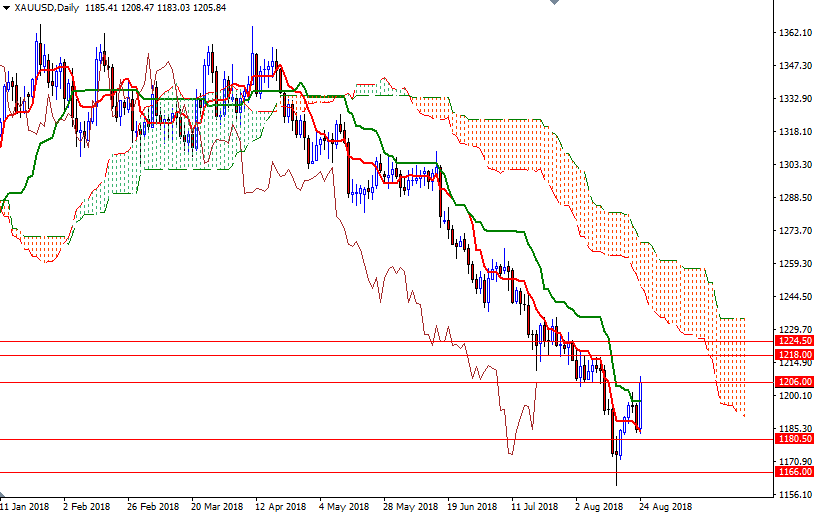

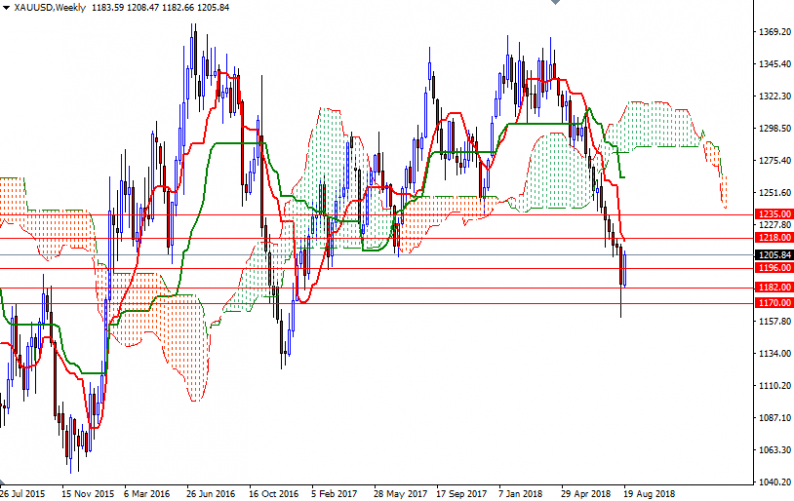

Technically, the bears have the overall technical advantage, with the market trading below the weekly and the daily Ichimoku clouds. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. In addition, the Chikou-span (closing price plotted 26 periods behind, brown line) is below the daily cloud. However, as I said last week, the short-term charts points to sideways-to-higher price action.

The first upside barrier stands in 1208/6. If XAU/USD confidently climbs above this area, prices will tend to more towards the daily clouds. In that case, look for further downside with 1218 and 1226-1224.50 as targets. The bulls have to produce a daily close above 1226 to make a run for 1240-1235. To the downside, keep an eye on the nearby supports such as 1202/0 and 1196/5. If prices fall back below 1195, the market will return to 1190-1188, the top of the 4-hourly cloud. The bottom of the 4-hourly cloud sits in the 1182-1180.50 area so the bears have to capture this camp to make an assault on 1172/0. A daily close below 1170 opens up the risk of a drop to 1166 or even 1160.

Leave A Comment