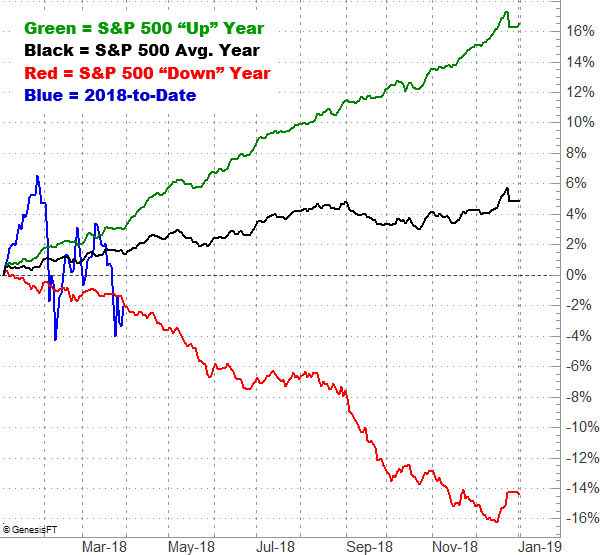

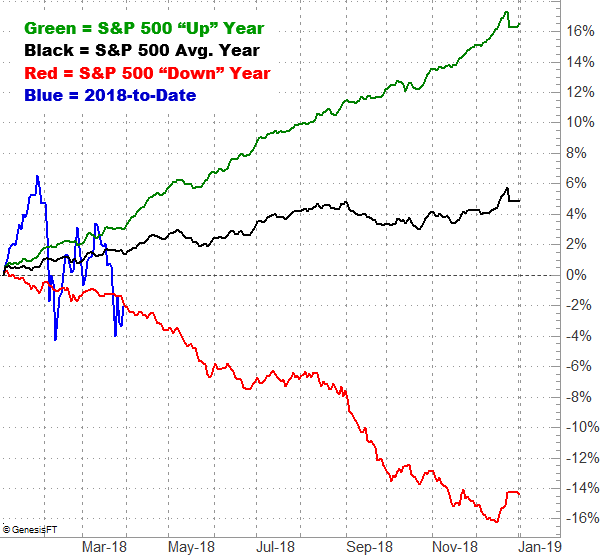

Once again, the market played with fire. And once again, the market managed to escape… unburned. Stocks could have certainly fared better than they did, but even a small bounce is a much-needed step back from the ledge the market was approaching just a week earlier. It’s something to build on.

Still, stocks are hardly out of the woods. A break under a major support level is still within easy reach, and a political storm continues to brew. Plus, the near-term trend is still technically a bearish one.

We’ll look at the good, the bad and the ugly below, after running down last week’s economic reports and previewing this week’s economic announcements.

Economic Data

Last week wasn’t a particularly big week in terms of economic news, but a couple of items are worth examining.

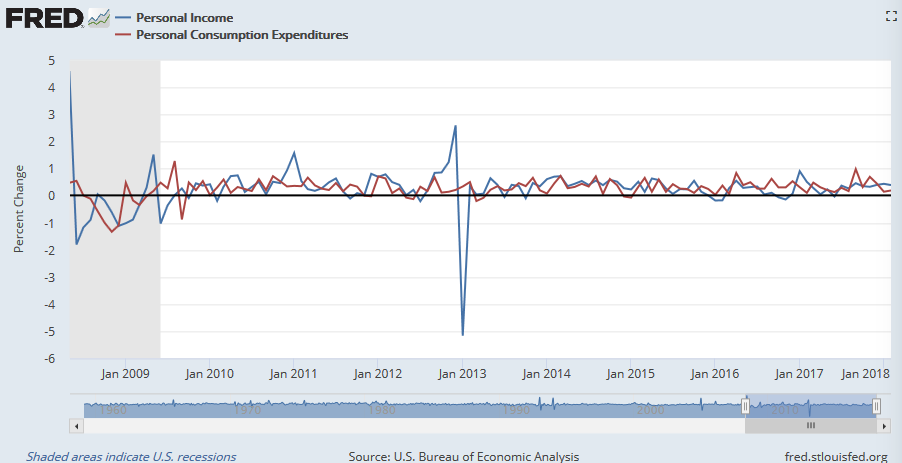

Chief among them is last month’s personal income and personal spending, both of which were up as much as expected, and up for a second month. In fact, both have been trending higher for years now.

Personal Income and Personal Spending Charts

Source: St. Louis FRED

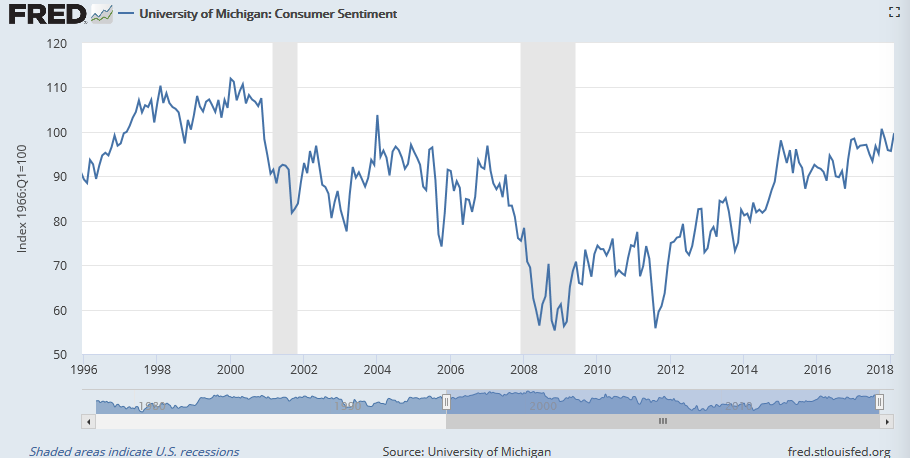

The other biggie was the third and final update of the Michigan Sentiment Index for March. It rolled in at 101.4, up a bit from February’s score, and extending an erratic but clear rise since 2009.

Michigan Sentiment Index Charts

Source: St. Louis FRED

Everything else is on the grid.

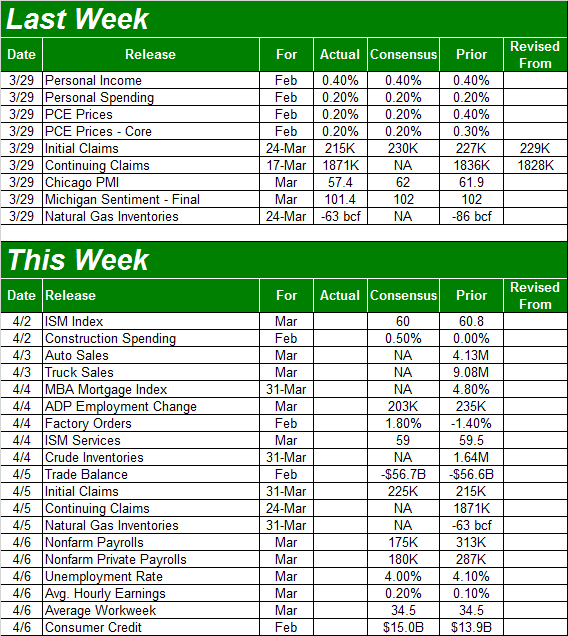

Economic Calendar

Source: Briefing.com

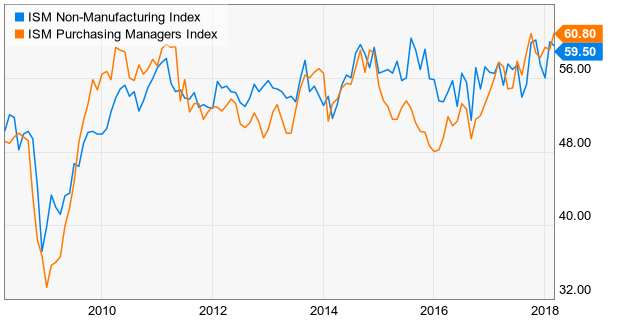

We’ll see a lot more activity this week in terms of economic news, beginning with the ISM Manufacturing Index report on Monday, and Wednesday’s ISM Services report. Both have been advancing nicely of late, in step with economic acceleration.

ISM Manufacturing and Services Index Charts

Source: YCharts

On Tuesday keep your eyes/ears open for March’s auto sales data; the industry needs a victory here, after a streak of declines. Note that “peak auto” clearly happened in 2016. The surge late last year stemmed from the impact of not one but two hurricanes.

Leave A Comment