?Even with Thursday’s and Friday’s lull, the shortened-trading week was a bullishly productive one. The S&P 500 (SPX) (SPY) ended the week at 1917.78, up 2.8%. On the other hand, most of the major indices are now squarely in the middle of some pretty significant support and resistance levels – they need to make a stronger commitment to one direction or the other before becoming trade-worthy. The bias, though, is bullish in many ways.

We’ll dissect the market’s upside and downside in a moment. Let’s first review last week’s economic news, and preview what’s in the cards for the economy this week.

Economic Data

It was a pretty big week last week, in terms of economic data. We got key updates on inflation, industrial production, and real estate. In no particular order…

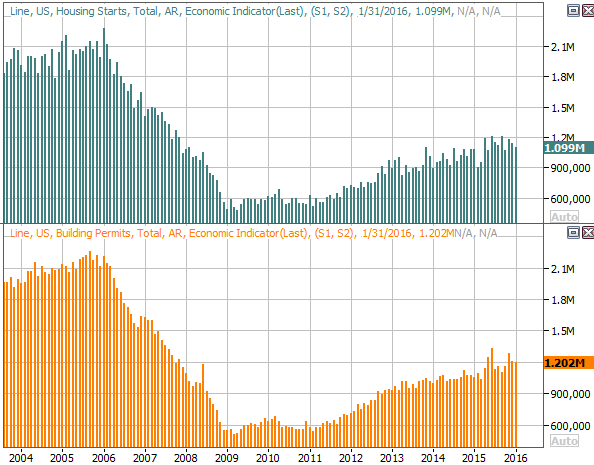

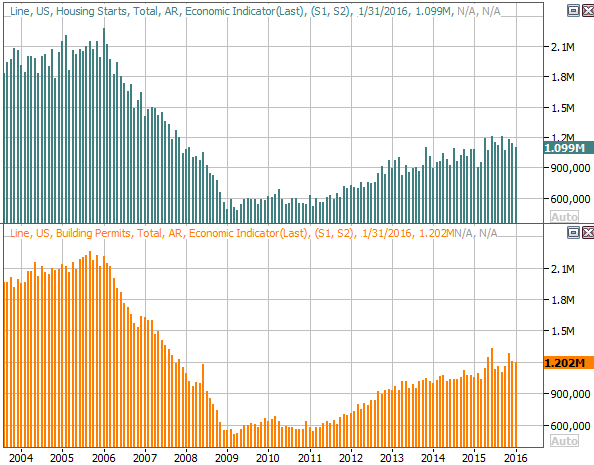

Housing starts and building permits issued in January weren’t bad, but they weren’t great either. Starts came in at a pace of 1.099 million, down from December’s pace of 1.143 million. Permits came in at 1.202 million, down just a bit from the previous month’s reading of 1.204 million. All the same, the bigger trend in both cases remains bullish.

Housing Starts and Building Permits Chart

Source: Thomson Reuters

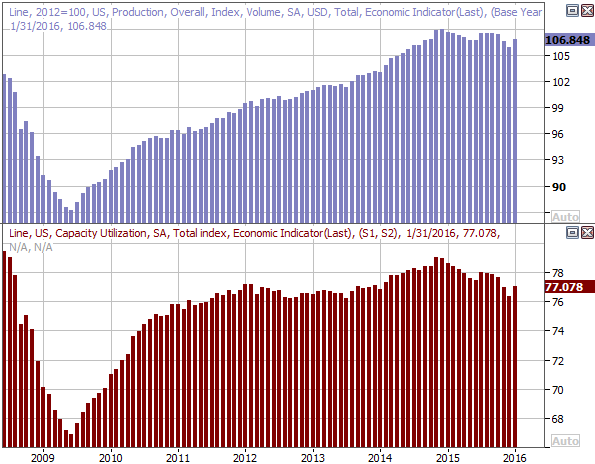

As for industrial production and capacity utilization, we got surprisingly good readings from both. Productivity was up 0.9% versus expectations for growth of only 0.3%, while capacity utilization grew from 76.4% to 77.1%.Not that one month makes a trend, but this was a much needed victory in terms of industrial productivity. As the chart indicates, both were starting to wane, such January’s jolt restores a fair amount of hope. Another “up” would go miles with investors.

Capacity Utilization and Industrial Production Chart

Source: Thomson Reuters

Finally, it looks like any concerns regarding a lack of inflation may not have been merited. Though still not rampant yet, inflation continues to improve in a healthy manner.The consumer inflation rate now stands at 1.37%, and removing food and energy from the equation, the rate stands at a full 2.2%. Producer inflation has yet to reach those levels, but across the board inflation is picking up again as the effects of weak oil prices are now over a year old. The Federal Reserve will need – or lease want – to contain this soon, using interest rate hikes.

Leave A Comment