Weekly Market Outlook – November 22nd, 2015

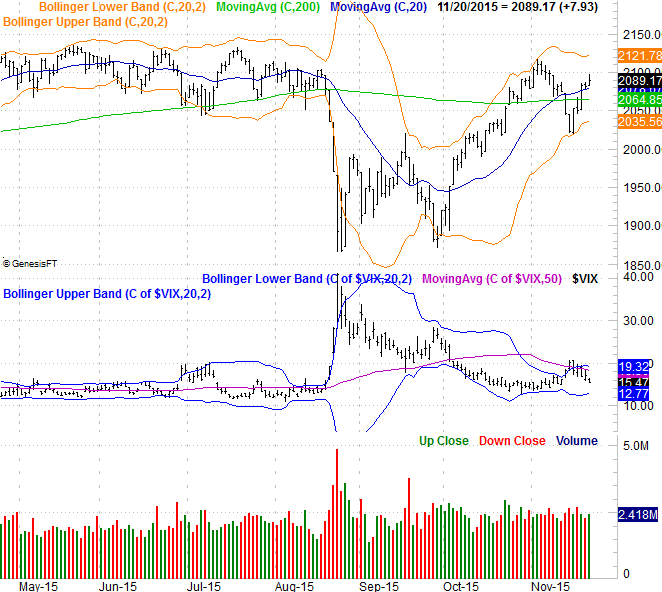

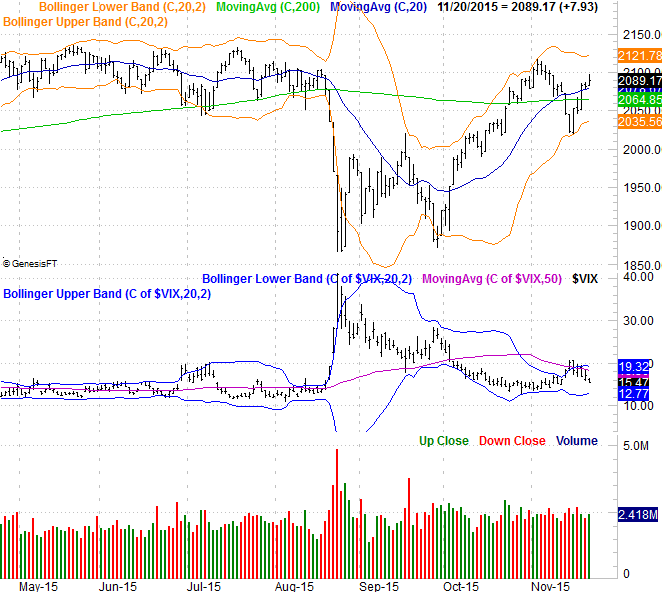

Last week a diametrical opposite to the action from two weeks ago. Two weeks ago, the bears were firmly in charge, and picking up steam. Something happened over the prior weekend though, and stocks hit the ground running higher last week… and never looked back. When all was said and done, the S&P 500 (SPX) (SPY) finished the week up 3.6%, having hurdled two key moving averages along the way.

And yet, the finish on Friday was anything but convincingly bullish.

This week could go either way, though it’s worth noting that the BigTrends TrendScore for stocks was a solid 83.5 (out of 100) as of Friday close, pointing bullishly. Thanksgiving week is also usually a bullish one too, even if tepidly.

We’ll run through it all, but first, let’s work through some of the key economic numbers.

Economic Data

Last week wasn’t a huge week for economic data. The biggest news was the release of the minutes from last month’s meeting of the Federal Reserve’s governors meeting. No curve-balls…but it does appear the Fed’s leaders were even more gung-ho to ramp up rates this December than the market was even anticipating. As of Friday’s close, traders are saying there’s a 74% chance the Fed Funds rate will move to 0.5% (and only a 26% chance it will remain at 0.25%).

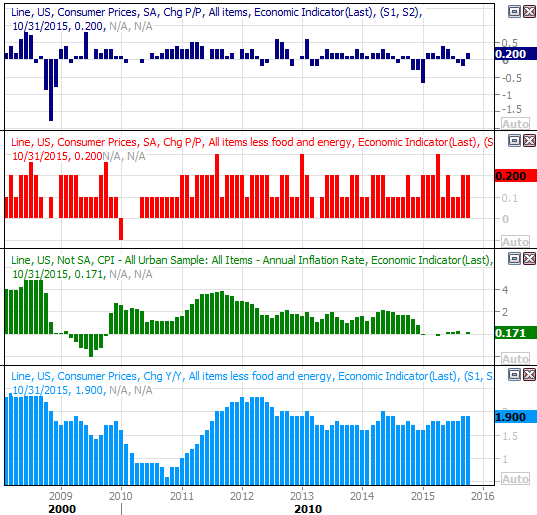

We also got a look at last month’s consumer inflation rate. For the month, price grew 0.2% overall and on a core (ex-food and ex-energy) basis. But, don’t jump to conclusions. On a year-over-year basis, the inflation rate now stands at 0.171% overall, and is still a tame 1.9% on a core basis. There’s no serious inflationary pressure forcing the Fed to pump up rates.

Inflation Chart

Source: Thomas Reuters

We also got an update on the home-construction front. Starts fell, but permits perked up. Both moves reversed September’s moves. More important, in both cases, the longer-term trend is still an upward-pointing one.

Leave A Comment