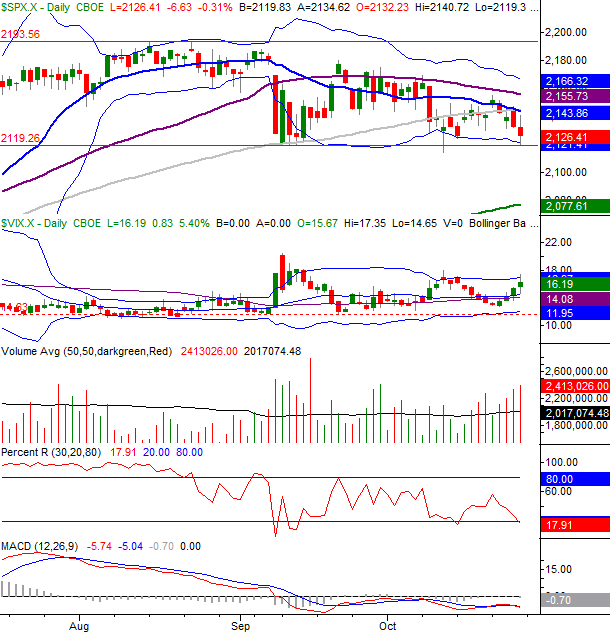

Stocks tried to get the market back in a bullish groove, staging a pretty solid advance on Monday of last week. It wasn’t meant to be though. That rally effort petered out beginning on Tuesday, and then accelerated as the week wore on with the weight of a big Q2 rally still getting in the way. By the time Friday’s closing bell rang most of the indices were within easy reach of a major support level. One stumble this week could finally pop this fragile (albeit short-term) bubble.

And if there was ever a week for it to happen, this is the week. There are a handful of major economic announcements and news events in the cards. One of them could dish out a big blow. Of course, we’ve been in this situation before without the bears getting the job done.

We’ll look at the key lines in the sand after running down this week’s and last week’s key economic numbers.

Economic Data

It was a relatively busy week in terms of economic news, but there’s no doubt about the highlight… the grand finale was Friday’s GDP growth rate estimate. Though only the first of three estimates, the surprising rate of 2.9% versus estimates of 2.5% growth was a head-turner. That’s the highest growth rate seen since the third quarter of 2015 (when GDP grew at 5.0%).

To be fair, unusually high inventory-level growth added 0.6% to the figure. Still, the rate is the rate – inventory buildup is always part of the reading – but even stripping out that part of the growth you’re still left with a fairly solid 2.0% expansion.

GDP Growth Chart

Source: U.S. Bureau of Economic Analysis

That strong reading certainly raises the likelihood of a rate hike before the end of this year.

It was also an important week for consumer sentiment measures, although not necessarily a great one. The Conference Board’s consumer confidence score slid from 103.5 in September to 98.6 for this month, while the Michigan Sentiment Index ended October with a final score of 87.2, down from 91.2 in September. While not “trouble” per se yet, we need some help on this front.

Leave A Comment