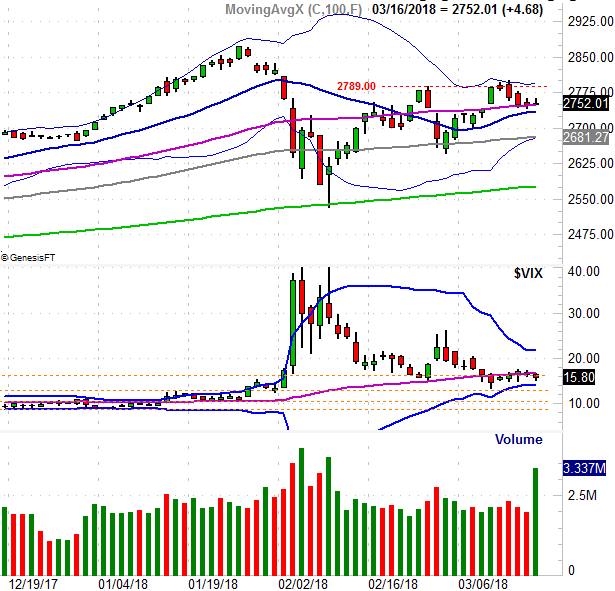

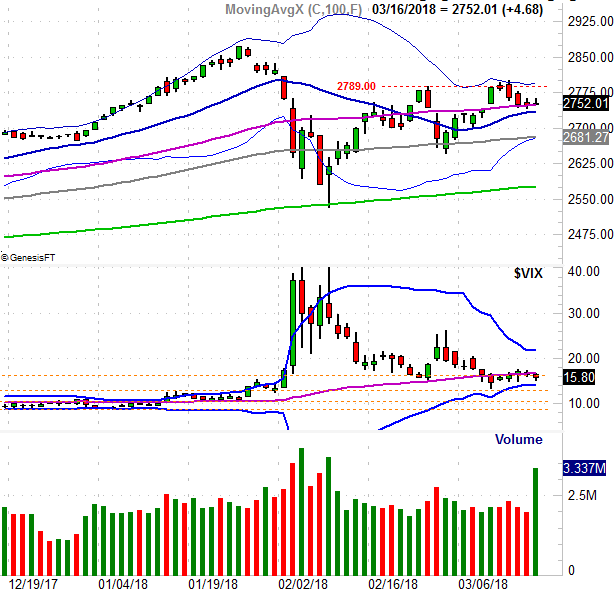

The bulls were able to muster something of a gain on Friday after slowing the bearish train on Thursday. But, it wasn’t enough to undo the damage done earlier in the week. Stocks lost a little ground last week, bringing a quick end to the prior week’s healthy bullishness.

It’s not the end of the world. Indeed, it’s been quite normal for the market to take one step back for every two steps it takes forward; last week was just one small step back. The overall recovery effort is still intact. Broadly speaking though, there’s not a lot of “oomph” behind this advance, with traders concerned about everything from valuations to an economic slowdown to political fighting in Washington D.C.

We’ll show you what we mean below, after a quick run-through of last week’s and this week’s economic news.

Economic Data

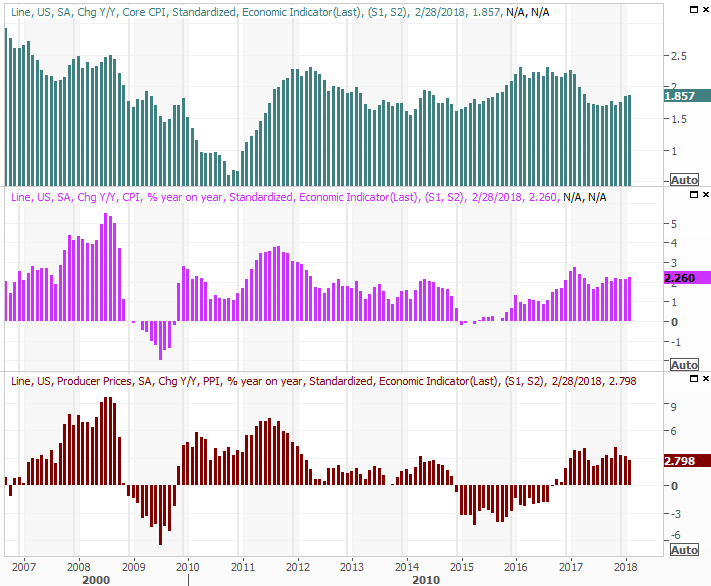

Good news… inflation is still fairly tame, all things considered. Price-hikes for consumers as well as companies were modest last month, rolling in as expected. The consumer inflation rate now stands at 2.26%, and on a core basis is 1.86%. Producer inflation is 2.8% on an annualized basis, not counting volatile food and energy input prices. Note that inflation rates are mostly edging higher.

Consumer and Producer Inflation (Annualized) Charts

Source: Thomson Reuters Eikon

There’s chatter circulating that the Fed could impose 100 basis points worth of rate hikes this year, in four quarter-point installments or in three doses with one of them being a 50-basis point increase. Though the data says three rate increases are likely (with one of them possibly coming this week), the four-hike/100 basis point argument is a bit over the top.

We also got last month’s retail sales data last week. It wasn’t as good as expected… or was it?

On a month-to-month basis, February’s consumerism fell 0.1% counting cars, but only grew 0.2% taking cars out of the equation; economists were expecting 0.4% growth.

Leave A Comment