Weekly Market Outlook – August 29, 2016

Unable to resist the weight of its 9% gain since its late-June low, the S&P 500 (SPX) (SPY) finally started to buckle last week. The index only lost 0.68% for the five-day span, but that was the worst weekly performance since June, and could end up serving as the profit-taking excuse some traders have been waiting for.

We’ll look at the matter in more detail after a closer look at last week’s and this week’s economic numbers. They matter more than usual now, with the prospect of rising interest rates on the table.

Economic Data

The economic news dance card was pretty light last week (though we’ll make up for it this week). In fact, the only items of real interest were last month’s home sales data and a confirmation of the Q2 GDP growth data we heard last month.

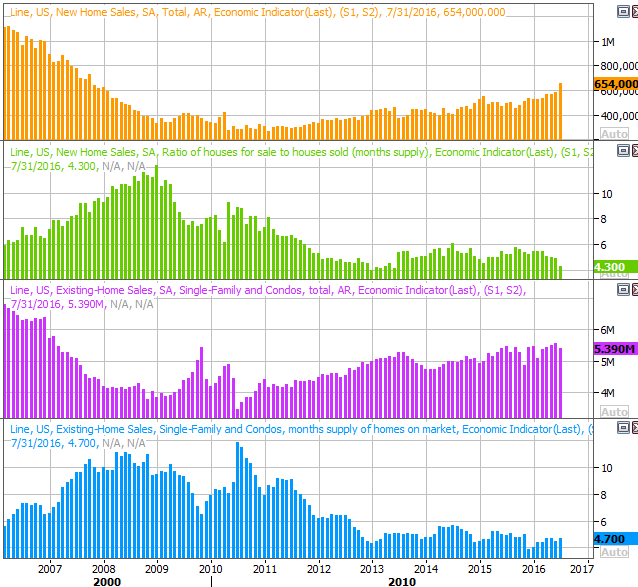

As for home sales, new-home sales soared to a multi-year high pace of 654,000 units. Meanwhile, sales of existing homes fell to a pace of 5.39 million. Between the two, overall home sales continue to march forward. Note that home sales may be held back by a sheer lack of inventory. New home inventory fell to a multi-year low of 4.3 months.

New and Existing Home Sales Chart

Source: Thomson Reuters

As for GDP growth, as was calculated with the first round of data, the economy grew by 1.1% last quarter. The data will go through one more revision before it’s set in stone, but it’s not likely to change much if it hasn’t already.

GDP Growth Chart

Source: Thomson Reuters

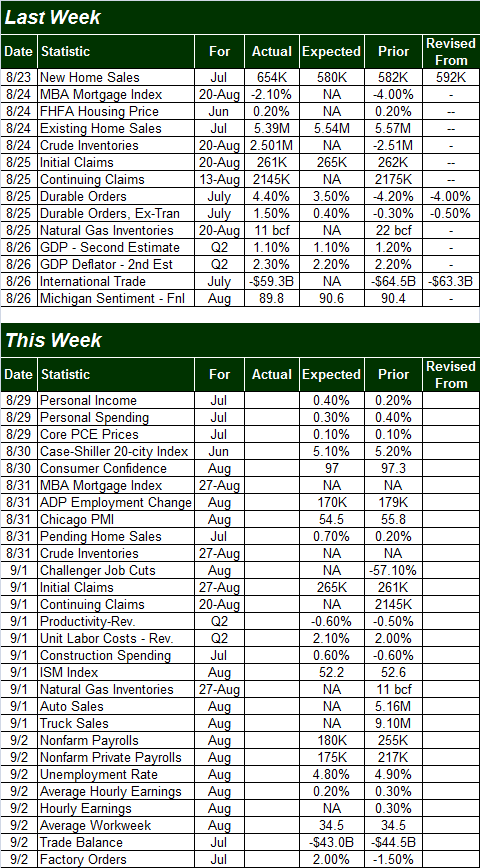

Everything else is on the following grid:

Economic Calendar

Source: Briefing.com

This week is going to be considerably busier, with the highlight being Friday’s unemployment report for August. There are a couple of items well worth watching before that, however.

One of them is August’s consumer confidence score from the Conference Board. We got the third and final Michigan Sentiment Index reading for August last week; it rolled in at 89.8 again. The Conference Board’s measure is expected to fall from 97.3 to 97.0. We can live with the stagnation, but watch out for a sizable drop in confidence. If it falls despite the fact that stocks are still within sight of record highs, the disparity could be a red flag that traders stand poised to sell their stocks.

Leave A Comment