In the early part of last week’s shortened trading action (the market was closed on Monday) it looked as if stocks might roll over again. Then Friday happened, rekindling the rebound effort at the last possible moment.

Will the reversal get traction this time around, after failing to do so a week ago? Maybe. The S&P 500 cleared a major hurdle on Friday it has been unable to clear just a few days prior. That’s a start.

We’ll look at the pending pivot in a moment, right after we quick review of last week’s economic news and a preview of this week’s economic data.

Economic Data

It was a very quiet week last week in terms of economic announcements. But, the couple of items we did get are very much worth a look… just because they require some ‘splainin’.

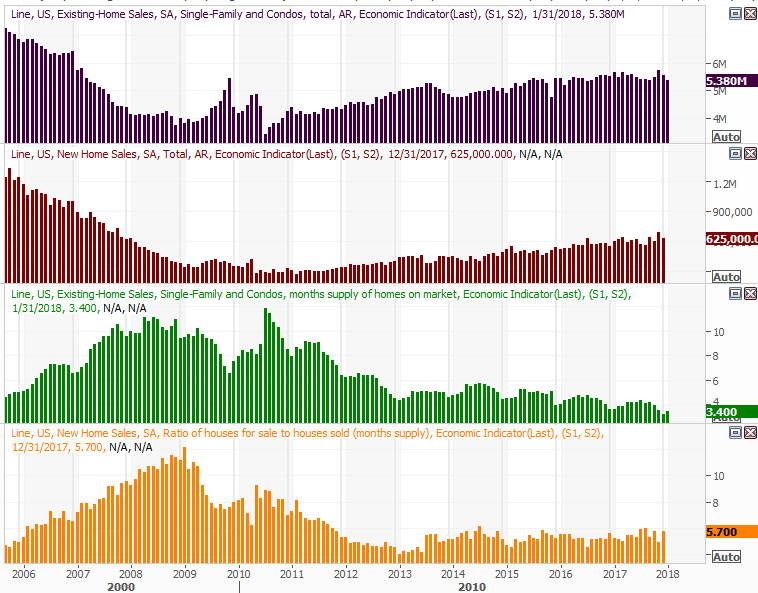

First and foremost, last month’s pace of new-home sales fell to 5.38 million, falling short of the expected 5.62 million. This news created more media hysteria than it should have, with headlines suggesting limited inventory of homes for sale was the problem. Thin inventories are a problem, to be clear, but it’s not a new problem. Likewise, January’s existing-home sales slowdown wasn’t quite as catastrophic as implied, and even may be even less so if new-home sales roll in higher than anticipated for January. And, as the graphic shows, there’s more inventory of new homes than existing homes.

New and Existing Home Sales (Annualized) and Inventory Charts

Source: Thomson Reuters Eikon

The other update was on the crude oil front – a look at the prior week’s inventory levels.

You’ll recall we’d seen a few weeks of modest increases, ending a long and rather rapid decline in crude stockpiles that accompanied a rally in crude prices. Now those inventories are leveling off, and are (for the time being anyway) acting like we won’t see any more extreme swings. That’s neither good nor bad for crude prices themselves, except perhaps in the sense we now no longer have reason to jump to extreme conclusions whenever we see even the slightest of movement here.

Leave A Comment