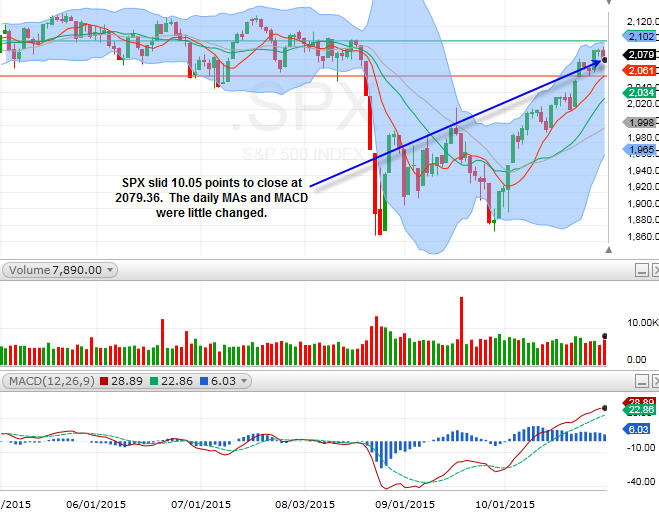

The market was very strong last week. A quick drop on Wednesday as an initial reaction to the Fed was quickly reversed by a sharp rally that pushed SPX to above 2090. In my Market Forecast last weekend, I talked about SPX having resistance between 2080 and 2100,

“SPX has resistance from 2080 to 2100…”

SPX ended the week just shy of 2080.

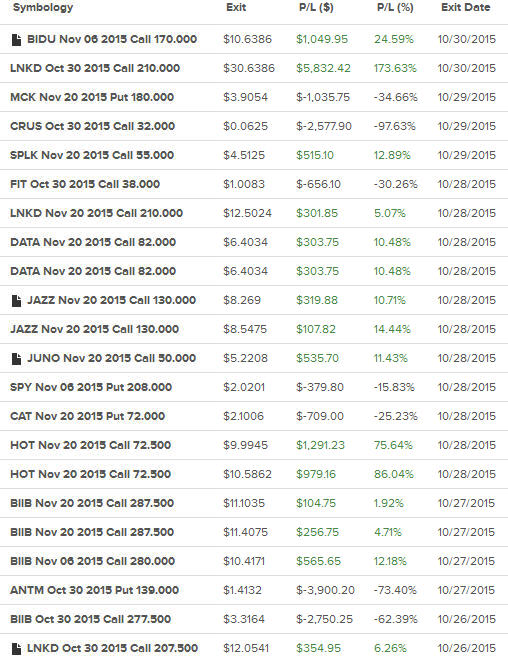

We traded well last week, hitting a big trade on LNKD calls, with a profit of +173%! We exited BIDU calls too early on Friday, which also would have been a triple-digit winner.

After the month of October, the market pretty much has recovered all of its losses from the sharp drop in August. The Dow is actually above the level at which it fell in August. Again, this seems to be the new theme: Buyers are buying the big caps, especially the blue chips. In a sharp contrast, the Russell 2000, the small caps, is lagging behind and has not fully recovered from the August tumble. Will this change? Will buyers start to shift gears and drive up the small cap stocks? We will be watching. But, I think it makes more sense to stick with the big caps as the global economy is still quite unstable. China just reported soft factory numbers today.

For the week, the Dow was up +16.84 points; SPX added +4.21 points; Nasdaq gained +21.89 points. Oil (WTI) was up, ending at above $46/barrel, while gold fell to just above $1140/ounce. At the time of this writing, Asian markets were mostly down. Here’s how the US markets closed on Friday:

SPX

On Friday, SPX slid 10.05 points to close at 2079.36. The daily MAs and MACD were little changed.

Nasdaq

Nasdaq fell 20.53 points to close at 5053.75. Its daily MAs were up slightly.

The major indices were little changed for the week. Although we did see strong buying on Wednesday afternoon, buyers were unwilling to keep push stocks higher.

Leave A Comment