What a week, from passage of tax reform becoming more likely to Bitcoin going parabolic to the successful completion of the first phase of Brexit negotiations. And not to mention the heartbreaking images of the fires coming out of California — talk about a state that has been getting a serious beating in 2017.

The economic “soft” data continues to be more optimistic than the actual hard data, which paints a less robust economic picture that isn’t consistent with the story of an acceleration.

At the start of the week, early Monday morning, the markets were set to open up well in the green after the Senate managed to push its 479-page tax simplification bill. I just have to point out that only in D.C. is that a simplification, but then again this is the group that considers a reduction in the rate of growth a spending cut. By day’s end though, the market fell back into the red, despite the President’s assertion that tax reform would ignite the stock market.

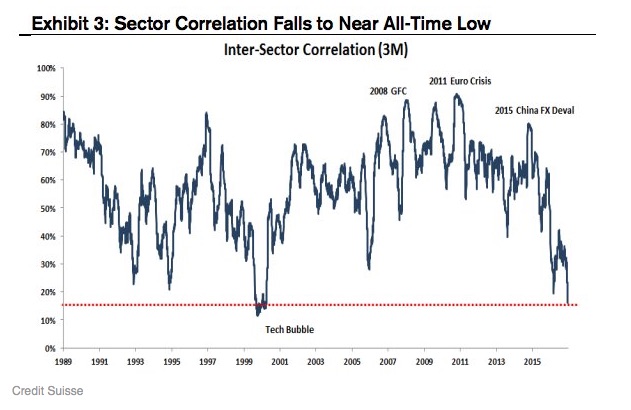

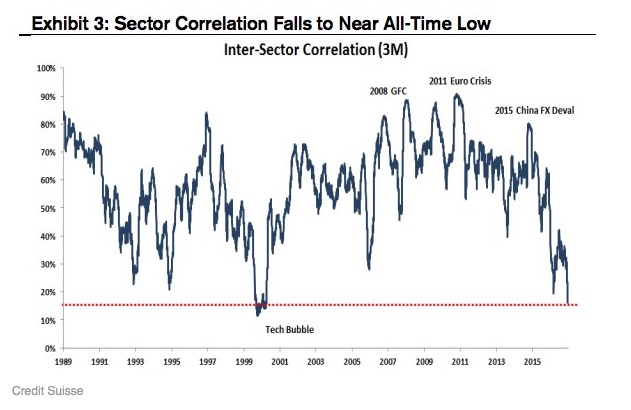

Tuesday the markets had the same reversal pattern, starting out strong only to fall into the close. By Thursday’s close, the major U.S. equity indices were in the red over the prior 5 trading days, with the small Cap Russell 2000 down over 1.5% as investors rotated into those sectors poised to benefit the most from the proposed tax reforms. We can see the magnitude of sector rotation as sector correlation falls to near all-time low.

While equities have been mostly euphoric this year, the bond market isn’t expressing quite the same level of enthusiasm. The spread between the 10-year and the 2-year Treasury bonds continues to shrink as we see the yield curve flatten to a degree we haven’t seen since 2007 with the 2-year rising above 1.8% for the first time in a year this week as yields on longer-dated Treasuries decline. When I look at that yield curve, the unprecedented size of the Federal Reserve’s balance sheet, and the fact that U.S. Federal Debt is now over 100% of GDP, I get rather nervous when I realize that with the departures of Yellen, Fischer, Dudley and Tarullo from the Federal Reserve we are losing roughly 43 years of combined experience. Given my personal feelings about the tinkering the Fed has done with the economy in past decades, I’m not sure if this is a positive or a negative, but we’re about to have a team with little experience in charge of driving the massive tanker that is the Fed into uncharted territory and what is likely to be a much more volatile world in 2018.

Leave A Comment