There is a big economic calendar featuring the most important monthly reports – employment, ISM manufacturing, ISM services, and auto sales. In normal times we would be analyzing the data and the implications for corporate earnings and interest rates. There will be some of that, of course, but the “real” market news seems to be taking a back seat. With the media focused on non-market events, it allows investors to ask the right question: Where can some additional work provide a big payoff?

Today’s WTWA will provide four insightful ideas that can boost your investment results – if you are able to ask the right questions.

Last Week Recap

In my last edition of WTWA I urged investors, bombarded with stories about the anniversary of the financial crisis, to quit fighting the last war. My objective was to provide useful information rather than guessing the twists and turns of the Washington news. I am taking the same approach this week. Readers have been receptive to this, and I appreciate it.

The Story in One Chart

I always start my personal review of the week by looking at a great chart. I especially like the version updated each week by Jill Mislinski. She includes a lot of valuable information in a single visual. The full post has even more charts and analysis, including commentary on volume. Check it out.

The market declined .99% on the week. The weekly trading range was about 1.1%, still very low. I summarize actual and implied volatility each week in our Indicator Snapshot section below. Volatility remains well below the long-term average.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too.

When relevant, I include expectations (E) and the prior reading (P).

The Good

The Bad

As has been the recent case, some of the “bad” news consists of indicators slightly off the best levels.

The Ugly

I am taking a week off from ugliness.

The Calendar

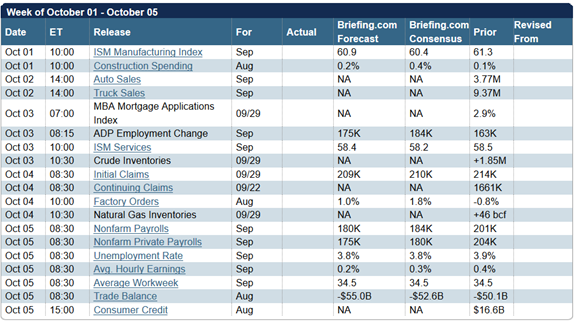

When the trading week starts with the first of the month, we get a big economic calendar. The employment reports will garner the most attention. The ISM manufacturing and services indexes provide a timely look at business activity. Auto sales round out the top reports.

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

There is a lot of important economic news, but that has not been very important in recent weeks. A solid economy and a gradual pace for the Fed seem to be reflected in the markets.

The emphasis on Washington “stories” is understandable, but not profitable for investors. The confirmation of a Supreme Court Justice is, of course, very important. The link to investing is tougher to find. The attraction as a news story is clear-cut. The issues are those where there are no real experts and everyone’s opinion is equal. Everyone wants to watch, form their own opinion, and discuss with friends.

Leave A Comment