The economic calendar includes many reports, but few of the most important. I expect the housing market to attract attention. There are several relevant releases on tap, and the sector is especially important. Some will take up a special slant, asking:

Will Millennial buyers extend the housing market rebound?

Last Week Recap

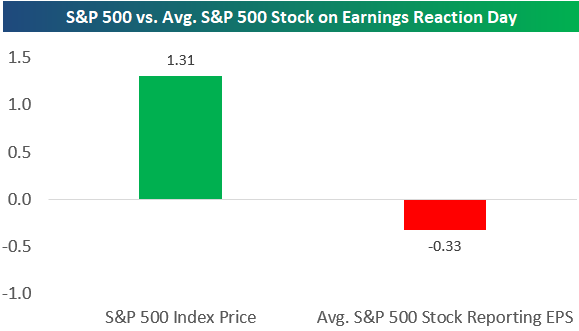

In the last edition of WTWA I mused on the confluence of records in the data and in stock market indexes. I suggested that some of the punditry would start worrying that things were “as good as it gets.” This was a topic for some, including David Templeton, who responded with a qualified “no,” but suggested the need to look beyond the mega cap stocks. Check out his reasoning and persuasive charts.

The Story in One Chart

I always start my personal review of the week by looking at this great chart from Doug Short via Jill Mislinski. She notes the loss of 0.21% on the week. Once again, it was a week of very low volatility; the intra-week range was only a touch more than 1%. Historically 1% moves are commonplace — each day.

Doug has a special knack for pulling together all the relevant information. His charts save more than a thousand words! Read the entire post for several more charts providing long-term perspective, including the size and frequency of drawdowns.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too.

The economic news has been mostly positive, as summarized by New Deal Democrat’s helpful compilation of long, short, and coincident indicators. His conclusion is neutral on the long term and positive in shorter time frames.

The Good

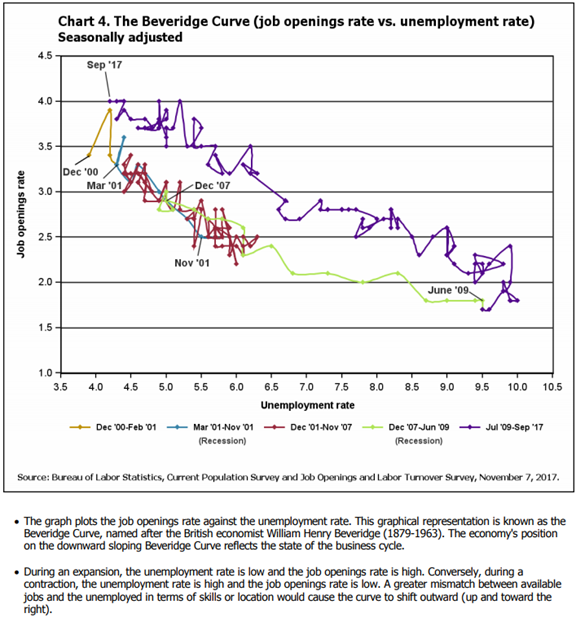

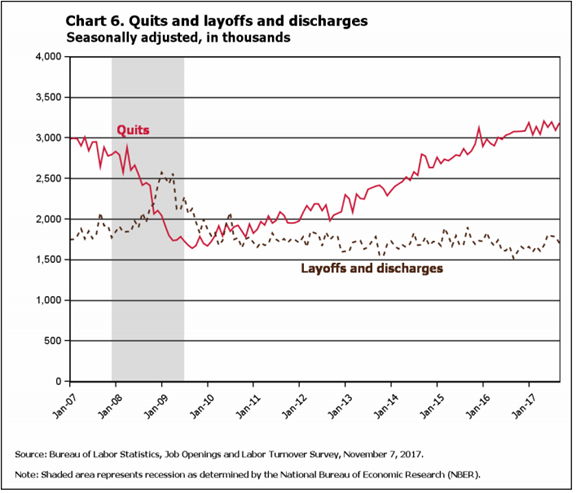

Job openings increased….and other good news from the JOLTS report. No one does a good job of analyzing this report. Many try to interpret it as a sign of employment growth, a purpose for which it was not designed. With fewer indicators to summarize this week, let me suggest the key things we should watch for.

- Ratio of unemployed to job openings.

The Bad

The Ugly

Each week seems to bring another case of outlandish violence. While there are some common themes among the perpetrators, there is no consensus about solutions – or even whether to act. Opinions about the best policy reaction seem to depend more upon beliefs rather than facts. That is always a tough situation for public policy proposals.

Millennial Notes

My research always leads me to a few items that are interesting, but not necessarily relevant to the week ahead. One such item was a list of terms and expressions that Millennials would use, but older people would not. I had the inspiration to write a paragraph or two using these terms, in the Blazing Saddlestradition. Mentioning this to Mrs. OldProf, she informed me that this was one of my dumber ideas. She was right, of course. A quick look at another source showed that many terms from the first source are now (already?) retired.

Leave A Comment