As some market worries have been put to rest, there is a growing appetite for new ones. Pundits who say that things look OK are not very exciting. Last week we saw a shift in attention. Despite healthy earnings and good economic data, I expect pundits to be asking:

What should investors be worried about?

Personal Note

No WTWA next weekend. If something major happens, I’ll post some thoughts. Would readers find it helpful to have an update of the indicators even when I am away?

Last Week

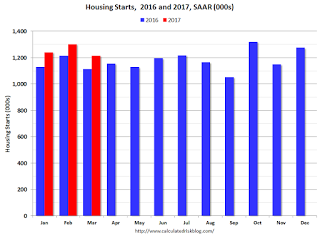

Last week the economic news was good, but mostly ignored.

Theme Recap

In my last WTWA I predicted a week focused on geopolitical risks. Despite some attention to earnings, economic data, and the latest Trump Administration pronouncements, that proved to be a reasonable guess.

The Story in One Chart

I always start my personal review of the week by looking at a chart of market performance for the week. There was little change for the week. The Thursday rebound was attributed to comments suggesting quicker movement on a tax reform package. If we measure the gain from the prior week’s close it is about 0.80%.

Whatever the news, the net market effect was (once again) very small.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something very positive. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too.

Once again, the economic news last week was good. The market got a little boost.

The Good

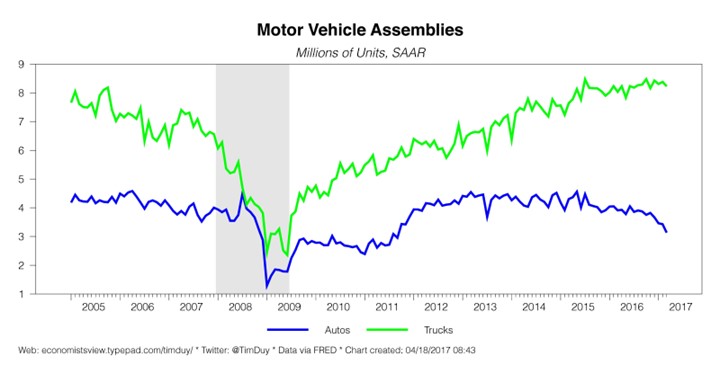

Tim Duy also takes a closer look, noting the weakness in autos and the strength in utilities. He also cites the American interest in larger cars.

Q1 Earnings.

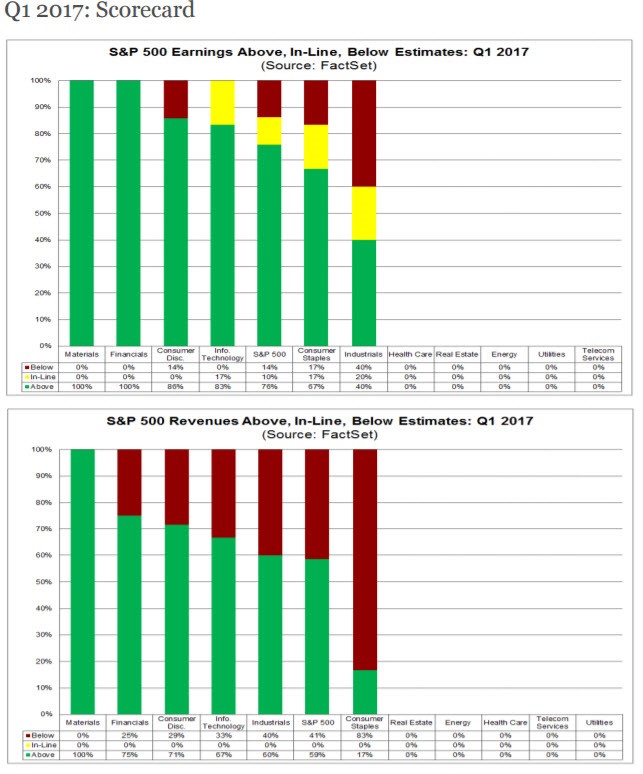

FactSet notes that reports are beating the historical metrics. Brian Gilmartin calls attention to the lag in energy stocks. Here is the key quote from John Butters:

To date, 6% of the companies in the S&P 500 have reported actual results for Q1 2017. In terms of earnings, more companies (76%) are reporting actual EPS above estimates compared to the 5-year average. In aggregate, companies are reporting earnings that are 6.7% above the estimates, which is also above the 5-year average. In terms of sales, more companies (59%) are reporting actual sales above estimates compared to the 5-year average. In aggregate, companies are reporting sales that are 0.2% above estimates, which is also above the 5-year average.

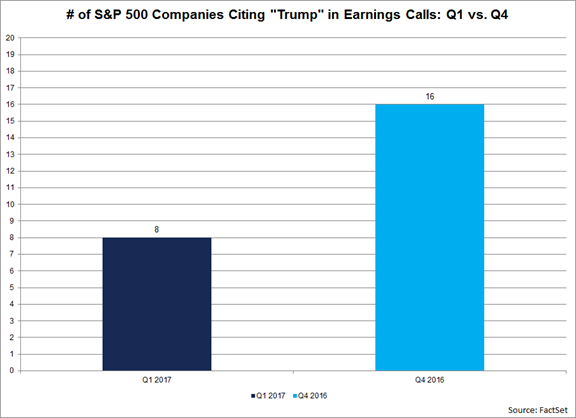

And fewer companies are citing President Trump as a factor. It is a small sample so far, but interesting to watch.

The Bad

The Ugly

Following up on an item from last year, cell phone use by drivers is nearly universal. Sensor data show that the phones are used in 88% of trips.

Blowing up a soccer team’s bus to make money on the team’s stock options is also ugly.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. No award this week, but nominations are always welcome. There are many bogus claims and charts out there!

This week I was especially disappointed with coverage – even by mainstream media – of the IMF report on world financial risk. From most of the stories you would never know that risk had decreased. One major source even reposted a typical ZH piece – no links, poor writing, extensive quotes without citations, etc. Sadly, many more people read this than the original report or any unbiased accounts.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that. Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a normal week for economic data.

The “A” List

Leave A Comment