After many years of standing pat on interest rates, there is finally a genuine chance of a shift in Fed policy. The punditry will be asking:

To hike, or not to hike?

Prior Theme Recap

In my last WTWA I predicted that the end of summer and market declines would create buzz about the need to change year-end market targets. That was mostly wrong, lasting for about one day. Once again there was plenty of volatility to discuss. As he does each week, Doug Short’s recap explains what happened and his great weekly snapshot lets you see it at a glance. The full article always includes several other helpful charges. (With the ever-increasing effects from foreign markets, you should also add Doug’s Doug Short’s recap to your reading list).

The chart shows the gain for the week (over two percent), but you can readily see why it did not feel that good. Wednesday’s big gap opening turned into a 1.39% loss on the day. At least the week was good enough for the Texas boys to take over from “Markets in Turmoil” in CNBC prime time.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

Whether or not the Fed decision this week actually matters is one of the questions, but it is still the story of the week. With an actual policy change in play, expect every pundit to explain what the Fed has done wrong and what it should do now. The question on the lips of all will be:

To hike, or not to hike?

There are secondary questions of what the Fed will do, as opposed to the more popular discussion of what it should do. And finally, everyone wonders about the market reaction.

The Viewpoints

We have a three part question with multiple viewpoints on each. The story has enough complexity to satisfy interviewers, pundits, and even some actual experts.

-

Should the Fed raise rates?

- Yes. Why has it taken so long? (Popular among Fed critics).

- No. The U.S. economy remains weak and is threatened by a worldwide recession.

- No. The U.S. is OK, but too many worldwide issues. (The World Bank, the IMF, and Larry Summers are taking this viewpoint).

- The difference between September and December is not relevant if there is a clear statement.

-

Will the Fed raise rates?

- Yes. The stated economic conditions have been met.

- No. Fed members are worried about the world economy.

- No. Fed members are worried about propping up financial markets.

- Tossup. The FOMC members are equally split so it is a close call.

-

What will be the market reaction to a hike?

- Lower. That is what happens at the start of a tightening cycle. And no semantic nonsense! Removing accommodation is tightening.

- Higher. Removing uncertainty is good.

- Initial reaction is meaningless.

As always, I have my own ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

The Good

There was some very good economic news.

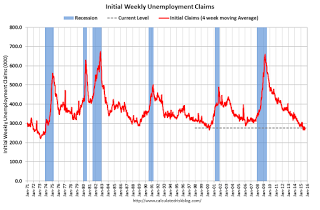

Initial jobless claims moved even lower, to 275K. Calculated Risk shows how strong this is:

There are many signs of bearish sentiment, generally regarded as a contrarian indicator.

- Sentiment polls have all swung into bearish territory, some as weak as in 2009.

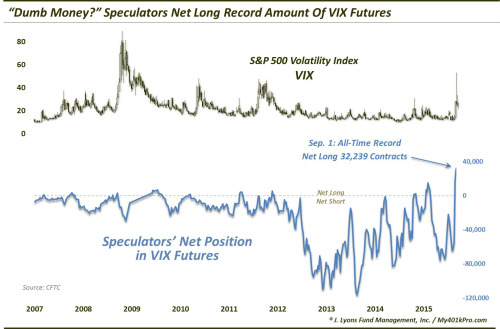

- Speculation in volatility futures hits a high. Dana Lyons wonders if this is the “dumb money?”

The Bad

There was also some negative news last week.

Leave A Comment