There is a lot of data to be reported in only three full trading days, but it does not rate to signal important economic changes. I expect plenty of participants to take the week off and even more will leave after the first hour on Wednesday. The punditry still has pages and air time to fill, despite the lack of fresh news. The punditry will be asking:

What are the best year-end investments?

Prior Theme Recap

In my last WTWA I predicted that the market story would focus on the message from falling commodity prices. This thesis lasted for one day, as the market continued the multi-week trading pattern of following crude oil prices. That was all. The rest of the week included a rally that most found inexplicable. Gains occurred in the face of terrorist actions, falling commodity prices, and a strong signal of an imminent increase in interest rates. The strong rally left most participants shaking their heads and reaching to invent explanations. To get the full story, let us look at Doug Short’s weekly chart. Doug’s full post shows the various relevant moving averages in a very negative week for stocks. (With the ever-increasing effects from foreign markets, you should also add Doug’s weekly chart to your reading list).

Doug’s update also provides multi-year context. See his weekly chart for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

The economic calendar is normal, but all of the reports occur within three days. Friday’s session is a half-day. Many participants will be taking off and others will leave after Wednesday morning’s data. TV producers will be reaching to find subjects. It may be the toughest week of the year to guess a theme. Volume will be low and surprise news could have a big effect. It is a bit too soon for the Santa Claus rally topic, but that is also possible.

My guess is that the discussion will focus on the surprising market resilience and what it means for investments.

People will be asking:

What are the best year-end investments?

There will be a wide range of viewpoints, featuring the following:

There is an argument for each approach. Expect to see some new faces on TV and new sources featured in columns. As always, I have my own ideas, reported in today’s conclusion. This week I have tried to give special emphasis to sources with specific stock ideas.

But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

The Good

There was a little good news, but most results were in line with expectations.

The Bad

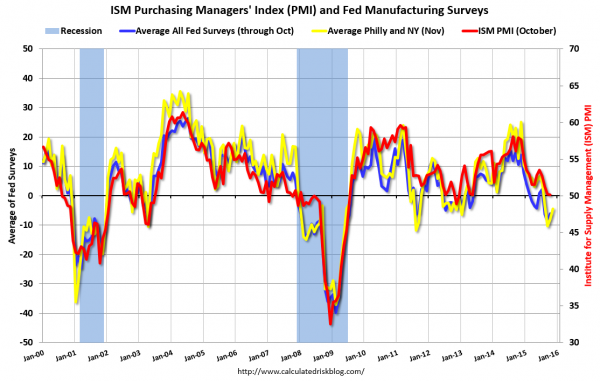

Some of the economic data missed expectations. Feel free to add other suggestions in the comments.

Leave A Comment