The economic calendar is again light in a holiday-shortened week. There are a variety of important news items, but no dominant theme. I expect the punditry to seize the opportunity by asking:

What are the biggest market worries?

Prior Theme Recap

In my last WTWA I predicted that everyone would be talking about the high and rising worry about a recession. That was one of the most frequent media topics for the week, with some sources even choosing “looming” as part of the description. Fed Chair Yellen grabbed the spotlight for her testimony, but even that centered on economic concerns and what the Fed might do. Friday’s rebound was notable in size, but left plenty of skeptics. As Doug Short notes, the rally came in concert with yet another mystery rally in oil prices. Skeptics saw short-covering action, with issues to be revisited this week. You can see the story in Doug Short’s weekly chart. (With the ever-increasing effects from foreign markets, you should also add Doug’s weekly chart to your reading list).

Doug’s update also provides multi-year context. See his weekly chart for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

Earnings season continues, but the economic calendar is light in a holiday-shortened week. In most of the world there will be news on trading on Monday, which will set the tone for U.S. markets. With continuing worldwide volatility, I am not expecting a single issue to dominate next week. Instead I expect the pundits to be asking:

What is the biggest worry for investors?

2016 began with declining stocks and plenty of concerns. New candidates surface each week. Listed below are the most-noted worries. Those getting a lot of fresh attention are listed last. I have omitted the evergreen valuation and disaster scenarios.

Stocks show technical weakness

- Almost breached important technical levels

- Lack of breadth

- Friday saved only by short-covering

New variants on the “R word”

- Earnings recession

- Growth recession

- Manufacturing recession

- New recession definitions (e.g., slow growth)

- Self-fulfilling prophecy recession

There is an emerging leadership crisis

- Barron’s cover featuring outsider candidates, Trump and Sanders

- Early takes on Justice Scalia’s death

I did the list without even going to ZH for ideas, so there are probably more.

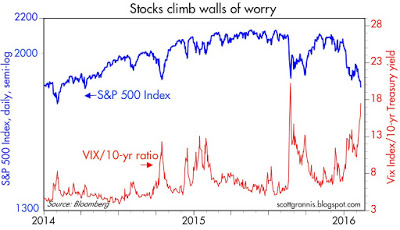

Scott Grannis reviews many of the issues in one of his helpful chart packs, accompanied by commentary. He reaches a mildly optimistic conclusion, despite the high level of fear revealed in this interesting indicator:

As always, I have my own opinion in the conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

The Good

On balance the news was pretty good last week, despite the market reaction.

The Bad

As always, some of the news was negative.

Leave A Comment