The economic calendar is normal, with an emphasis on inflation data. The week will begin with analysis of the annual Berkshire Hathaway meeting, the wisdom of Buffett and Munger, and a multi-hour CNBC program including Warren Buffett, Charlie Munger, and Bill Gates. While the questions will range widely, the punditry will soon turn to the mystery of the moment: Why are stocks stuck in neutral?

Last Week Recap

In my last edition of WTWA I asked whether the avalanche of economic data would send interest rates higher. That was part of the discussion, particularly around the FOMC announcement. At the end of the week, Elon Musk stole the headlines. Friday’s trading seemed to leave pundits bewildered. The reports on the economy were fine, but not super-strong. Inflation expectations and interest rates did not change.

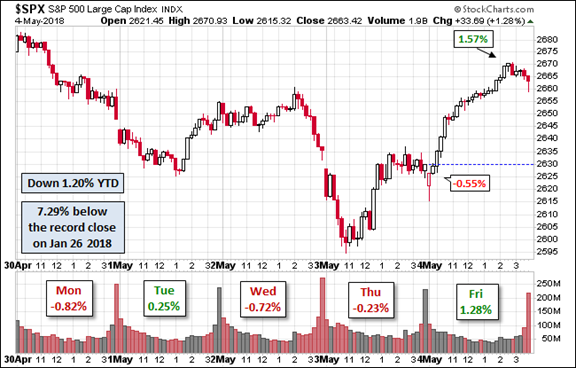

The Story in One Chart

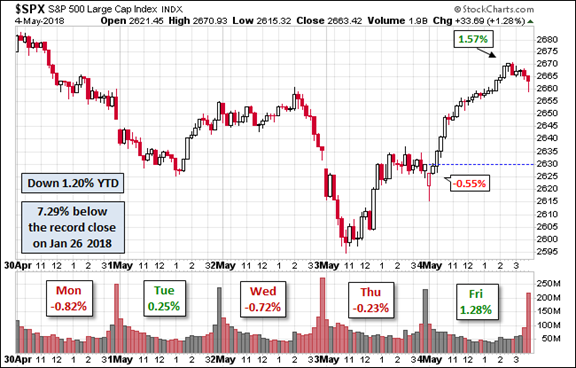

I always start my personal review of the week by looking at a great chart. I especially like the version updated each week by Jill Mislinski. She includes a lot of valuable information in a single visual. The full post has even more charts and analysis, so check it out.

While the market was unchanged for the week, once again there was action along the way. The trading range was about 3.2%. I summarize actual and implied volatility each week in our Indicator Snapshot section below. As you can see, volatility has been moving lower.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too.

The Good

Employment shows continuing solid gains. The market reaction seemed to confirm a “Goldilocks” report – continuing strength, but not enough to stimulate an aggressive Fed reaction.

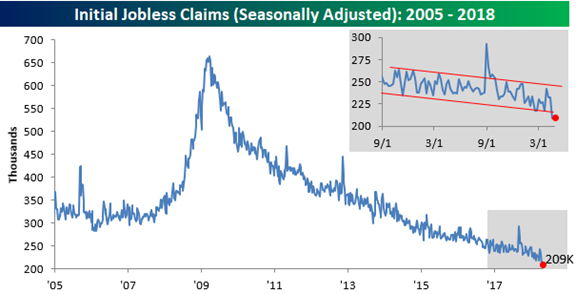

Jobless claims remain at record lows, with the streak of readings lower than 250K now at 24 – longest since 1973. (Bespoke).

The Bad

The Ugly

Huge ER bills for little or no treatment? $5000 for an ice pack and a firm statement refusing further care? This is a problem that deserves attention. (Vox).

The Noteworthy

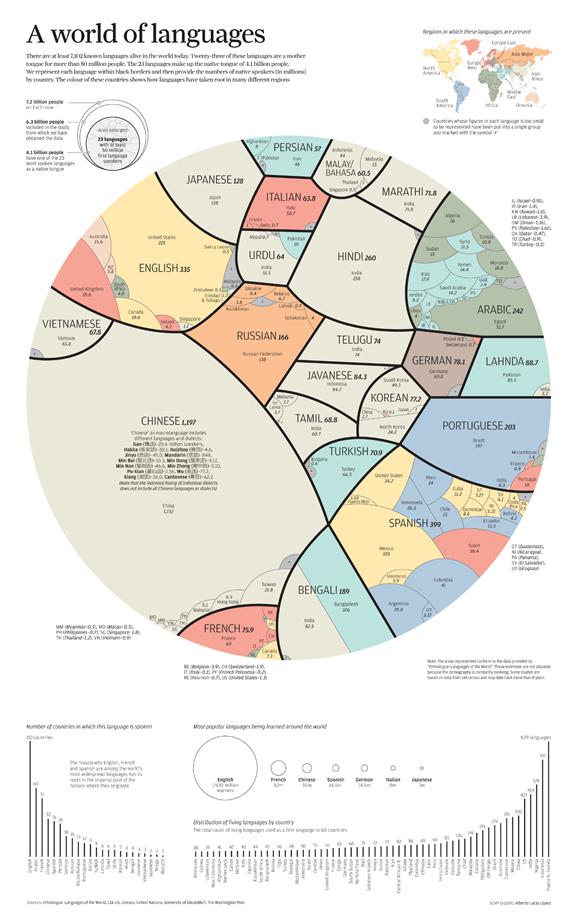

The Visual Capitalist always has informative and stimulating charts. For those in the US, this is an especially important source of perspective. Could you have listed the top ten languages? The top five?

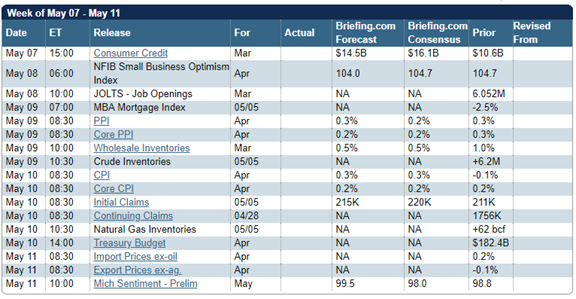

The Calendar

The economic calendar is normal, with an emphasis on labor markets and inflation data. Earnings season continues, and Fed members will be on the speaking circuit. If the week is like those from recent months, a surprise event may well claim the spotlight.

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

The week begins with a post-mortem on the BuffettFest, so expect a start with some good advice about value investing. This will not last long, since it provides little grist for the daily demands of financial media. The recent market mystery compares a market in neutral with a streak of (apparently) good news. I expect pundits and financial writers to be asking: Why are stocks stuck in neutral?

Leave A Comment