The economic calendar includes few reports, crammed into two days of a holiday-shortened week. Many will be taking time off – including some of the “A List” pundits. I expect to see some new faces on financial television and a lot of discussion about consumers and the economy. Many will be asking:

What does Black Friday mean for the economy, and for stocks?

Last Week Recap

In the last edition of WTWA I suggested that housing would be the most important story, and that some would focus on millennials as a potential market driver. I may have been accurate on the biggest story, but not on the media attention. Allegations of sexual misconduct seem to command popular interest and improve readership and ratings. Even the story about elephants pushed housing news aside.

The ability to influence the current agenda is extremely important, but it deserves more analysis than I can provide here. A future topic on my ever-growing agenda.

The Story in One Chart

I always start my personal review of the week by looking at this great chart from Doug Short via Jill Mislinski. She notes the loss of 0.13% on the week. Once again, it was a week of very low volatility; the intra-week range was only about 1.5%. Eddy Elfenbein takes note, and provides a great perspective on the current market. A small decline stands out after 54 consecutive days where the market closed within 1% of the all-time high.

Doug has a special knack for pulling together all the relevant information. His charts save more than a thousand words! Read the entire post for several more charts providing long-term perspective, including the size and frequency of drawdowns.

Personal Note

I will be working part of next week but expect to miss the next two installments of WTWA. I’ll try to post some of the indicator information.

I have much to be thankful for, as does my family. I hope my readers enjoy some great time with family and friends in the week ahead.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The economic news has been mostly positive, despite the uptick market volatility and the slight decline.

The Good

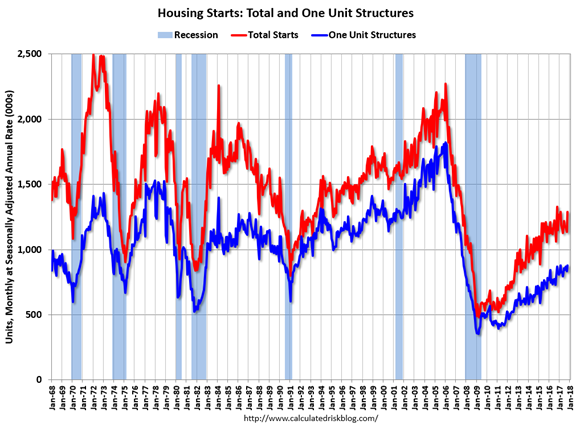

New Deal Democrat, something of a skeptic on the housing story, calls it an “excellent report.” He notes that the effect of last year’s mortgage interest increase is being offset by demographic forces. (That has a familiar ring to it).

Jill Mislinski offers another perspective, a population-adjusted view. By this measure, starts remain much lower than the historical highs, part of a declining long-term trend.

The Bad

The Ugly

The Bitcoin slide. Values dropped below $7000 on Wednesday, a decline of more than $1000 on the day. This illustrates my recent post on the Stock Exchange where I suggested Bitcoin as a trading vehicle, not an investment.

We will soon have Bitcoin futures available for trading at the Merc. Futures contracts allow substantial leverage on the underlying. Is that really needed here? Brian Gilmartin looks at the possible motives and the effect on CME. It is a good read. This product will be used both for hedging and for speculation. This could have a dramatic effect on the prior trading patterns. Stay tuned.

Leave A Comment