U.S. equity futures are higher in the first trading session of 2018 offsetting Friday’s last hour sharp drop, as Asian stocks soar to new all-time highs, while a surging euro which has rallied near to a 3 year high thanks to the sliding dollar, which in turn dropped to a 3 month low, pressured European stocks across the board. WTI crude oil prices retreated from a 2-1/2 year high despite initial upside as a result of the Iran violence. Treasuries fell, while gold extended a three-week rally.

Sentiment was also helped by news that North Korea had offered an olive branch to South Korea, with Kim Jong Un saying he was “open to dialogue” with Seoul.

European stocks inched lower on the first trading day of the new year, extending a losing streak that trimmed 2017 gains last week, while the euro rises to $1.2035, a level not seen since September. Europe’s Stoxx 600 fell 0.5% while the euro gained as much as 0.5% to $1.208, flirting with September peak. As a result, the exporter-heavy DAX was the most hit among European benchmarks, down 1% and losing ground for the fifth session. Europe’s auto sector index down 2%, hit by strengthening euro as well as by bleak outlook from Hyundai, and a drop in French new car registrations: Lufthansa, BMW, Volkswagen, Daimler were among the biggest decliners.

European bonds likewise started off the year on the wrong foot, with yields rising following strong inflationary signals from today’s EU manufacturing PMIs and the latest German CPI. Of note, Germany’s 10y yields on course to 0.50%.

Also of note: with the start of 2018, ECB QE resumes at a slower pace of €30 billion per month for nine months. The reduced purchases in 2018 means that net supply of EGBs will be almost flat, strongly contrasting with deeply negative net supply in previous years, driving 10y bund yield to 0.85%, according to SocGen.

Overnight, the ECB’s Mersch has warned against too slow an exit from expansionary monetary policy, stating that current policy risks undermining the Euro Area’s ‘culture of saving’. Meanwhile, ECB’s Coeure said that he sees “a reasonable chance” the ECB’s PSPP will not be extended again when it expires in September.

A breakdown of today’s Eurozone PMIs, which printed at the highest level on record:

“Forward-looking indicators bode well for the new year,” Chris Williamson, a chief business economist at IHS Markit which compiled the manufacturing data, pointing to a near-record pace of new orders and job creation.

Earlier, Asian stocks showed no concerns as they blasted off to new all-time highs to greet the new year, supported by strong Chinese data. The Caixin Manufacturing PMI, released overnight, came in at 51.5, beating estimates of 50.6. This helped the Chinese bourses outperform with the Hang Seng (+1.8%) and Shanghai Composite (+1.0%) outperforming other indices. South Korean markets edged slightly higher (+0.4%), despite the recent geopolitical developments in the North with Kim Jong Un claiming he has a “nuclear button” on his desk. Korean automakers underperformed as both Hyundai and Kia Motors warned of only modest sales growth this year. Japanese markets were closed for a public holiday.

Chinese stocks greeted the new trading year with solid gains after Caixin factory index beats all estimates and a report suggests nationwide property tax may not start before 2020 according to Bloomberg reports. H-shares rallied as much as 2.8% while Hang Seng rose 1.7%.

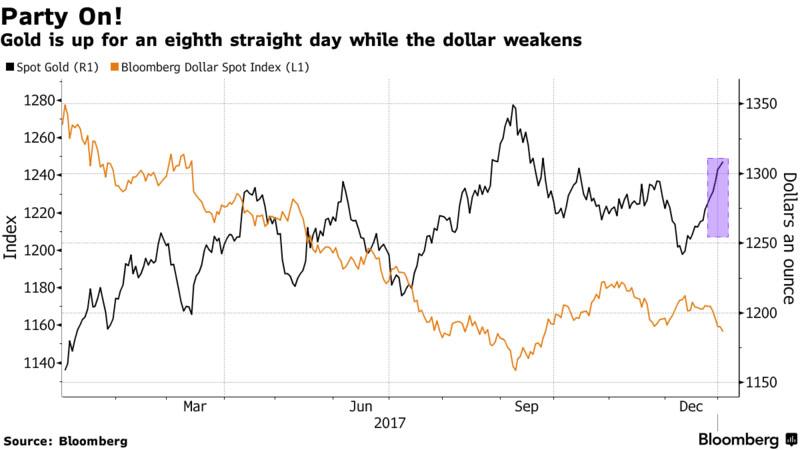

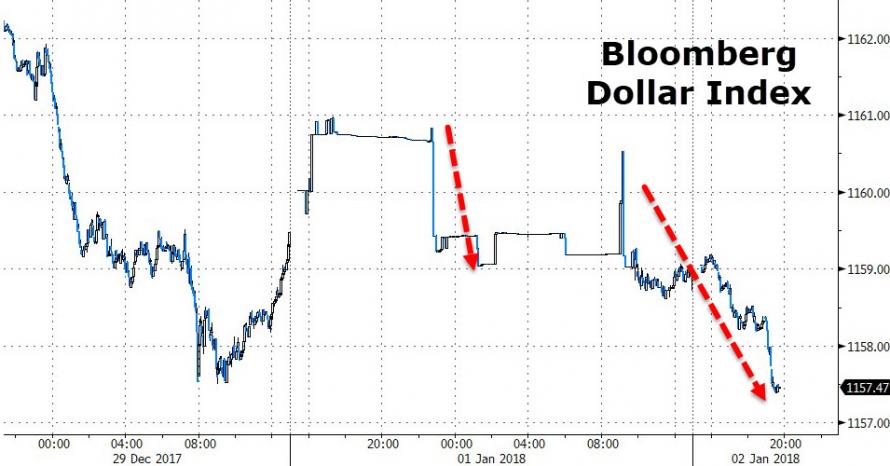

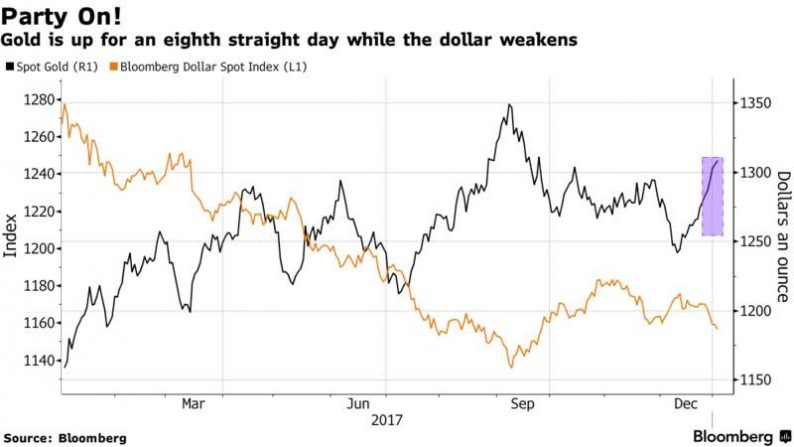

In macro, as noted overnight the dollar weakened against all G10 peers, extending last year’s underperformance even as cryptocurrencies surged.

The U.S. currency fell further as London trading resumed after the new year holiday, with the Bloomberg Dollar Spot Index fell for a fifth day, reaching its lowest level since Sept. 26, while the broader DXY index touched a four-month low against the euro, which was buoyed by strong manufacturing PMI data, which hit a new all time high despite a handful of notable countries seeing their PMIs peak. Trading was muted in Asia with Japanese markets closed until Jan. 4.

Tuesday’s dollar drop added to the dollar’s more than 12 percent slide against the euro last year, its worst performance since 2003. Analysts surveyed by Bloomberg forecast the U.S. Dollar Index to slide further in 2018 as concerns about low inflation raise questions about the prospects for tighter Federal Reserve policy. “In our call of further dollar depreciation this year we are assuming a cautious approach by the FOMC given the considerable inflation undershoot last year leaves greater room for a more patient approach than many assume,” said Derek Halpenny, European head of global market research at MUFG. While the Japanese bank sees two Fed interest-rate increases this year, it predicts a 5% slide in the dollar index.

A major hurdle for the U.S. currency will be Wednesday’s release of minutes from the Federal Reserve’s December meeting when it raised interest rates. Two policymakers voted against the move amid doubts inflation would accelerate as hoped.

Leave A Comment