Written by Matthew Tucker

…According to Bloomberg, the market is currently pricing in a 100% chance that the Federal Reserve (Fed) will raise rates from the current 0.50%-0.75% range to 0.75%-1.00% [when it meets this week for the last time this year]. Here’s what that mean to short-term and long-term investors alike.

The market’s confidence is driven by recent strong economic data:

All of this looks to have given the Fed confidence that it can go ahead and increase short-term rates, and it has clearly communicated this intention out to the market.

What does a rate hike mean to investors?

This potential increase in short-term interest rates probably won’t have much of an impact on most fixed income portfolios. The forecasted move itself is small, and it mostly affects shorter maturity bonds that do not have as much interest rate sensitivity as longer maturity bonds.

Outside the bond market, there will be slightly higher interest rates for some consumer loans like home equity lines of credit and adjustable-rate mortgages. In return we may see slightly higher interest rates on checking and savings accounts. All in all, we believe the impact for investors should not be significant.

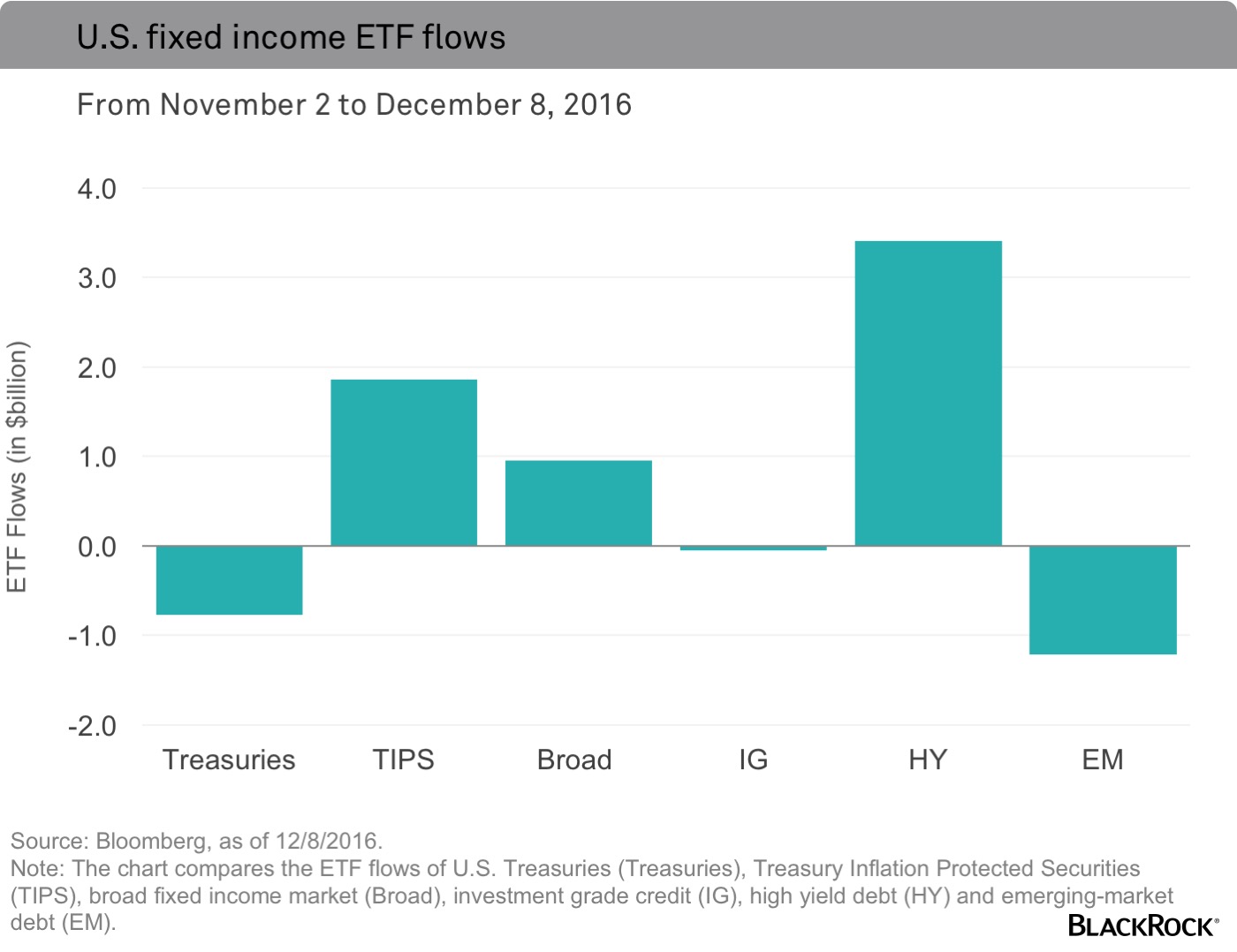

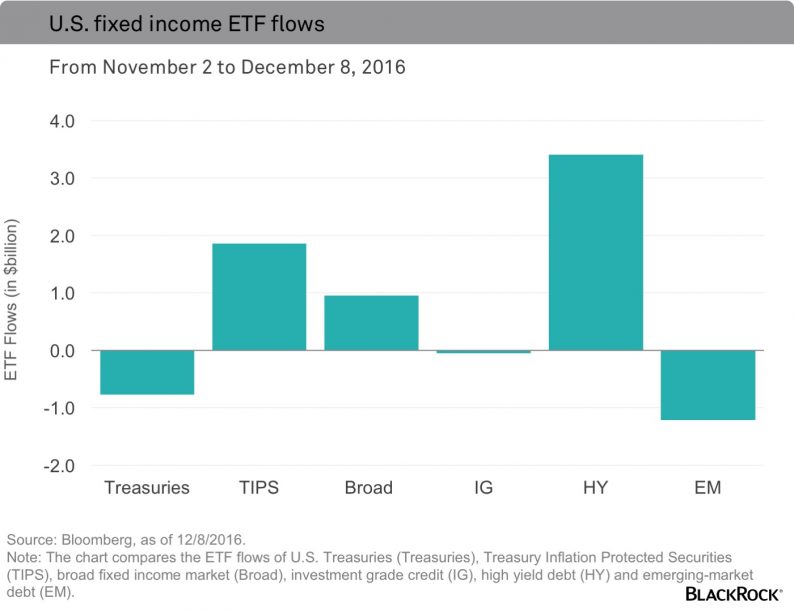

Interestingly, if we look at the capital flows for U.S. fixed income exchange-traded funds (ETFs) in the accompanying chart, there has been quite a bit of activity since the last Fed meeting on November 2.

Although some of the flow activity may be related to the Fed moving closer to raising rates, most of it has occurred since the U.S. election. The new administration has signaled policies such as tax cuts, increased Treasury issuance and reduced regulation that many investors believe could result in higher interest rates, higher inflation and a favorable environment for corporate bonds. Consequently we have seen 10-year Treasury yields rise sharply from 1.86% on November 8 to 2.41% on December 8.

Leave A Comment