Over the last few years, two new investment opportunities of note have come online.

Both have the potential to rise in value more than anything else available to the general public… in history.

The first is private startup equity (equity crowdfunding). This gives everyone the chance to invest very early in companies that are small enough to grow 100 times – or more.

The second is digital currencies (Bitcoin and others). And that’s what we’re going to talk about today.

Specifically, we’re going to explore what would happen if bitcoin went mainstream.

As is the case with most new disruptive technologies, the world’s never seen anything quite like crypto. There’s still quite a bit of skepticism to overcome.

Bitcoin is still in the very early adopter phase, which means it still has quite a ways to go, assuming we’re headed for mainstream adoption.

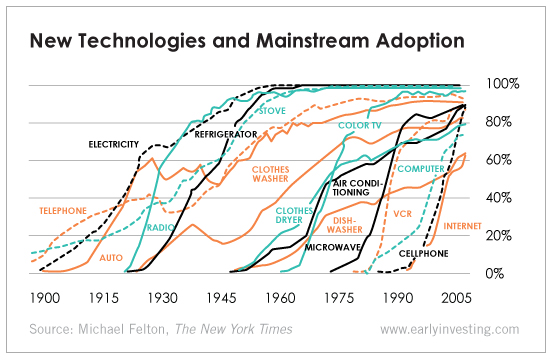

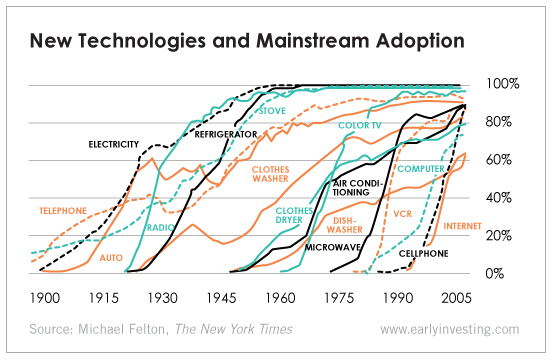

To get an idea of what “going mainstream” looks like, here’s a chart showing the rate at which consumers adopted various new technologies.

You’ll notice that each curve is roughly S-shaped, and that over time, adoption grows faster. For example, it took around 35 years for the refrigerator to reach complete adoption, while it only took around 15 years for the cellphone.

With Bitcoin and cryptocurrencies, we’re in the first inning. Perhaps 1% of Americans own any at all. Crypto adoption today is where cellphone adoption was in 1992.

Cryptocurrencies are high-risk, high-reward assets. As such, they should make up only a small percentage of your overall portfolio.

It’s not a sure thing it’ll hit mainstream adoption. But it’s looking more likely every day.

Because as more people make money off bitcoin, more of their friends hear about it. More people get interested and eventually become comfortable enough to invest.

This is bitcoin’s secret to viral organic adoption. And unless a black swan event happens, it will continue doing its thing.

Leave A Comment