While investors hang on every dovish word bluffed from a venerable Fed speaker’s mouth, the cognitive dissonance when something negative is uttered is stunning. Since Greenspan’s “irrational exuberance” moment, asset-gatherers and commission-takers have advised ignoring Fedspeak on stocks… historically, that was a mistake for investors.

Having shocked a soaring market yesterday with the Minutes stating:

“Broad U.S. equity price indexes increased over the intermeeting period, and some measures of valuations, such as price-to-earnings ratios, rose further above historical norms. … Some participants viewed equity prices as quite high relative to standard valuation measures.”

Of course, business media was quick to assert this is nothing to worry about, however, as CNBC’s Mike Santoli reports, traders shouldn’t be so quick to dismiss these comments from Fed officials.

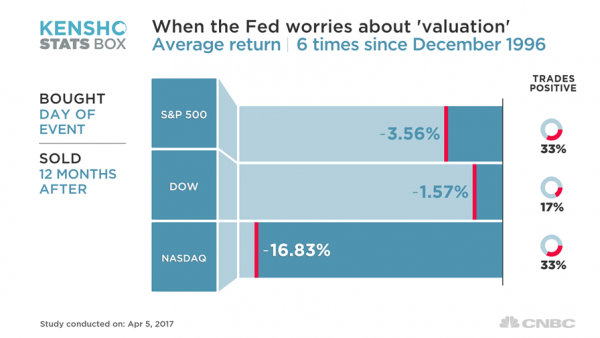

History shows when worries about valuation appear in these official minutes, stocks often struggle in the following year.

We found six mentions of an overvalued stock market in the minutes by searching the Fed’s website for the word “valuation” going back to 1996. According to Kensho, here’s the performance of the major market averages one year after the meeting when such a mention took place.

Here are the specific mentions of high “valuation” in the minutes, according to the Fed’s website, along with the S&P 500’s subsequent return from the meeting when that mention was made.

Leave A Comment