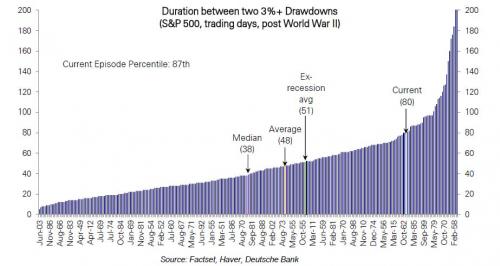

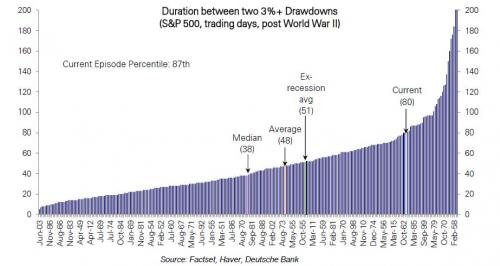

The relentless, steady, monotonous levitation to all time highs keeps chugging along: while last week saw the S&P experience its first 1% intraday move in nearly two months, there has yet to be a comparable move on the downside. As Deutsche Bank notes, pull backs of 3-5% in the S&P 500 are typical every 2 to 3 months historically. The last such pull back occurred just prior to the US presidential election. The 4 month uninterrupted rally since is now well above average and if it continues for another 2 weeks will put it in the top 10% of rallies by duration. At 14%, the size of the rally is also somewhat larger than the historical average between such pullbacks (+10%).

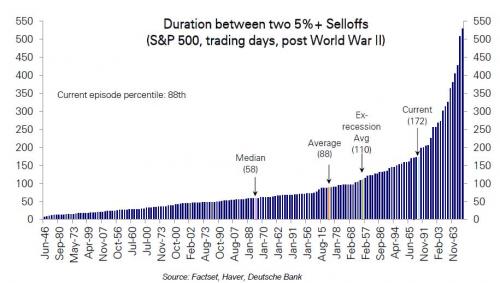

Incidentally, sell-offs of 5% or more occurred on average every 5 to 6 months. With the last one occurring after the Brexit vote, the 8 months since is also well above the historical average. If the rally continues past mid-April it will be in the top 10% by duration. In size, the 19% rally since then is also well above the 14% historical average.

So while it is clear that the recent move is an outlier, the next question is what factors have kept the rally going. Here, Deutsche Bank offers several possible answers:

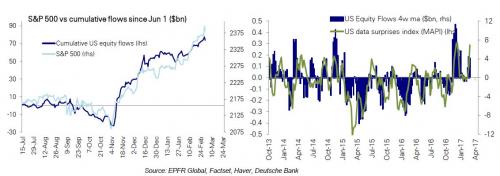

Strong equity inflows following large outflows and massive under-allocation. After stalling at the beginning of the year, US equity fund flows have resumed over the last 5 weeks. US equities have got $80bn of inflows since the election but from a slightly longer term perspective, under-allocation remains massive. Over the last two years cumulative outflows from US equities still stand at a large -$230bn compared to inflows of +$250bn to other developed market equities and +$310bn into bond funds. The direction and pace of equity inflows remains tightly tied to macro data surprises.

US equity fund positioning moved from under- to over-weight though has been pared since. From slightly underweight positioning at the start of the year, positioning rose steadily through January, then leveled off and over the last two weeks has been trimmed even as data surprises which tend to drive positioning have moved up, suggesting funds may already be anticipating a modest slowdown in data surprises.

Leave A Comment