When determining the direction of the housing market, analysts like to look toward the millennial generation to provide future demand. The most common age in America is 27. The average age of first time home buyers is 33 which implies there will be a surge in housing demand in the next few years. While there will be an increase in housing demand, an interesting fact worth reviewing is the definition of a first time home buyer according to the government. While you may think a first time home buyer is someone who never owned a home, that’s not what the government views as a first time buyer.

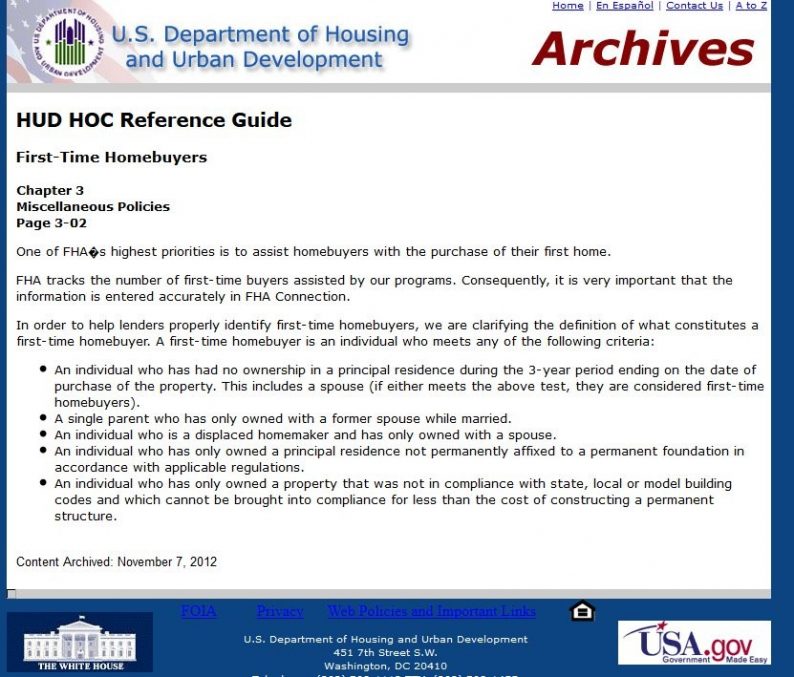

As you can see from the screenshot of the U.S. Department of Housing and Urban Development website, a person who had no ownership in a principal residence during the 3 year period before the purchase of a house is considered a first time home buyer.

HUD Definition Of First Time Homeowner

Someone can be a first time home buyer 10 times in their life in theory. Given that there are 5 extra ways someone can be a first time buyer besides being a first time home owner, the average age of home buyers is probably pushed higher than it would otherwise be. It’s possible the true average age of first time buyers is a couple years younger than 33 years of age.

The goal of HUD is to get people in houses. To achieve this goal normal terms are changed to mean what the government wants. By expanding the definition of a first time home buyer, more people can qualify for FHA loans which allow less money down, a lower income, and a worse credit score. The government still thinks getting people in homes is a priority even after the housing bubble. We’re not saying that because the government didn’t learn it’s lesson, there will be another housing bubble. Private loan issuers learned their lesson and now require documentation and higher credit scores. There also isn’t wild speculation in the marketas people have reservations about making the same mistake twice. However, there should still be a lesson learned about government intervention. When the government gets involved in an industry, it boosts demand like in housing in the 2000s and in college tuitions today. The government’s goal of encouraging everyone to go to college has the unintended consequence of increasing prices.

Leave A Comment