“On a final note, what was the one asset you did not want to own when I started Duquesne in 1981? Hint … it has traded for 5000 years and for the first time has a positive carry in many parts of the globe as bankers are now experimenting with the absurd notion of negative interest rates. Some regard it as a metal. We regard it as a currency and it remains our largest currency allocation.” – Stan Druckenmiller

Stan Druckenmiller made headlines at the Sohn conference saying the bull market in stocks had “exhausted itself” and that Gold remains his “largest currency allocation.”

“Largest currency allocation.”

Interesting choice of words. But what is Gold in actuality? Is it a currency, commodity, or some combination thereof? Is it an inflation hedge or a safe haven?

Let’s examine each of these labels.

Gold as a Currency

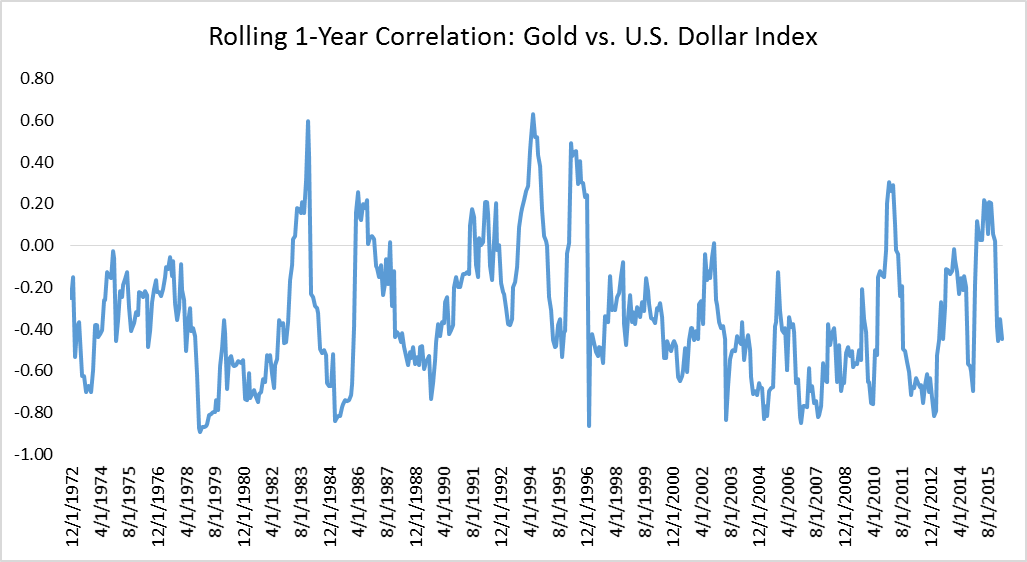

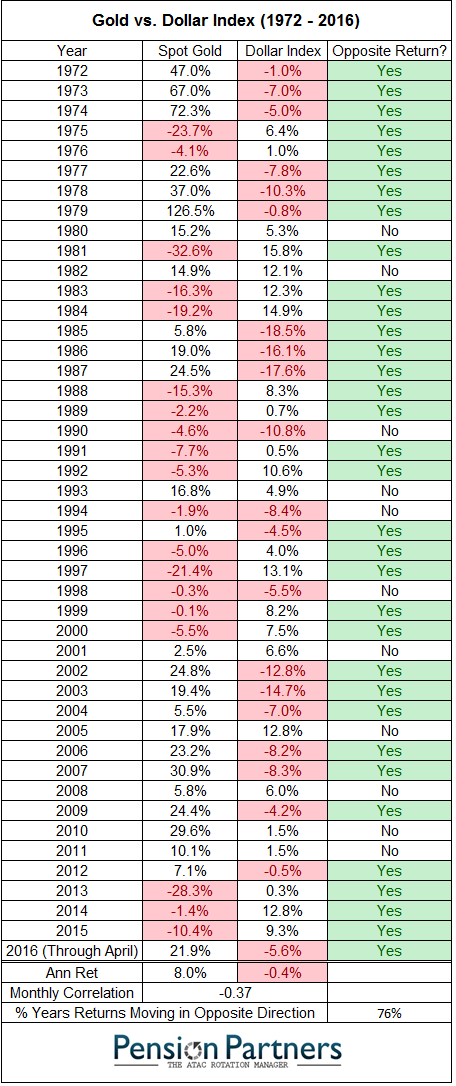

Since the end of the Gold standard in 1972, we see an overall correlation of -0.37 between Gold and the Dollar Index, meaning that on average Gold and the Dollar move in opposite directions.

But on average doesn’t mean always. In looking at calendar year returns, Gold and the Dollar have moved in opposite directions 75% of the time. That means in 1 out of every 4 years they are actually moving either up and down together.

And while Gold and the U.S. Dollar tend to move in opposite directions, the moves are not anything close to proportional. Since 1972, the Dollar Index has fallen 16% (-0.4% annualized) while Gold has risen 2875% (8% annualized). There is clearly more to Gold than just a falling Dollar.

Gold as a Commodity

Is Gold more of a Commodity? Let’s take a look.

Since 1972, the monthly correlation between Gold and the Thomson Reuters Equal Weight Commodity Index (CCI Index) is .39.

While Gold and Commodities tend to move together, they don’t always move together and the cumulative appreciation since 1972 has not been close to proportionate. In 31% of years Gold has moved in the opposite direction to the equal weight commodity index, with an annualized return of 8.0% for Gold versus 3.1% for the CCI Index.

Leave A Comment