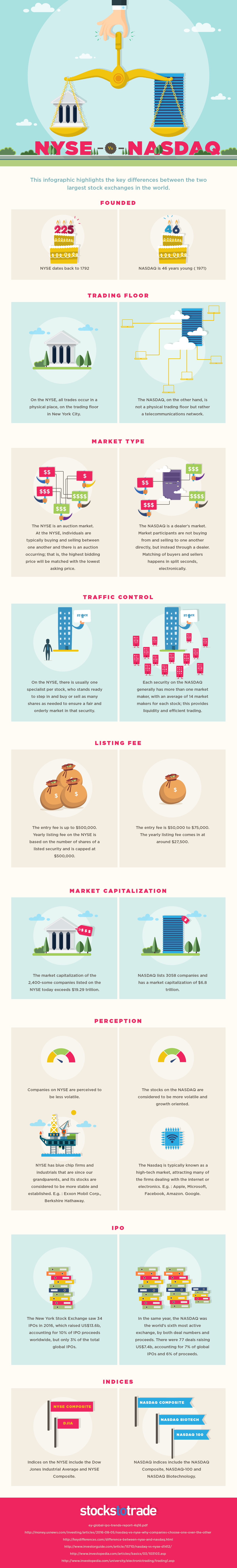

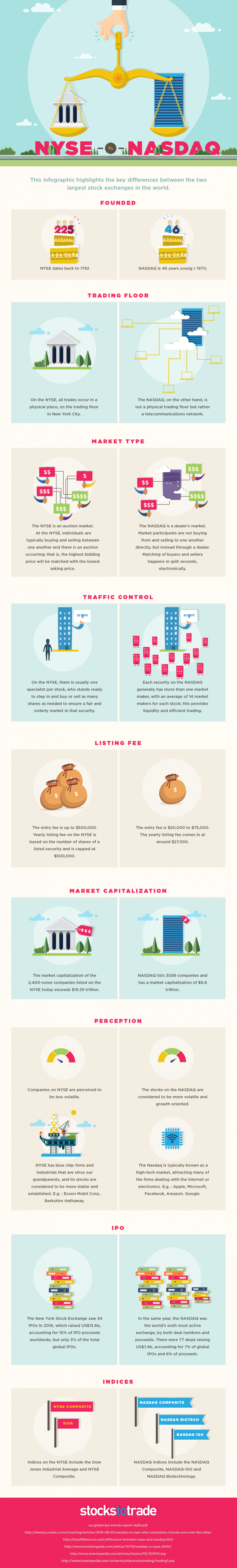

The NYSE and Nasdaq exchanges are worth a collective $32.0 trillion in market capitalization, making up a sizable portion of the global equities market.

However, while they are both large American stock exchanges containing listings that are household names, they are also very different in how they work, as well as how they are perceived by investors.

COMPARING THE NYSE AND NASDAQ EXCHANGES

Today’s infographic from StocksToTrade.com explains the major differences between these two exchanges.

The NYSE and Nasdaq have significant differences, including the size and number of listings, how trades are made, and also how they are perceived by investors.

SIZE AND NUMBER OF LISTINGS

By the value of listed companies, the NYSE and Nasdaq are the two largest exchanges in the world.

The NYSE has over 2,700 companies that combine for $21.3 trillion in market capitalization. It’s also home to many of the big “blue chip” companies that have existed for decades, like Walmart, Exxon Mobil, or General Electric. This is partly because the exchange has existed since 1792.

Meanwhile, the Nasdaq has more companies than the NYSE, but has a wider spectrum in terms of the size of companies. Of course, the exchange is known for having the large tech-focused companies like Facebook, Google, and Amazon, but there are many smaller listings on the Nasdaq as well. In fact, there are around 1,200 smaller securities listed on the 46-year-old exchange with market caps of $200 million or less.

In total, there are over 3,200 companies listed on the Nasdaq, worth a total of $10.7 trillion in market capitalization.

OPERATIONAL DIFFERENCES

Aside from the obvious differences in the size and types of listings, the NYSE and Nasdaq also have significant operational differences.

For example, trades still technically happen on NYSE’s trading floor in New York City, while the Nasdaq takes a more technological approach. It exists as a telecommunications network, rather than an absolute physical location.

Leave A Comment