Kinder Morgan (KMI) reported earnings last week, including a long expected dividend hike and a pleasantly surprising stock buyback. In many ways the stock performance and corporate finance moves of KMI reflect the Master Limited Partnership (MLP) sector as a whole.

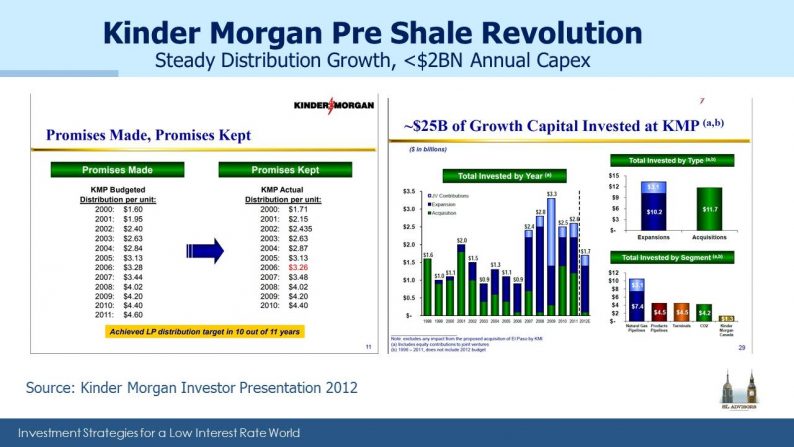

Pre-Shale Revolution, Kinder Morgan Partners (KMP) had rewarded investors with steady distribution growth and modest (for their size) investments in new projects. Their investor presentation included a slide labelled “Promises Made, Promises Kept” with a table showing these consistently higher payouts.

Not all companies make old investor presentations available on their website – since it allows users to compare statements across years, it can be embarrassing. To KMI’s credit, they do. Consequently, we’re able to delve back several years and recall the world MLPs used to inhabit. This was a time of attractive, stable distributions with modest growth and an occasional need for growth capital. The Shale Revolution was not widely regarded as the energy sector game changer it became. Wealthy U.S. investors tolerant of K-1s liked the mostly tax-deferred distributions. MLPs were an income-generating asset class.

KMP, which was at the time the main operating entity, noted that from 1997 to 2011 it had invested $24BN in new projects and acquisitions. As was the norm, most of that growth had been financed by issuing debt and equity, since KMP paid out most of its Distributable Cash Flow (DCF) in distributions. Over the next two and a half years as infrastructure demand grew, they invested $20BN in growth projects & acquisitions for a total of $44BN over 17 years. The chart below on the left includes $2.3B of organic capex budgeted for 2H14 to total 46.5B by YE2014.

By mid 2014 KMI had concluded that the MLP investor base was too small to finance its growth. The 2014 presentation heralding the combination of KMI with KMP to create one integrated entity identified $17BN of organic growth projects over the next five years. Since 1997, $20BN of the $44BN had been invested in greenfield & expansion projects, with the balance being acquisitions. So the $17BN five year projected figure was analogous to the $20BN from the prior 17 years, since future acquisitions (the other source of growth) are generally very hard to forecast.

Leave A Comment