Now that GDP has become almost as meaningless an economic indicator as the unemployment rate (which at 5.1% is lower than China’s but just happens to ignore tens of millions of potential workers who have given up hope to find a job and countless “disabled” individuals), and a few heavy snowfalls are sufficient to get economists clamoring for (and getting) double seasonal adjustments, many ask if there is another, more accurate way, of estimating US economic output.

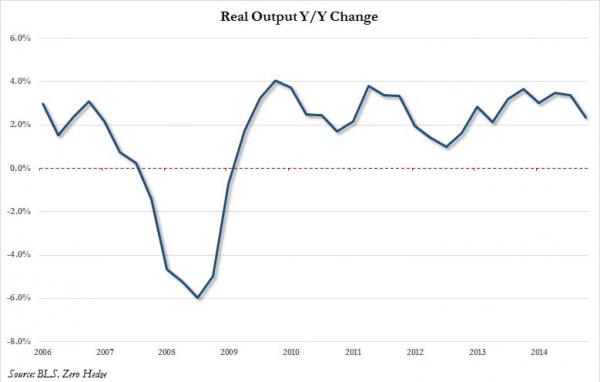

The answer is: yes, there is – it’s called “real economic output”, and it is a released by the BLS every quarter, as a product of productivity, hours worked, and compensation and then applying a deflator adjustment.

This is perhaps an even more accurate indication of the true state of the US domestic economy considering all the complaints by the Fed over the state of the global economy and eliminate the “noise” from trade which has been depressing GDP for quarters.

Unfortunately, what the real output data reveals is not pretty. Rising by 2.3% Y/Y in Q3, this was not only down substantially from 3.4% in Q3 and 3.5% in Q1, but this was the weakest increase since Q1 2014!

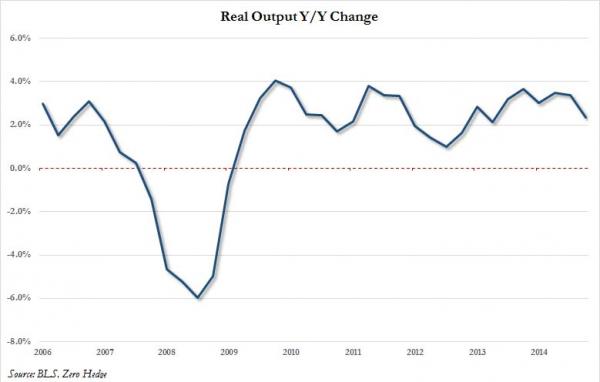

But wait, there’s more.As Newedge strategist Brad Wishak points out “for the last 20 years at least, a 285k 5-month Mov. Avg in the MoM Change in nonfarm payrolls has signaled the top in job creation for that cycle. This is shown in the chart below.”

So on one hand we have US output growth slowing by a third in one quarter, on the other we may have peaked in the job creation cycle, and somehow Yellen is 6 weeks away from hiking rates?

Source

Leave A Comment