For all the obfuscation surrounding the topic of stock buybacks and corporations returning record amounts of cash to their shareholders, the bottom line is as simple as it gets.

This is what you are taught in CFO 101 class:

That’s it.

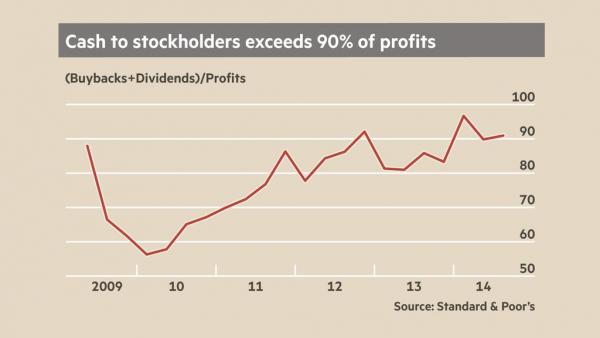

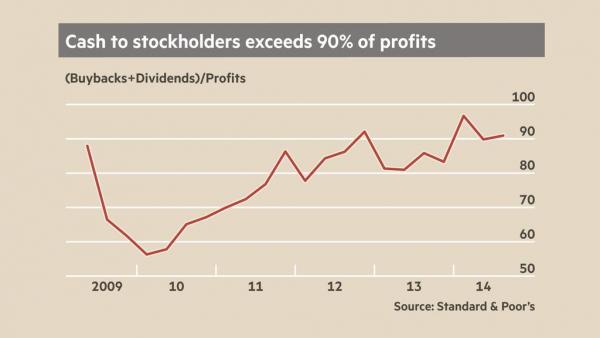

Well, based on this shocking chart from the FT’s John Authers, does it seem that America’s corporations – who are returning over a record 90% of Net Income to shareholders – are seeing (m)any growth opportunities?

Leave A Comment