Image: BigstockThe Q3 cycle is over, with the bulk of companies having already revealed their quarterly results. The period was once again a time of positivity, with earnings growth remaining positive and seeing a nice boost from technology.But one late reporter, Lululemon (LULU – Free Report), posted results that positively shocked investors. Let’s take a closer look at the results.

Image: BigstockThe Q3 cycle is over, with the bulk of companies having already revealed their quarterly results. The period was once again a time of positivity, with earnings growth remaining positive and seeing a nice boost from technology.But one late reporter, Lululemon (LULU – Free Report), posted results that positively shocked investors. Let’s take a closer look at the results.

Lulu Enjoys Profitability Boost

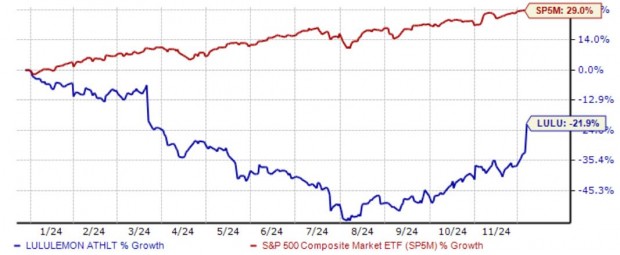

Concerning headline figures in its release, Lululemon posted a 7% beat relative to the Zacks Consensus EPS estimate and reported sales 2% ahead of expectations, with both items higher than the year-ago period.Still, the biggest highlight of the release was margin expansion, with the company’s gross margin improving 150 basis points to 20.5%. Gross profit totaled $1.4 billion, climbing a solid 12% year-over-year.In addition, comparable store sales increased 4% year-over-year, reflecting the fact that their existing locations are still experiencing modest growth. And Lululemon added 28 new stores throughout the period, expanding its footprint nicely.The results perked up shares in a big way, a welcomed development among investors following a rough start to 2024. Up 60% in three months, the stock has bounced back following a tough start, widely outperforming over the time period. Provided below is a chart illustrating the year-to-date performance of shares. Image Source: Zacks Investment ResearchLululemon wrapped up the strong print by announcing a $1 billion increase to its existing buyback program, which may help put in a floor for shares.

Image Source: Zacks Investment ResearchLululemon wrapped up the strong print by announcing a $1 billion increase to its existing buyback program, which may help put in a floor for shares.

Bottom Line

Lululemon (LULU – Free Report) helped send the Q3 earnings cycle off in a positive way, with the company’s results pleasing investors and causing shares to melt higher following the print.More By This Author:3 Stocks To Buy For Data Center Exposure Tap Into Crypto Exposure With These 2 Stocks: HOOD, COIN2 Stocks Set To Benefit From A Busy Holiday Season: Walmart, Amazon

Leave A Comment