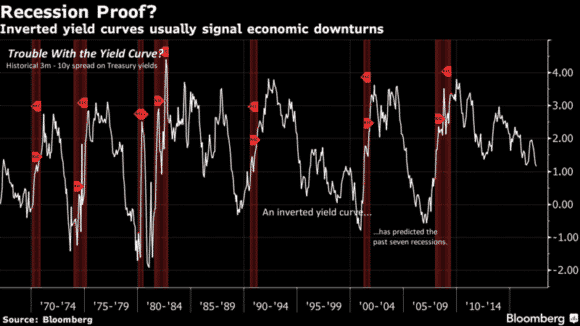

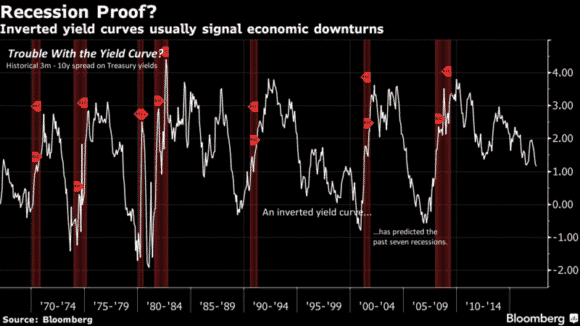

The yield curve is a wonderful predictor of future recessions. In fact, it’s predicted all 7 of the last recessions in the USA. In a general sense, this is a signal that there’s a disconnect between what Central Banks believe and what bond markets believe. Since Central Banks can control short-term rates with precision they can assert control on overnight rates in anticipation of future economic conditions.¹ But the yield curve will typically invert when long bond investors believe growth is slowing and Central Banks believe growth is too hot. So Central Banks are typically raising rates trying to cool the economy while long bond investors are setting rates lower in anticipation of slower growth. The record shows that Central Bankers are usually on the wrong end of this prediction.

As you can see in the image above the yield curve has been flattening for quite a few years and appears to be on a downtrend towards a possible inversion. We will very likely hear many scary stories in the coming years about how this is bad for the economy. So what’s the curve really telling us? A few key points:

So, the bottom line is that the curve isn’t inverted, doesn’t appear close to inverting and won’t be cause for concern until a decent amount of time after it inverts. So let’s hold off on scary yield curve stories for now.

¹ – See, Who Determines Interest Rates?

Leave A Comment