Earlier today, BofA chief technician Stephen Suttmeier (who has so far done a far more admirable job of reading the chartist tea leaves than his predecessors, Stolper 2.0 MacNeil Curry who quietly left the bank) pounded the table for the second day in a row why all rallies should be sold.

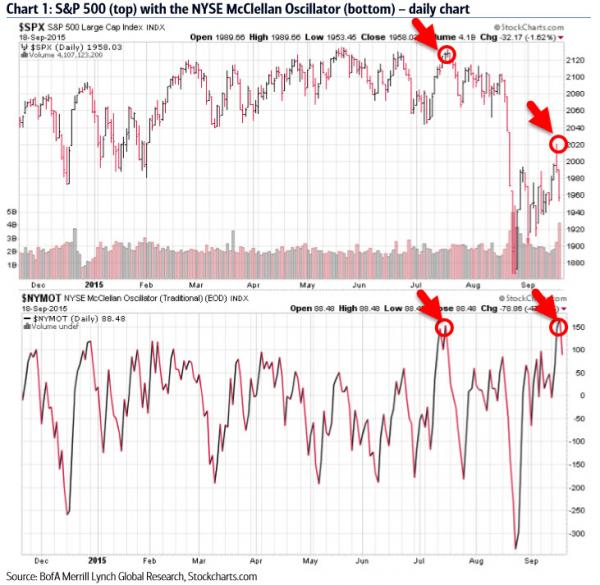

Looking at the S&P chart, Suttmeier said “the daily NYSE McClellan Oscillator got more overbought last week than it was at the highs in July. In our view, this suggests “dislocation” rather than “capitulation” and we continue to see the risk of retest/undercut of the lows.”

Perhaps he is right (the last thing we need is another contra-fade indicator to replace Stolper 2.0: we already have Gartman) but what about those who avoid indices and would rather trade single names? BofA has some ideas there too.

Looking entirely at the charts (so no fundamentals at all here, but in a market where the only things that matter is what Goldman tells the Fed to say, and when Virtu’s HFT algos launch a momentum ignition program that is probably not that bad) Suttmeier highlights the charts of three stocks “that have improved and show potential for upside breakouts in an uncertain market: NLSN, PCLN, and CRM.”

Nielson Holdings PLC (NLSN)

NLSN builds a bullish triangle base from July 2014 and with recent relative breakouts vs. the S&P 500, the stock has begun to show leadership. The relative breakouts are a potential leading indicator for NLSN. A sustained move above the $49 area is the technical catalyst that completes the base and favor upside to $58. The chart structure remains bullish while above $44.00-42.80.

Priceline (PCLN)

PCLN is building a bullish head and shoulders continuation pattern and has begun to emerge as leadership vs. the S&P 500. A sustained push above $1375-1395 is the technical catalyst that completes the head and shoulders and favors a stronger rally toward $1750-1775. Holding above 1174-1103 maintains the bullish setup for PCLN.

Leave A Comment