Apple (AAPL) was one of the pioneers in personal computing but has since grown to become one of the world’s most dominant forces in consumer electronics with more than $225 billion in annual revenue.

Today the company produces numerous consumer devices, including smartphones, desktop and laptop computers, tablets, smartwatches, voice-controlled smart speakers, TV boxes, and various phone accessories.

Apple also offers an increasingly wide array of software services integrated into its hardware products, including the App Store, Apple Music, iCloud, FaceTime, Apple Pay, and Apple CarPlay.

Today Apple’s business continues to be dominated by the iPhone, which accounted for 62% of revenue in fiscal 2017, with over 215 million units sold. Mac computers (11%), iPad tablets (8%), and other products (6% – Apple TV, Apple Watch, Beats products, phone accessories, iPod touch) are Apple’s other major hardware computers, although they are relatively small drivers compared to the iPhone.

With smartphone penetration exceeding 80% in America and plateauing in many other developed countries around the world, Apple’s massive iPhone business has found meaningful growth harder to achieve in recent years.

However, faster growth in other product lines, especially its services division (13% of sales – iTunes, iCloud, Apple Pay, AppleCare support, etc.), mean that the company’s future revenue and cash flow is likely to become more diversified.

Apple is also a truly global company, with its sales being far more diversified than the average U.S. multinational corporation. The Americas region accounted for 42% of revenue in fiscal 2017, followed by Europe (24%), Greater China (20%), Japan (8%), other parts of Asia (7%).

Business Analysis

Warren Buffett is famous for his strong focus on wide moat businesses. Specifically, he focuses on owning companies with meaningful competitive advantages that provide strong pricing power and excellent profitability.

Consumer electronics is a notoriously challenging industry, driven by huge competition, continually changing consumer tastes, capital-intensive operations, short product life cycles, and steadily declining margins. In other words, hardly the place that you usually find great dividend stocks.

However, Apple seems to be different thanks to several key factors, which is why Buffett’s company, Berkshire Hathaway (BRK-B), owns more than $20 billion worth of Apple stock (3rd largest Berkshire holding).

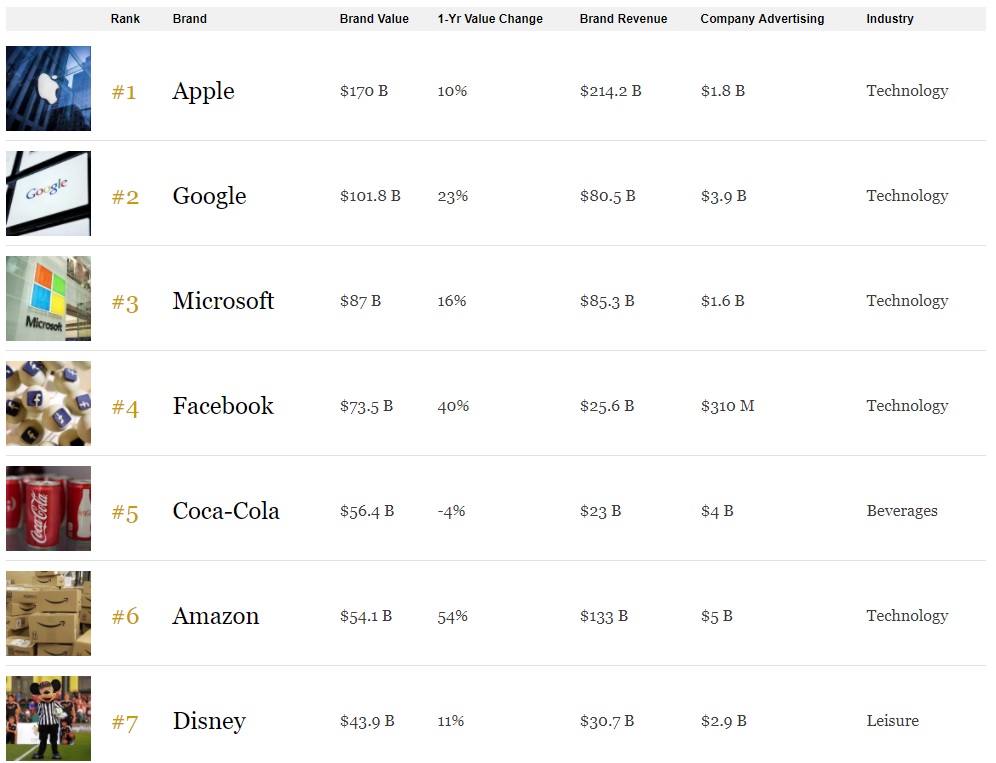

Most notably is Apple’s incredibly strong brand, which in 2017 was the most valuable in the world by a wide margin.

Most Valuable Brands In The World (2017)

Source: Forbes

See the latest on AAPL, GOOGL, MSFT, FB, KO, AMZN, DIS

The key to Apple’s premium brand, which has even managed to find success in emerging markets (sales growing 20% a year), is Apple’s very tight integration of its hardware and software offerings.

In other words, Apple has created a “walled garden” in which all of its products sync together through numerous software services, such as:

Consumers who purchase Apple hardware are thus less likely to switch to rival devices that run on other operating systems, such as Android. If they switched, they would lose almost all of their content that can only be accessed using devices that run on Apple’s iOS operating system.

With over half a billion users on Apple’s iOS platform, third-party developers also have greater incentives to create apps designed for Apple’s devices rather than smaller alternatives with less monetization potential. This creates a virtuous cycle where Apple customers enjoy a greater selection of apps that makes their mobile devices more useful, bringing even more users onto the platform and thus making it all the more attractive for third-party developers.

The end result is a stickier ecosystem that allows Apple to command higher prices for its hardware products, even if the actual physical capabilities of its devices are largely the same as rival offerings today.

Leave A Comment