Total Retail Spend Grows On Hurricane-Linked Demand

First, I want to point out that the two hurricanes that have devastated Texas, Florida, and Puerto Rico have been horrible. Hundreds of thousands, if not millions of peoples’ lives were affected. And their circumstances have changed dramatically over these past couple months.

BUT… these hurricanes were a positive for economists looking for a boost in spending.

These hurricanes disrupted routine spending… but boosted spending on autos (car/truck replacement), building materials (home repair) and gas prices (prices surged).

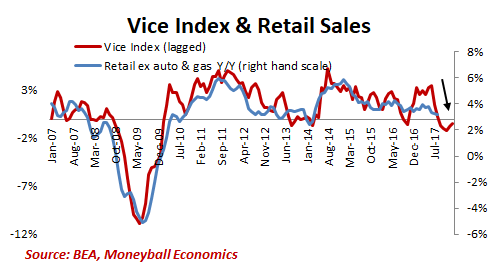

Vice Index Now Points To Lower Spending

Recent downward revisions to retail data confirms that the Vice Index correctly predicted a pullback in spending growth.

Wage Growth Levels Off On Improved Comps

The collapse in 2H 2016 compensation growth will boost growth rates through 2017.

A similar pattern is visible in the Vice Index chart above.

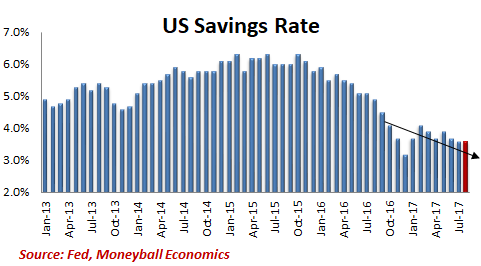

Accompanying the slide in compensation growth is a similar slowdown in the savings rate.

It’s getting harder to squeeze more spending from consumers. Their savings are down. They don’t have as much money to spend leisurely as they used to.

National Retail Federation Predicts Holiday Spending Growth

Per the NRF, a trick of the calendar will pull in spending and prevent the spending rate from falling below last year’s.

Weekend days are always a bigger shopping day, regardless of the season. And this year the holiday period gets to include an extra one. Otherwise the spending rate would fall below last year’s.

That’s part of the softness is being echoed in the Vice Index data. The other part is that the NRF notes the weakness in the lower income segment. No doubt the strong stock market and continued job market strength will underpin middle and upper income spending. But will it be enough to offset the broader weakness? Vice Index says no.

Leave A Comment