Tech stocks will get overvalued on a frequent basis. Mainly, because this group is exciting to investors. Everyone hopes to nail the next Apple (Nasdaq: AAPL) or the next Microsoft (Nasdaq: MSFT). However, there are fundamental reasons why these stocks tend to beat the market.

Graph 1 – IGM vs. S&P 500 – 2007 to present

(Source: Yahoo Finance)

The main reason for the excitement and outperformance is partially based on the constant pursuit of an edge. While traditional companies work on milking an existing edge, tech companies try to reach the next paradigm curve. Some of the high-profile tech companies have been able to execute on their edge and were able to deliver financial results that most pundits would consider impossible a couple of years ago.

One example is Amazon (Nasdaq: AMZN). Not long ago, Amazon was heavily criticized for not having profits, now traditional retail stocks are suffering a market rout on the perception that traditional retail is doomed. From cloud servers to assortment algorithms, Amazon has built several edges.

Another perspective supporting tech stocks is the macroeconomic context of the past decade. The zero-interest-rate period pushed investors to search for higher risk-return propositions. This being the case, one could only expect that interest rate hikes should reverse this process.

What place should tech stock have on a portfolio?

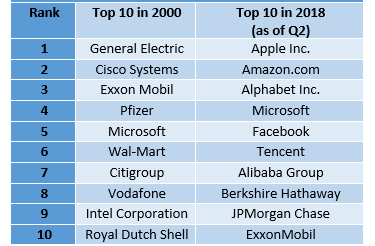

The truth is that tech stocks have been a key element to healthy portfolio returns. After the dotcom bubble, most tech stocks were dismissed as fads. Although there was a high mortality rate, many tech stocks survived and thrived. Looking at the top 10 stocks in 2000, at the height of the dotcom bubble, and looking at it now, we can see a very different picture in terms of the sectors represented. For instance, one of the hotshots of the 2000s, Amazon, made it to the top ten.

Table 1 – Top Ten stocks by market cap, comparison 2000 to 2018Q2

(Source: Adapted from Wikipedia)

It seems clear that the virtue is in the middle. Buying each, and every fad from the 2000s was a mistake, but discarding the tech sector altogether wasn’t a better remedy. The top ten of the most valuable companies is now replete of tech companies.

However, as I’ve pointed out, interest rates usually work as gravity for stocks, and the paradigm on this front is clearly shifting.

Leave A Comment