With Brexit still not reaching an agreement, which poses a downside risk, short GBP/JPY?

BoE is widely expected to keep its interest unchanged tomorrow as Governor Mark Carney made it clear during the last meeting that they had no plans to tighten.

During BoE’s last meeting, Governor Carney spoke of the possible scenarios that would require a rate cut if Brexit negotiations were to go south.

At the current juncture, Brexit progress seems bleak as there are a lot of uncertainties regarding the kind of trading relationship that will eventually evolve from the Brexit negotiations.

However, the UK budget that was announced on Monday strengthens the case for a near-term interest rate as the stimulus package could lift economic growth by 0.3% in 2019.

It is unlikely that BoE has factored in the budget numbers, therefore BoE could use Brexit uncertainty as the justification for keeping rates unchanged.

In terms of economic data, UK’s economy has been doing well with unemployment rate at a 40-year low, pay growth at a 10-year high and inflation well above the central bank’s target of 2%.

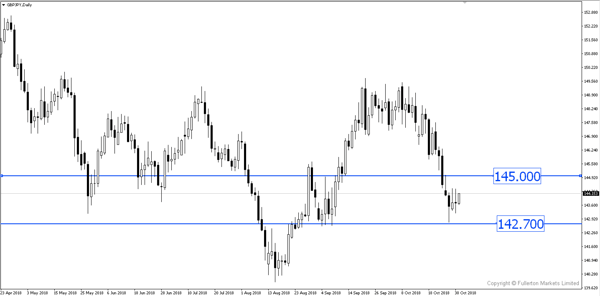

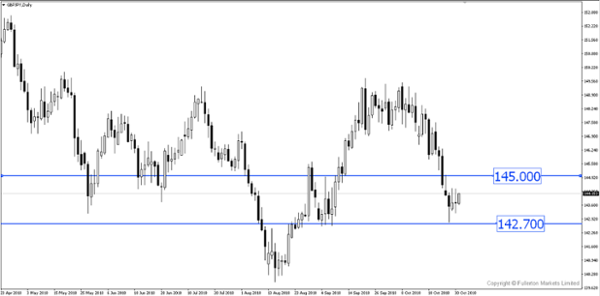

If BoE talks about the possibility of easing and cuts their economic projections, we could see GBP/JPY fall to 142.70 price level. However, if BoE looks past the recent slowdown in data and focuses on the upside risk of inflation, GBP/JPY could spike up to 145.00 price level.

Leave A Comment