Halliburton (HAL) reports Q3 earnings Monday. Analysts expect revenue of $5.35 billion and EPS of $0.37. The revenue estimate implies 8% growth sequentially. Investors should focus on the following key items:

North America Should Deliver Again

North America land drilling was characterized by cut throat competition after oil prices diverged to the down side in the second half of 2014. Large players like Halliburton and Schlumberger (SLB) have ended their price war, which has allowed several players to actually make money. The OPEC oil supply cut has raised prices above $50, more than high enough for shale oil plays to drill and make money.

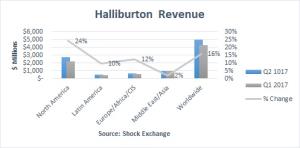

Increased drilling inured to the benefit of Halliburton last quarter. Revenue from each region saw Y/Y increases, but revenue from North America was downright gaudy, improving by 24%. Since the company received 56% of its revenue from the region, it was sitting in the catbird seat.

I expect more of the same this quarter. Through mid-October the North America rig count was up by over 100%. That implies more land drilling activity from North America, which is in Halliburton’s sweet spot.

Will Management Ring The Alarm?

All good things must come to an end. Last quarter management intimated shale oil plays might tap the brakes on additional E&P:

Today, rig count growth is showing signs of plateauing and customers are tapping the brakes. This demonstrates that individual companies are making rational decision in the best interest of their shareholders. This tapping of the brakes is happening all over the place in North America. I can tell you the market will respond, it will rebalance and these companies will stay alive, survive and thrive because that’s what they do.

Schlumberger’s Q3 revenue from North America rose by double-digits, yet it intimated that North America land drillers were moderating their appetite for investment in the region and focused more on cash flow management than unbridled expansion.

Leave A Comment