The consensus view expects a split Congress outcome with a largely muted market reaction, though many are not ruling out a surprise.

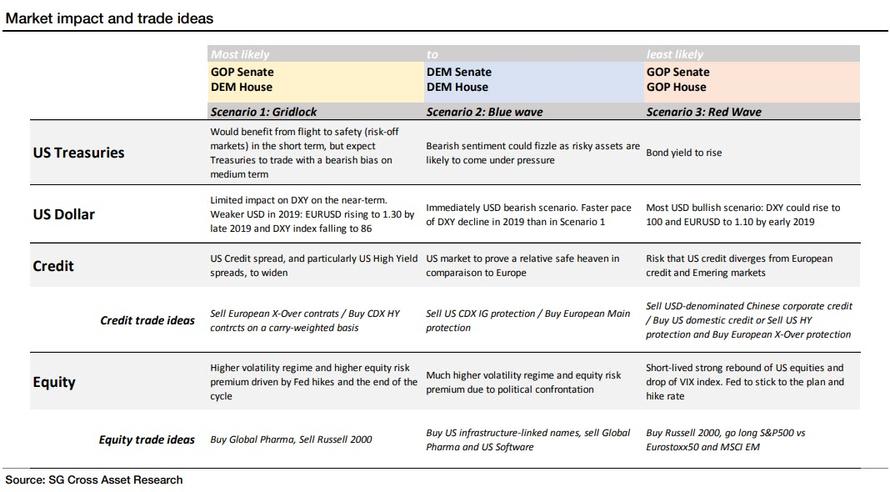

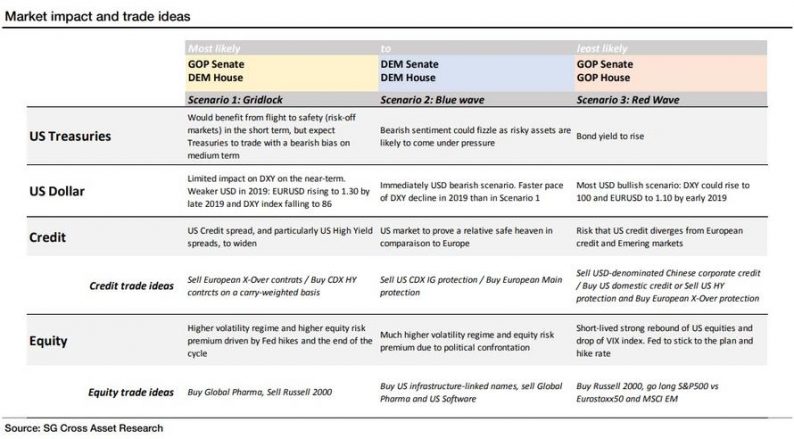

In order to assess the medium-term market impact of the midterms and recommend trade ideas, SocGen economists, strategists, and analysts have worked under three different scenarios according to the election outcome.

SocGen’s US economist has provided potential policy outcome stemming from these three potential elections outcomes:

Stocks

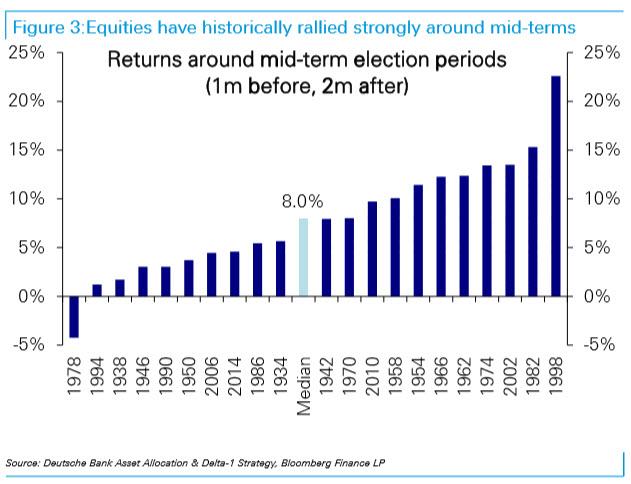

Largely representing consensus, Deutsche Bank’s equity strategists believe that the environment is ripe for an equity rally into year end. Markets have historically rallied around midterm elections, though this is equally due to historic coincidence (growth has tended to be strong around elections) as the actual elections. They expect this scenario to repeat, as growth looks strong, positioning is light, and Democratic gains could act as a check on the president’s trade war policies. On the other hand, some Democratic politicians have expressed support for President Trump’s trade war, so they may actually support an escalation against China.

As Deutsche Bank explains, the base case is the Democrats taking over the House and holds the potential to reduce downside risks from trade policy friction. We see a variety of possible channels through which the administration’s agenda on trade is likely to be curtailed by a switch in majority. Congressional investigations and potential impeachment proceedings, even though nominal, would likely use up signi?cant bandwidth while a growing number of Democrats and even Republicans are likely to attempt reducing Presidential power in dealing with trade. If trade frictions reduce, that allows the market focus to shift back on strong US growth; and also ease pressure on global growth and in our view would lead to a stronger eventual rally. The market is currently pricing in almost no growth implying signi?cant scope for a catch-up rally.

Leave A Comment