Right now, in the wake of the French 1st round election results, the Fed futures market is saying there’s a 72% chance of a Fed rate hike by June. So the obvious question is what this means for the economy, especially given recent yield curve flattening. I am cautiously optimistic. But I have some caveats and list a few places to look for signs of weakness below.

First, let’s acknowledge that for the past several years, it’s seemed almost as if investors have been waiting for the next financial crisis, fearful that the last one presaged yet more to come. But that ‘next’ crisis hasn’t happened. Instead, markets have gone from strength to strength – equity market in particular.

But it’s the credit markets where the rubber hits the road. After all, it was credit writedowns of mortgage-backed securities which ushered in the last financial crisis. Since then, credit markets have passed each and every test with flying colours. And the meltdown in the energy credit markets in 2015 and 2016 were a very big test indeed.

But of course, we haven’t had to contend with a Fed rate hike chain. And now that the Fed is finally normalizing rates, this will test markets because the Fed has signalled that it intends to continue to raise interest rates despite some signs of weakness in economic and credit data.

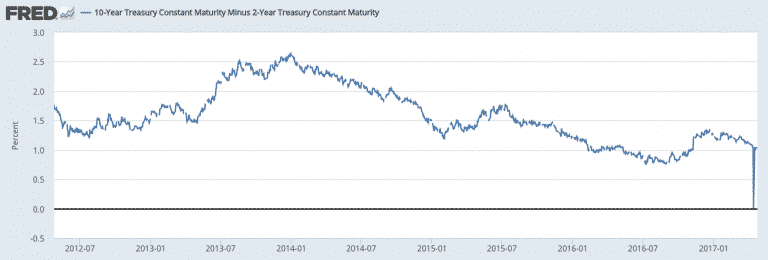

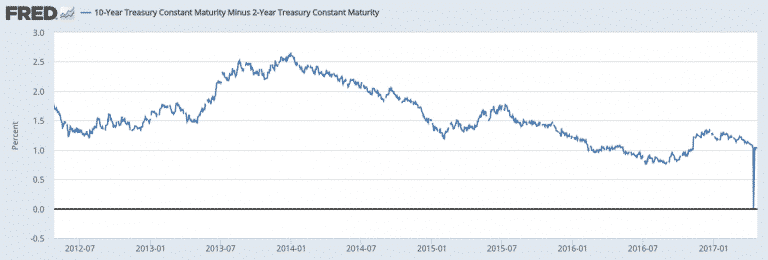

To date, the Fed’s policy normalization efforts have led to a lot of curve flattening. For example, the 2-10 year Treasury spread has gone from 2.66% three years ago when 2014 began to as low as 77 basis points in August. Right now, the differential is just barely above 1%.

And this flattening has all occurred as a result of tapering asset purchases and three 25 basis point rate hikes.

Let me say here that I think yield curve flattening in a Fed hiking cycle is not an a priori sign of economic weakness, though it is usually interpreted as such. What I am going to say on this is a bit wonky but bear with me because I think it matters.

Leave A Comment